Shows

InsuranceAUM.comEpisode 347: Executive Spotlight: Meet The Institutes & Their CEO - Pete MillerOn this episode of the InsuranceAUM Podcast, Pete Miller, President and CEO of The Institutes, joins host Stewart Foley for a wide-ranging conversation on the newly announced affiliation and why it represents a meaningful step forward for the insurance industry. Together, they discuss how The Institutes’ more than century-long legacy in professional education complements InsuranceAUM’s focus on insurance investment knowledge, and why closing the education gap between underwriting, operations, and investing is becoming increasingly important as portfolios grow more complex.

The conversation also dives into leadership, culture, and the role of values in building organizations that last. Miller shares insights...

2026-01-0548 min

Broad PerspectivesSyndenn Sweet & Debbie Stewart 05-11-2025Syndenn Sweet is a hearing impaired creator living in Tucson, AZ. She owns Hanner House Records located in the heart of Tucson. She is a singer/songwriter, multi-instrumentalist, producer, Foley artist, luthier, published author, visual-artist and poet.

As a musician she has appeared with: Mr. Natures Music Garden, ESP, and The Sapiens Music Collaborative, Sunny and the whisky machine, Random animal, Mama’s Boy and other various Tucson acts.

Syndenn currently performs with: Cat Mountain, the Desert Museum Family Band, sweet west, Broke down palace, THE SHRIEKING VIOLETS and Feral Claw.

For more in...

2025-05-1128 min

InsuranceAUM.comEpisode 293: Private Equity Secondaries: Optimizing Through Portfolio ConstructionIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Shane Feeney, Managing Director and Global Head of Secondaries at Northleaf Capital. They explore the growing importance of private equity secondaries, how portfolio construction can optimize outcomes, and why secondaries are gaining traction with institutional and insurance investors.

The conversation covers the evolution of the secondaries market, risk management through diversification, and the dynamics of LP-led and GP-led transactions. Shane also shares insights into current supply-demand trends, what differentiates top-tier managers, and practical advice for insurance CIOs entering the space.

2025-04-2935 min

InsuranceAUM.comEpisode 292: Private Markets Portfolio Construction for InsurersIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, speaks with Toby True, Partner on the Investment Strategy and Risk Management Team at Adams Street Partners, about the complexities and evolving best practices in private market portfolio construction for insurers. Toby shares how Adams Street tailors investment strategies to align bottom-up decisions with the unique objectives, risk tolerance, and liquidity needs of insurance portfolios.

The conversation explores how illiquidity impacts portfolio design, why data and historical patterns are increasingly valuable in modeling private market exposure, and what current market conditions—such as slowed distributions and resilient fundamentals—mean fo...

2025-04-2134 min

InsuranceAUM.comEpisode 291: Fund Finance: Evolution, Insights, & OpportunitiesIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, speaks with Shelley Morrison, Head of Fund Finance at Aberdeen Investments, about the growing relevance of fund finance in insurance portfolios. Shelley breaks down the fundamentals of subscription line loans, or “sublines,” and explains how these short-duration, investment-grade assets deliver enhanced yield without excess credit risk. She also outlines how fund finance fits into the broader private credit landscape and why it's gaining traction with insurers seeking diversification and downside protection.

The conversation highlights Aberdeen Investments’ disciplined underwriting approach, relationship-driven sourcing, and ability to build custom portfolios tailored to insu...

2025-04-1721 min

InsuranceAUM.comEpisode 290: An Update on the Residential Mortgage Market and Insurance Company InvolvementIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, is joined by Justin Mahoney, co-founder of Shelter Growth Capital, for an in-depth discussion on the residential mortgage loan (RML) market and its increasing relevance to insurance portfolios. Justin offers a data-driven look at the macro trends affecting the housing market, including supply shortages, disciplined credit underwriting, and the nuanced relationship between home price appreciation and affordability. He explains why RMLs are drawing growing interest from insurers, thanks to favorable capital treatment, risk-adjusted return potential, and access to Federal Home Loan Bank financing.

The conversation also covers investment s...

2025-04-0925 min

InsuranceAUM.comEpisode 289: The Dividend Edge: Balancing Yield & Risk in Insurance PortfoliosIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, is joined by Michael Hunstad, Deputy CIO and CIO of Global Equities, and Jeff Sampson, Senior Portfolio Manager for Global Equities at Northern Trust Asset Management. They discuss the evolving landscape of dividend strategies, equity allocations, and risk-aware portfolio construction for insurers navigating today’s market complexity.

From balancing income and capital appreciation to mitigating concentration risk and factoring in tax efficiency, Hunstad and Sampson share actionable insights tailored to insurance investors. With dividend-paying equities becoming more diversified and relevant in a normalized rate environment, this episode offers prac...

2025-04-0732 min

InsuranceAUM.comEpisode 288: Executive Spotlight: Eric Partlan, CFA, CAIA, Chief Investment Officer at MassMutualIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Eric Partlan, Chief Investment Officer at MassMutual, for an engaging installment of the CIO Spotlight series. With MassMutual’s $285 billion general account and deep legacy as a mutual insurer, Eric shares insights into how the firm’s long-term orientation, mutual structure, and strategic partnerships drive its investment approach—particularly in private credit, structured products, and ALM strategies.

Eric also reflects on his unique career journey from aerospace engineering to the CIO role, offering a candid look into his philosophy on leadership, team building, and fostering intelle...

2025-04-0128 min

InsuranceAUM.comEpisode 287: The Next 10 Years: Key Trends Influencing Insurers' Asset Allocation DecisionsIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, is joined by Anwiti Bahuguna, PhD, Chief Investment Officer of Global Asset Allocation at Northern Trust Asset Management. The conversation explores Northern Trust’s latest long-term capital market assumptions and the macroeconomic forces likely to shape insurer portfolios over the next decade—from AI-enabled productivity and energy transition to evolving patterns of globalization.

Anwiti shares how her team blends quantitative modeling with insights from asset class specialists to create actionable 10-year outlooks for insurance investors. The discussion spans implications for fixed income and equity allocations, real assets as infla...

2025-03-2531 min

InsuranceAUM.comEpisode 286: Resident Expertise - Advice for Insurers Investing in Residential Mortgage LoansIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Dan Pallone, Managing Director of Global Loan Operations at SS&C Technologies, to discuss the latest trends in the residential mortgage market. With rising interest rates, limited housing supply, and increasing investor interest, how are insurers positioning themselves in this evolving landscape?

Dan shares insights into the advantages of residential mortgage loans (RMLs) over traditional mortgage-backed securities, key operational considerations for insurers looking to scale in this asset class, and the impact of automation on mortgage investing. Tune in to learn how insurance investors can n...

2025-03-2030 min

InsuranceAUM.comEpisode 285: Plugging into the Energy Transition OpportunityIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Edward Levin, Managing Director and Co-Head of Direct Infrastructure at Voya Investment Management, to explore the evolving landscape of renewable energy finance. With over 20 years of experience in energy transition projects, Edward shares insights into how the sector has matured, the increasing demand for power driven by AI and manufacturing onshoring, and the evolving financing structures supporting renewable infrastructure.

Edward also breaks down the impact of federal policies like the Inflation Reduction Act, the role of tax credits, and how bipartisan support continues to drive i...

2025-03-1730 min

InsuranceAUM.comEpisode 284: Bonds, Benchmarks, and Beyond: An Insider's Perspective on Fixed Income InvestingIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Christine Thorpe, Institutional Portfolio Manager at Fidelity Investments, to discuss the critical role of core fixed income in insurance portfolios. Despite being the largest allocation for most insurers, core fixed income often takes a backseat to higher-yielding asset classes. Christine shares insights on sector positioning, duration management, and Fidelity’s preference for rates over spreads in today’s evolving market.

With Fidelity managing approximately $2 trillion in fixed income strategies, Christine also highlights the firm’s team-based investment culture and how it helps drive consistent performance. She discuss...

2025-03-1430 min

InsuranceAUM.comEpisode 283: Leadership Excellence: Attracting and Retaining Top Talent in Insurance Asset ManagementIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Milena Humplik and Margot DeMore, co-founders of Broad Street, to discuss career management from both sides of the desk. They share insights into hiring trends in insurance asset management, the skill sets in demand, and how leadership plays a crucial role in talent retention.

Milena and Margot also offer guidance on navigating career transitions, the evolving return-to-office landscape, and what makes a truly great leader in today’s industry. Whether you're an employer looking to build a strong team or a professional considering your next mov...

2025-03-1229 min

InsuranceAUM.comEpisode 282: Discovering New Opportunities For Yield And Safety In The Municipal Bond MarketIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, is joined by Jim Kaniclides, Head of U.S. Insurance, and Jeff Burger, CFA, Senior Portfolio Manager of Municipal Bonds at Insight Investment. Together, they discuss the evolving landscape of municipal bonds, offering insights into how insurers can balance yield, liquidity, and safety in today’s fixed-income markets.

Jim and Jeff break down the shift from tax-exempt to taxable municipal bonds, their role in insurance portfolios, and the diversification benefits they provide compared to corporate bonds. They also highlight how municipals align with ESG and impact investing trends whi...

2025-03-1039 min

InsuranceAUM.comEpisode 281: How Can BDCs Be Used to Optimize Direct Lending?In this episode of the InsuranceAUM.com podcast, host Stewart Foley, CFA, speaks with Michael Occi, President of Morgan Stanley Private Credit’s BDC platform, to explore how insurance investors can leverage BDCs to gain deeper insights into the direct lending market. They discuss how BDCs provide transparency into asset quality, credit conditions, and portfolio performance, offering valuable data that insurance investors can use to assess risk and optimize their strategies. Michael explains the evolution of BDC structures, the growing role of non-traded BDCs, and how these vehicles fit into the broader private credit landscape.

The conversation also covers the reg...

2025-03-0627 min

InsuranceAUM.comEpisode 280: The Right Way to Invest in Emerging Market DebtIn this episode of the InsuranceAUM.com podcast, host Stewart Foley, CFA, sits down with Vlad Liberzon, partner and portfolio manager at GoldenTree Asset Management, to discuss the evolving landscape of emerging market debt (EMD) and how insurers can approach the asset class strategically. With over 20 years of experience in EMD investing, Vlad shares insights into the asset class’s transformation, from its early days of high correlation and commodity reliance to today’s diverse and uncorrelated opportunities across 90 countries. He breaks down the factors driving EMD’s growth, the risks insurers often associate with the asset class, and why many m...

2025-03-0432 min

InsuranceAUM.comEpisode 279: Overview Of the Private Equity Market: Today’s Changing LandscapeIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Champ Raju, Managing Partner and Head of Private Equity at PPM America Capital Partners, to discuss the evolving private equity landscape and the investment strategies gaining traction in today’s market. They explore the current fundraising environment, M&A activity, and the increasing role of co-investments and GP-led secondary deals in institutional portfolios.

Champ explains how co-investments offer institutional investors, including insurance companies, an opportunity to reduce fees and gain direct exposure to private equity deals. He also breaks down single-asset GP-led secondary transactions, highlighting the...

2025-02-2726 min

InsuranceAUM.comEpisode 278: Understanding Secondary Markets: A Conversation with Nate Walton of AresIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, speaks with Nate Walton, Partner and Head of Private Equity Secondaries at Ares Management, about the evolving role of secondaries in private markets. They discuss how GP-led transactions, liquidity solutions, and structured investments are transforming private equity.

Nate shares insights on why secondaries are becoming a key strategy for institutional investors, how they provide downside protection, and what trends to watch in 2025. Whether you're looking to optimize your private equity allocations or better understand the secondary market, this episode offers valuable insights.

2025-02-2436 min

InsuranceAUM.comEpisode 277: Breaking Down Evergreen Funds: Flexibility, Transparency, and PerformanceIn this episode of the InsuranceAUM.com podcast, host Stewart Foley, CFA, welcomes Fabian Korzendorfer, Partner with StepStone’s Private Debt research team, for an in-depth discussion on Evergreen Funds: A Compelling Tool for Private Markets. Fabian joins from Switzerland to share his expertise on how evergreen funds provide flexibility, liquidity, and efficiency, making them an increasingly attractive option for both institutional and individual investors. Together, they explore the structural advantages of evergreen funds over traditional drawdown models, their impact on portfolio diversification, and why private debt is particularly well-suited for this investment vehicle.

Stewart and Fabian also dive into how...

2025-02-2131 min

Outdoor Cats PodcastEpisode 12: Political Pie Throwing and Dead Kennedys (ft. Michael Stewart Foley)What do '78 San Fran and '25 Worcester have in common? Quite a bit, turns out. We bring on historian Michael Stewart Foley to talk about his book Fresh Fruit For Rotting Vegetables, a history of the Dead Kennedys record by the same name and the context in which that work of art / protest document was birthed: San Francisco, 1978. After the assassinations of Harvey Milk and George Moscone, newly sworn in Mayor Dianne Feinstein ushered in a wretched era of city governance built on an axis of neoliberal evils: the real estate industry, the police, and the nascent culture...

2025-02-211h 15

InsuranceAUM.comEpisode 276: Navigating the Evolution of Asset Finance and Opportunistic Credit with CenterbridgeIn this episode of the InsuranceAUM.com podcast, host Stewart Foley, CFA, welcomes Aaron Fink, Senior Managing Director at Centerbridge, to explore the evolution of asset finance and opportunistic credit. Aaron shares insights on how Centerbridge's cycle-agnostic approach allows them to dynamically allocate capital across private equity, credit, and real estate, ensuring they capitalize on opportunities regardless of market conditions. From his early career in asset finance trading to leading Centerbridge’s asset finance efforts, Aaron discusses the firm’s unique investment philosophy and its ability to pivot between public and private markets to generate returns.

The conversation dives into key m...

2025-02-1931 min

InsuranceAUM.comEpisode 275: StepStone Insights: Demystifying Venture Capital for Insurance Portfolio ManagersIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Anthony Giambrone and Stephen West, both Managing Directors on the Venture Capital and Growth team at StepStone, to explore an asset class that isn’t traditionally front and center for insurance portfolios: venture capital. They discuss why insurers may want to consider VC exposure, how the asset class has evolved over the years, and what strategies can help insurance investors navigate this space.

With insurance investment portfolios becoming more diversified, Anthony and Stephen share insights on why venture capital has gained traction among institutional investors, how...

2025-02-1426 min

InsuranceAUM.comEpisode 274: Tips and Tools for Staying Current with NAIC Statutory FilingsIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Barbara Arnold and Scott Kurland of SS&C Technologies to explore the latest developments in NAIC statutory reporting. With growing portfolio complexity and evolving regulatory requirements, insurers are facing increasing challenges in maintaining compliance while ensuring accuracy and efficiency in reporting.

Barbara and Scott discuss the major trends shaping the industry, including the growing role of alternative investments, the shift to multi-manager models, and changes in asset classifications that impact reporting requirements. They also highlight the rising adoption of outsourcing and co-sourcing solutions, helping insurers streamline...

2025-02-1220 min

InsuranceAUM.comEpisode 273: Going back to First Principals in a Brave New WorldIn this episode of the InsuranceAUM.com podcast, host Stewart Foley, CFA, sits down with Michael Acton, Managing Director and Head of Research and Strategy at AEW, to explore the evolving landscape of commercial real estate investing. As the industry navigates a post-pandemic world, rising interest rates, and a wave of loan maturities, Acton shares insights on how investors can return to first principles to identify opportunities amid uncertainty. He discusses the hybrid nature of real estate as an asset class, its role in portfolio diversification, and the impact of economic shifts on valuations.

Acton also provides a deep dive i...

2025-02-1027 min

InsuranceAUM.comEpisode 272: The Art of Credit Underwriting: Lessons from OHA and Missouri TeachersIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, is joined by Victor Debenedetti, principal at OHA, and Anthony Vikhter, senior investment analyst at Missouri Teachers, for an in-depth discussion on best practices in underwriting private credit. As private credit continues to expand, investors must understand the nuances of due diligence, risk assessment, and structuring deals to ensure long-term success.

Victor and Anthony share their perspectives on credit monitoring, distressed situations, and the importance of aligning private credit strategies with institutional objectives. They also discuss how private credit differs from private equity and why this asset class h...

2025-02-0549 min

InsuranceAUM.comEpisode 271: Direct Lending Decoded: Macquarie's Strategic Approach to Middle Market InvestingIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Brian Van Elslander, Head of MAM Direct Lending Portfolio Management, Americas, and Bill Eckmann, Head of Macquarie Principal Finance, Americas, to discuss the evolving landscape of direct lending. With private credit playing an increasingly significant role in institutional portfolios, Brian and Bill share insights on the growth of Macquarie’s direct lending platform, the firm’s approach to alignment and risk management, and key considerations for insurance investors exploring this asset class.

They also examine current market dynamics, sector opportunities, and best practices for insurers looki...

2025-02-0333 min

InsuranceAUM.comEpisode 270: Asset-Based Finance Public Versus Private, A Guide to Adult SwimmingIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, sits down with Alessandro Pagani, portfolio manager and head of the mortgage and structured finance team at Loomis Sayles, to explore the complexities of asset-based finance. They discuss the key differences between public and private ABS, the growing role of private credit, and how insurers should approach this evolving space. With rising interest rates and changing bank capital requirements, the demand for private asset-backed lending has surged—creating both opportunities and risks for investors.

Alessandro shares his insights on liquidity considerations, risk assessment, and the importance of due dil...

2025-01-3035 min

InsuranceAUM.comEpisode 269: Asset-Based Finance (ABF): Building Resilient Portfolios for InsurersIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, explores the growing market of private structured credit, also known as private ABF, with Poorvi Dholakia and Paul Carroll of MetLife Investment Management. They discuss how this asset class stands out through customized structures, enhanced covenants, and attractive yield premiums, making it an increasingly valuable component of insurance portfolios.

The conversation delves into the key factors driving the growth of private ABF since the 2008 financial crisis, the role of regulatory changes, and how scale and underwriting expertise create a competitive edge in this space. Risk considerations, such as c...

2025-01-2836 min

InsuranceAUM.comEpisode 268: The Power of Patient Capital: Navigating Private Credit Through Market CyclesIn this episode of the InsuranceAUM.com Podcast, Stewart Foley sits down with Michael King, Senior Managing Director and Co-Head of Senior Credit at Manulife Investment Management, to take a deep dive into the world of direct lending and sponsored finance. Michael shares his journey from carpentry to credit, discusses the unique dynamics of middle market private equity firms, and unpacks Manulife’s patient, deliberate approach to growing its private credit platform.

Discover how Manulife’s focus on consistent underwriting, strong sponsor relationships, and market access has fueled success through various economic cycles, and hear Michael’s thoughts on private credit’...

2025-01-1433 min

InsuranceAUM.comEpisode 267: Real Estate Debt Markets: Finding Value in Market DislocationsJoin host Stewart Foley, CFA on the InsuranceAUM.com Podcast as we explore private real estate debt with experts Will Pattison, Head of Research and Strategy Real Estate, and Clint Culp, Regional Head of Real Estate Debt Production, both from MetLife Investment Management. Together, they provide valuable insights into current market dynamics, including shifts in commercial real estate lending, the impact of rising construction costs, and how migration trends are shaping the future of real estate investments.

Gain an understanding of how MIM leverages decades of data to inform investment strategies and manage risk, while uncovering opportunities in today’s mar...

2025-01-0927 min

InsuranceAUM.comEpisode 266: Wellington Management’s 2025 Insurance OutlookJoin host Stewart Foley on the InsuranceAUM.com Podcast as he sits down with Tim Antonelli, head of Insurance Multi-Asset Strategy and portfolio manager at Wellington Management. In this episode, Tim shares his 2025 outlook for insurers, focusing on themes like locking in structural income, optimizing surplus portfolios, and navigating regulatory changes.

With insights drawn from over 150 meetings with insurers worldwide, Tim discusses how the industry is evolving, the importance of fighting recency bias, and the growing role of asset-based finance. From managing surplus assets with a Swiss Army knife approach to uncovering yield opportunities in hybrid securities and private placement d...

2025-01-0328 min

InsuranceAUM.comEpisode 265: The Cyclical Nature of Real Estate DebtJoin host Stewart Foley, CFA, on the InsuranceAUM.com Podcast as he explores the dynamic world of commercial real estate debt with Jack Gay, Global Head of Commercial Real Estate Debt, and Jason Hernandez, Head of Real Estate Debt in the Americas at Nuveen Real Estate. In this engaging conversation, Jack and Jason share their unique perspectives on the evolving CRE debt market, highlighting areas of opportunity and caution in today’s economic landscape. From the surging demand for housing and logistics to the ongoing challenges in the office sector, they unpack the factors driving investment decisions and risk management st...

2024-12-2033 min

InsuranceAUM.comEpisode 264: The Future of Real Estate: Trends and Strategies with Maggie ColemanIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley sits down with Maggie Coleman, Chief Investment Officer for North America Real Estate Equity at Manulife Investment Management, for a timely discussion on real estate investing. Maggie shares her insights on the current macroeconomic environment, the challenges and opportunities in today’s market, and the long-term trends shaping the real estate landscape.

They dive into themes such as affordability, industrial growth, and the emerging sectors driven by demographic and technological shifts. Maggie also provides a candid perspective on office real estate, risk management strategies, and the importance of ESG con...

2024-12-1835 min

InsuranceAUM.comEpisode 263: Navigating the Economic Landscape: Tariffs, Productivity, and the Future of US GrowthIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley sits down with Blerina Uruci, Chief US Economist in the Fixed Income Division of T. Rowe Price, for an in-depth conversation on the critical macroeconomic trends shaping the investment landscape. From the impact of US elections to the Fed's rate policy and the rising influence of productivity growth, Blerina offers expert perspectives on how these developments could influence investor sentiment and economic performance.

With a unique global perspective, Blerina shares her take on trade policies, fiscal uncertainties, and the evolving role of inflation in a higher-for-longer interest rate environment. D...

2024-12-1629 min

InsuranceAUM.comEpisode 262: Secondaries Offer Liquidity Opportunity for Well-Informed Investors With Competitive EdgeIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley, CFA, is joined by Jeff Akers, head of private equity secondaries at Adam Street Partners, to discuss the growing importance of private equity secondaries in insurance portfolios. Jeff shares his expertise on how this asset class helps investors avoid the J-curve, provides a shorter duration investment with predictable cash flows, and delivers fixed-income-like characteristics with equity-level upside.

From the basics of private equity secondaries to their strategic fit for insurers prioritizing stable returns, this conversation dives deep into the advantages of investing in a market that has grown from $10 b...

2024-12-1335 min

InsuranceAUM.comEpisode 261: The Future of Real Estate Debt: Uncovering Hidden Investment OpportunitiesJoin host Stewart Foley as he sits down with Doug Bouquard, Partner and Head of Real Estate Credit at TPG, to explore the evolving landscape of real estate debt. Doug shares his journey into the industry and highlights the current shifts in the market, including the retreat of banks from traditional lending and the growing role of private credit. He discusses how these changes create new opportunities for insurers to fill the gap and capitalize on asset-backed lending that aligns with their long-term liabilities.

The conversation dives into key trends driving real estate credit, from dislocations in specific sectors like o...

2024-12-1134 min

InsuranceAUM.comEpisode 260: Behind the Numbers: Insights from Quant Experts at Principal Asset Management, StepStone Group, and Fidelity InvestmentsIn this episode of the InsuranceAUM.com Podcast, our host Stewart Foley, CFA, dives into the fascinating world of quantitative methods in insurance asset management with experts from Principal Asset Management, StepStone Group, and Fidelity Investments. Together, they explore how data-driven strategies are transforming portfolio construction, risk assessment, and liquidity management in private markets. From understanding how quants develop models to navigating the unique challenges of private markets, this episode delivers actionable insights for institutional investors.

Learn how quantitative approaches help identify opportunities, mitigate risks, and drive smarter investment decisions. Whether you’re curious about how quants build tailored solutions or...

2024-12-0944 min

InsuranceAUM.comEpisode 259: Demystifying Real Estate CreditIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley welcomes Nailah Flake, Managing Partner and Head of Real Estate Debt at Brookfield. Nailah shares her unique career journey, from teaching dance to leading real estate credit at one of the largest asset managers globally.

Together, they discuss the vast and diverse real estate market, touching on compelling sectors like industrial, housing, and alternative asset classes. Nailah provides insights into the mechanics of real estate credit, its differences from corporate credit, and the evolving landscape amid rising interest rates, market volatility, and bank retrenchment. She also highlights Brookfield’s app...

2024-12-0429 min

InsuranceAUM.comEpisode 258: Fixed Income Deep Dive: Understanding Private Placement InvestmentsIn this episode of the InsuranceAUM.com podcast, host Stewart Foley welcomes Nelson Correa, Head of Private Placements at NEAM. Nelson discusses what makes private placements an attractive asset class for insurers, offering higher spreads than public bonds while maintaining strong covenant protections. He addresses liquidity misconceptions, explains how private placements are structured, and highlights their role in helping insurers achieve long-term investment goals.

Nelson also shares insights into NEAM’s enhanced private placement capabilities following his team’s addition and provides a market outlook, identifying opportunities in infrastructure and family-owned companies. Tune in to learn how private placements can offer...

2024-12-0227 min

InsuranceAUM.comEpisode 257: High Yield Real Estate Lending: Navigating the Shifting LandscapeIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley sits down with Bill Maclay, CFA, portfolio manager at Fidelity Investments, to explore the evolving landscape of high-yield real estate lending. With banks pulling back and a significant volume of commercial real estate debt maturing over the next three years, Bill shares how private lenders are stepping up to fill the gap. He provides an in-depth look at Fidelity's real estate platform, their approach to navigating current market challenges, and the opportunities for investors in middle-market lending.

From bridge loans to construction financing and gap funding, Bill explains how F...

2024-11-2139 min

InsuranceAUM.comEpisode 256: Best Practices for Portfolio Construction in Private AssetsJoin host Stewart Foley on the InsuranceAUM.com Podcast as we dive into the intricacies of private asset portfolio construction with insights from Bryan Jenkins and Eric Solfisburg of Hamilton Lane. This episode explores how a strategic approach to portfolio construction—focusing on factors like asset allocation, investment pacing, and liquidity management—can enhance outcomes for insurance investors. With over three decades in private markets, Hamilton Lane shares its expertise on balancing return and risk while managing the challenges of data and transparency that are unique to this asset class.

The conversation also covers the vital considerations around data and analy...

2024-11-1930 min

InsuranceAUM.comEpisode 255: CLO Market Pulse with Ian Gilbertson of InvescoIn this episode of the InsuranceAUM.com podcast, host Stewart Foley, CFA, sits down with Ian Gilbertson, CLO Portfolio Manager and Co-Head of U.S. CLOs at Invesco, for a deep dive into the world of Collateralized Loan Obligations (CLOs) and their role in insurance investment portfolios. Ian provides a primer on CLOs, explaining their structure, the types of assets they hold, and why this asset class has shown such resilience and stability.

They discuss the growth of CLOs in insurance company portfolios, their historical performance, and why they continue to attract insurers even amid changing regulatory requirements. Ian also s...

2024-11-1431 min

AM Best Audio PodcastInsuranceAUM’s Foley: Podcast Explores Insurance Asset ManagementStewart Foley, host of the InsuranceAUM podcast, discusses how he delves into the latest trends, challenges and opportunities to provide listeners with perspectives and practical advice in the world of insurance asset management.

2024-11-0410 minAM Best AudioInsuranceAUM’s Foley: Podcast Explores Insurance Asset ManagementStewart Foley, host of the InsuranceAUM podcast, discusses how he delves into the latest trends, challenges and opportunities to provide listeners with perspectives and practical advice in the world of insurance asset management.

2024-11-0410 min

The Columbia ChronicleThree C's with Greer Stewart: Oct. 25, 2024HED: This week on the Three C’s: Wicked Week; Women in audio hosts student led horror foley night in the audio studio, ISG & Panic hold Neon Night to celebrate the art of storytelling and Shop Columbia holds 5th annual Dark Market

2024-10-2602 min

The Birth Lounge PodcastEp. 290: Could Catheters be causing Unnecessary Cesareans? with Dr. Douglas Wood, OBGYNDr. Wood joins the show to discuss his groundbreaking new invention aimed at reducing unnecessary C-sections. The conversation explores the evolving trends in epidural use, the importance of patient autonomy, and effective coaching during labor. Dr. Wood elaborates on the issues surrounding 'failure to progress' and introduces his innovative catheter designed to mitigate common complications associated with Foley catheters during labor. This informative episode sheds light on improving maternal and infant health outcomes and offers insights into the future of obstetric care.

Epidurals: Trends and Practices

Coaching During Labor

Failure to P...

2024-09-041h 00The Fast Brackets Podcast#144 Krazy Ed Foley and Marc Smith from MSR SuspensionsKrazy Ed Foley talks how he got his iconic name and winning TS at the PDRA Pro Stars.

Marc Smith from MSR Suspensions discusses adjustments to help getting down the track in hot conditions.

Rex and JP discuss the NHRA's oldest ever National Event winner, give race results and talk EE, Tony Stewart and the IRP revamp

2024-07-181h 12The Fast Brackets Podcast#144 Krazy Ed Foley and Marc Smith from MSR SuspensionsKrazy Ed Foley discusses how he got his trademark name and winning Top Sportsman at the PDRA Pro Stars.

Marc Smith from MSR Suspensions discusses how to adjust to overly hot tracks this time of year.

Rex and JP talk the oldest NHRA winner ever, give race results and give thoughts on Tony Stewart, Erica Enders and the new and improved IRP!

2024-07-171h 29

The Best Of Scott CarsonWhy Private Real Estate Debt Can Benefit Insurance Investors With Scott Carson From The Insurance AUM Podcast With Stewart FoleyIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley dives into the world of private and public real estate debt, exploring how insurance investors can benefit from this asset class. With insights from experienced portfolio managers, the discussion covers everything from commercial mortgage-backed securities (CMBS) to private real estate debt, highlighting the yield enhancement, diversification, and inflation protection these investments can offer.The conversation delves into current market dynamics, including rising interest rates, inflationary pressures, and how these forces are shaping real estate debt opportunities. Topics include underwriting discipline, sector selection, and the importance of equity...

2024-06-1934 min

The Best Of Scott CarsonWhy Private Real Estate Debt Can Benefit Insurance Investors With Scott Carson From The Insurance AUM Podcast With Stewart FoleyIn this episode of the InsuranceAUM.com Podcast, host Stewart Foley dives into the world of private and public real estate debt, exploring how insurance investors can benefit from this asset class. With insights from experienced portfolio managers, the discussion covers everything from commercial mortgage-backed securities (CMBS) to private real estate debt, highlighting the yield enhancement, diversification, and inflation protection these investments can offer.The conversation delves into current market dynamics, including rising interest rates, inflationary pressures, and how these forces are shaping real estate debt opportunities. Topics include underwriting discipline, sector selection, and the importance of equity cushions...

2024-06-1934 min

The HunterEp 02 - Embracing Change and Prioritizing Well-Being with Stewart FoleyStewart Foley, founder of Insurance AUM, discusses his career in insurance asset management and the growth of his platform. He shares the importance of self-reflection and his experiences of taking time off to go on motorcycle rides for well-being. Foley also highlights the opportunities in the insurance industry and the impact of technology on insurance and asset management.

Takeaways

The insurance industry offers diverse career opportunities and is often overlooked by young professionals.

Insurance companies are sophisticated investors and play a significant role in the asset management industry.

Technology, such as in...

2024-05-2147 min

The James McMahon Music PodcastEpisode 268: Duglas T. Stewart, BMX BanditsBMX Bandits are a legendary Scottish guitar pop band formed in Bellshill. Since their formation in 1985, vocalist Duglas T. Stewart has been their only permanent member.Their new album, Dreamers On The Run, is released on April 26th.Watch this episode here: https://www.youtube.com/watch?v=WxSJl5eEC10&t=2sShow theme by Bis.GET TICKETS TO MY CONVERSATION WITH LUKE HAINES AT ROUGH TRADE WEST, LONDON, ON APRIL 4th. Want more? Join The James McMahon Music Podcast Patreon. https://www.youtube.com/watch?v...

2024-03-2738 min

Fantastical Truth196. How Do Fantastical Books Get Made? | with Jamie FoleyWe all love fantastical books. But how do fantastical books get made? Who takes all that raw material, polishes the edges, and turns the story into a shining jewel? We’ll explore this magical process, the making of fantastical novels, with Enclave Publishing creative director Jamie Foley.

Episode sponsors

Enclave Publishing: Mortal Queens

The Culling Begins by Anthony DeGroot

I. W.R.I.T.E.: How to Write a Novel course

Mission update

Two new Onscreen articles arrived last week:

‘Rebel Moon: A Child of Fire’ Plants the Seeds for Promising New Space Opera, A. D. S...

2024-01-231h 04

Film Blerds - PodcastAQUAMAN AND THE LOST KINGDOM / THE COLOR PURPLE (2023) /ANYONE BUT YOU / REBEL MOON PART ONE (Part 2 of 2 episodes)Our newest episode is so big we had to split it into two episodes!!!(Episode 105 Part 2)The Lobby:SAW XI greenlit with a September 27, 2024 release dateRalph Maccio and Jackie Chan are co-starring in a new KARATE KID movie together A24 is working with Hideo for the DEATH STRANDING movieTHE BIKERIDERS is now dated for June 24,2024 at Focus Features. Benny Safdie to direct The Rock in a MMA drama for A24Jonathan Majors found guilty and dropped from Marvel as KangSCREAM VII: Director Christopher Landon walks.Paramount and...

2023-12-3100 min

Film Blerds - PodcastAQUAMAN AND THE LOST KINGDOM / THE COLOR PURPLE (2023) /ANYONE BUT YOU / REBEL MOON PART ONE (Part 2 of 2 episodes)Our newest episode is so big we had to split it into two episodes!!!(Episode 105 Part 2)The Lobby:SAW XI greenlit with a September 27, 2024 release dateRalph Maccio and Jackie Chan are co-starring in a new KARATE KID movie together A24 is working with Hideo for the DEATH STRANDING movieTHE BIKERIDERS is now dated for June 24,2024 at Focus Features. Benny Safdie to direct The Rock in a MMA drama for A24Jonathan Majors found guilty and dropped from Marvel as KangSCREAM VII: Director Christopher Landon walks.Paramount and...

2023-12-3100 min

Film Blerds - PodcastAQUAMAN AND THE LOST KINGDOM / THE COLOR PURPLE (2023) /ANYONE BUT YOU / REBEL MOON PART ONE (Part 1 of 2 episodes)Our newest episode is so big we had to split it into two episodes!!!(Episode 105 Part 1)The Lobby:SAW XI greenlit with a September 27, 2024 release dateRalph Maccio and Jackie Chan are co-starring in a new KARATE KID movie together A24 is working with Hideo for the DEATH STRANDING movieTHE BIKERIDERS is now dated for June 24,2024 at Focus Features. Benny Safdie to direct The Rock in a MMA drama for A24Jonathan Majors found guilty and dropped from Marvel as KangSCREAM VII: Director Christopher Landon walks.Paramount and...

2023-12-3100 min

Film Blerds - PodcastAQUAMAN AND THE LOST KINGDOM / THE COLOR PURPLE (2023) /ANYONE BUT YOU / REBEL MOON PART ONE (Part 1 of 2 episodes)Our newest episode is so big we had to split it into two episodes!!!(Episode 105 Part 1)The Lobby:SAW XI greenlit with a September 27, 2024 release dateRalph Maccio and Jackie Chan are co-starring in a new KARATE KID movie together A24 is working with Hideo for the DEATH STRANDING movieTHE BIKERIDERS is now dated for June 24,2024 at Focus Features. Benny Safdie to direct The Rock in a MMA drama for A24Jonathan Majors found guilty and dropped from Marvel as KangSCREAM VII: Director Christopher Landon walks.Paramount and...

2023-12-3100 min

Take 1 with Bill CameronTake 1 with Bill Cameron (12-10-2023) - Guest Interviewer John Dempsey with Chicago Author Dennis FoleyThis week, welcome back John Dempsey who this week interviews author Dennis Foley, a guy who writes books about Chicago. His new book "Feloniously Yours: A Memoir" is out now. It is the fifth book written by Foley, who grew up on the south side of Chicago. Hear about his life growing up on the south side and how he almost died getting stabbed when he was 15 and his many other near-death experiences. Foley also shares how he became a felon. Bill Cameron is back with the round-table as he's joined by Heather Cherone, Greg Hinz and...

2023-12-0842 min

Get A Better Broadcast, Podcast and Voice-Over Voice0986 – The Diction-ary of Voice – F2023.09.13 – 0986 – The Diction-ary of Voice – F **FFade (in, out, up, down, under) - to gradually adjust the volume of sound from low to high or high to lowFader – an audio channel’s level controllerFade to black/fade away – to decrease the volume of a sound until it cannot be heardFalsetto - the vocal register just above the modal voice register and overlapping with it by approximately one octaveFeedback – the loud howl-round, looped sound when a ‘live’ mic is too close to a speaker or headpho...

2023-09-1304 min

Research Insights, a Society of Actuaries PodcastSOA Research Institute Research Insights/InsuranceAUM.com joint podcast - Impact of Investment Market Conditions on Actuarial Assumptions for Modeling Insurers' Liabilities in Q4 Don't miss our latest episode of the Research Insights Podcast straight to you from the Research Institute at the Society of Actuaries! Listen to guest Stewart Foley, Founder and Managing Partner at InsuranceAUM.com, and Dr. Andrew Aziz, Chief Strategy Officer & Head of Product at SS&C Algorithmics, discuss current trends in the insurance asset management industry with host Dale Hall, Managing Director of Research at the Society of Actuaries Research Institute. InsuranceAUM.com landing page: https://insuranceaum.com/ SOA Research Institute: https://www.soa.org/research/research-institute/

2023-09-0117 minAM Best AudioInsurance AUM's Foley: AI Set for Major Impact on Analytics, Risk ManagementStewart Foley, founder, Insurance AUM, sees a race shaping up with development applications, but warns that artificial intelligence can give incorrect results. Foley spoke with AM Best TV at the 2023 IASA Insurance Conference in Minneapolis.

2023-07-0606 min

AM Best Audio PodcastInsurance AUM's Foley: AI Set for Major Impact on Analytics, Risk ManagementStewart Foley, founder, Insurance AUM, sees a race shaping up with development applications, but warns that artificial intelligence can give incorrect results. Foley spoke with AM Best TV at the 2023 IASA Insurance Conference in Minneapolis.

2023-07-0606 min

Hollywood Raw PodcastStories From The Field - with Street Photographer Justin FoleyStreet journalist Justin Foley stops back by the "Hollywood Raw podcast with Dax Holt and Adam Glyn" to talk about his wild career running around the streets of LA catching up with the biggest stars in the world. Foley explains why Craig's has just become a place to be seen. This is a must-listen-to interview if you're into celebrity news and what it takes to work the streets like a pro. Don’t miss a thing! Follow Hollywood Raw on Insta, Facebook, and Twitter. Dax Holt - Insta / Twitter Adam Glyn - Insta / Tw...

2023-06-0758 min

WomanicaRagers: Maria W. StewartMaria W. Stewart (1803-1879) was a Black woman who defied societal taboos to fight against slavery. Her passionate speeches and essays furthered the abolitionist movement — and made her one of the first American women to become a public speaker. This month, we’re highlighting Ragers: women who used their anger— often righteous, though not always— to accomplish extraordinary things. History classes can get a bad rap, and sometimes for good reason. When we were students, we couldn’t help wondering... where were all the ladies at? Why were so many incredible stories missing from the typical curr...

2023-05-1806 min

Tuff Luck Tattoo PodcastEpisode 012 Mark StewartI hope you all enjoy this episode with Mark (@markstewarttattooer) we touch on what its like owning @forevertattooparlour and his new adventure opening @friendshiptattoonc

If you’re a tattooer and you’re interested in sitting down with us please DM us on Instagram.

If you’d like to support the podcast in any way please follow us on

Instagram @tufflucktattoopodcast and buy some merchandise on our store

frontier using the link in our bio.Featured in this episode is @bobbykarate @nich_c_tattooer @markstewarttattooer

Music by DJ Matt Foley

https://linktr.ee/tufflucktattoopodcast

2023-04-241h 56

Serious ShitSS #2: My Friday Is Sunday | Serious Shit | Subject To Change Ent.On this episodes the guys are down one member. That doesn't kill their flow though as Alpaspecter and VinTheHuman talk about nerd room decorating, Vin's weekend off, the trials of being a working adult and waaaay too many movies. All this, a terrible Stewart Foley impression AND a VR Troopers reference!? How could you pass it up!?---------------------------------------------------------------------------------------------OUR SOCIAL MEDIATikTok:https://www.tiktok.com/@vin.the.humanhttps://www.tiktok.com/@drtneilhttps://www.tiktok.com/@atomicgoregirl?lang=enFacebook:https://www.facebook.com...

2023-03-0637 min

Health Care Law Today PodcastThe Emerging Investigatory Focus on Telehealth: What You Need to KnowIn this episode of Health Care Law Today, Nate Lacktman and Maureen Stewart are joined by Mark Josephs, Deputy General Counsel of LifeMD to discuss the current regulatory and legal environment for telemedicine companies regarding online subscription services, and the recent investigations by the federal government of these services.

2022-12-0938 min

Dirty Moderate with Adam EpsteinJohnny Cash was a Dirty Moderate with Michael Stewart FoleyMichael Stewart Foley - celebrated historian of American political culture. With a family history of labor activism and political campaigning, this Bostonite has turned his All-American upbringing into a lifelong study of America and all of her flawed charms. His totally fucking marvelous book, Citizen Cash: The political Life and Times of Johnny Cash, is a must read for Dirty Moderates, but truly should be required reading for the masses who have only read or been fed the cliff’s notes version of the soul of this country. He and Adam have a he...

2022-07-0556 min

30 Going On 13Buffy The Vampire SlayerIn this episode we discuss the pandemonium of the inaugural 30GO13 Livestream, Maddy's gasoline-flavoured 'chos, getting a PHD in "Buffy", "Josh" Whedon, being an Anthony Stewart Head-Head, how much the intro song slaps, Liv's love of Pizza Pizza's musical curation, Xander's "brother from Bring It On" vibes, how greasy hair was in the 90's, ugly vampires, Bones, calling an ice cream shop a bar, why vampires are always hot and SO MUCH MORE!!!

Thanks for listening and we'll catch you on the flip-phone!

2022-07-011h 41

The High Performance ZoneJoin my guest Jess "GRIT" Stewart who is all about Gratitude & Grit. Taking real life hard lessons being raised from a Marine pilot on a ranch. Her motto in life - DON'T JUST GET IT DONE, GET IT DONE RIGHT with a grateful heart!Jess Stewart was raised on a cattle ranch in the Sierra Nevada mountains and trained as a teacher before setting up a medical billing business from the mobile home she shared with her husband and two young children. Over the next 15 years, Jess’s company grew exponentially, and, at the time of its sale, it had offices in California and Colorado and an international division with almost 150 employees. Today, Jess lives in Fort Worth, Texas, where she works as a business guide and uses her experience of running and scaling a business to help leadership teams put their plans in...

2022-05-261h 23

The Great Song PodcastAll For Love (from The Three Musketeers) [Bryan Adams, Rod Stewart, and Sting] w Dave Barnes - Episode 908The ultimate trio of adult contemporary powerhouse dudes gave us one of the absolute hardest movie songs of all time, so it's only fitting that we become a trio once again with our very own D'Artagnan, mister Dave Barnes! We dig deep into this incredible track from Disney's The Three Musketeers soundtrack, plus discussions of all things relevant, and some of course irrelevant.

Check out Dave's latest tunes and the "Nights Like These" tour at davebarnes.com.

Get the extended version of this and many more episodes at patreon.com/greatsongpod!

Visit greatsongpodcast...

2022-03-2346 min

WFO Radio PodcastAmalie Oil NHRA Gatornationals Results featuring Tony Stewart from the Winners Circle 3/15/2022Alan Reinhart and Joe Castello recap the 2022 Amalie Oil NHRA Gatornationals from Gainesville, FL. Joe catches up with Tony Stewart in the Winners Circle following his first win as an owner in NHRA Camping World Drag Racing. The former NASCAR, USAC, and Indy Car champion discusses his road to victory and gets video bombed by Matt Hagan. Joe and Alan break down the Top Fuel final between Tripp Tatum and Doug Foley. The round by round for Matt Hagan and the emotional final for Jim Head Inc. Dallas Glenn's Pro Stock win over Kyle Koretsky, and Karen Stoffer's best single...

2022-03-151h 29

WRGCJohnny Cash and the Limits of American EmpathyAlmost two decades after his death, country music artist Johnny Cash maintains a hallowed place in American culture. Revered for the way he wrote and sang America into song, he’s equally admired for the way he lived his life: An ardent defender of the underdog who never shied away from the opportunity to speak truth to power.

In the ninth collaboration between WRGC and the Center for Georgia Studies, historian Michael Stewart Foley joins Georgia College’s Mark Huddle to explore how Johnny Cash’s life influenced his politics, and how the singer used empathy to engage in the turbul...

2022-03-0457 min

New Books in Performing ArtsMichael Stewart Foley, "Citizen Cash: The Political Life and Times of Johnny Cash" (Basic Books, 2021)Johnny Cash famously declared himself to be “The Man in Black”. He sang that he dressed in a “somber tone” for “the poor and the beaten down, livin' in the hopeless, hungry side of town” and for “the prisoner who is long paid for his crime, but is there because he's a victim of the times”. He famously performed for inmates of Folsom, San Quintin, and a number of other less well-known prisons. Cash publicly supported Native American activists and invited prominent African American guests on his prime-time television show. Yet, he initially supported Richard Nixon, shared the stage with the arch-co...

2022-02-021h 31

New Books in MusicMichael Stewart Foley, "Citizen Cash: The Political Life and Times of Johnny Cash" (Basic Books, 2021)Johnny Cash famously declared himself to be “The Man in Black”. He sang that he dressed in a “somber tone” for “the poor and the beaten down, livin' in the hopeless, hungry side of town” and for “the prisoner who is long paid for his crime, but is there because he's a victim of the times”. He famously performed for inmates of Folsom, San Quintin, and a number of other less well-known prisons. Cash publicly supported Native American activists and invited prominent African American guests on his prime-time television show. Yet, he initially supported Richard Nixon, shared the stage with the arch-co...

2022-02-021h 26

Green & Red: Podcasts for Scrappy RadicalsJohnny Cash's Politics, w/ historian Michael Stewart Foley (G&R 127)*Citizen Cash: The Political Life of Johnny Cash* is a fantastic new book by Michael Stewart Foley, and we sat down and talked to him all about it. This is a must-listen, must-see episode.

We talked about Cash's upbringing in the depression and how the New Deal helped his family and led him to develop a "politics of empathy." We discussed his views on race, and especially his "Blood, Sweat, and Tears" album.

We talked about his work on behalf of prisoners and Native Americans, his views on the Vietnam War, and the way he stood...

2021-12-131h 09

Grab the Top Full Trial Audiobooks in Biography & Memoir, Law & PoliticsCitizen Cash: The Political Life and Times of Johnny Cash by Michael Stewart FoleyPlease visit https://thebookvoice.com/podcasts/1/audiobook/499481 to listen full audiobooks. Title: Citizen Cash: The Political Life and Times of Johnny Cash Author: Michael Stewart Foley Narrator: Greg Littlefield, Michael Stewart Format: Unabridged Audiobook Length: 11 hours 11 minutes Release date: December 7, 2021 Genres: Law & Politics Publisher's Summary: A leading historian argues that Johnny Cash was the most important political artist of his time Johnny Cash was an American icon, known for his level, bass-baritone voice and somber demeanor, and for huge hits like “Ring of Fire” and “I Walk the Line.” But he was also the most prominent political artist in the United S...

2021-12-0703 min

Experience A Full Audiobook That Is Simply Powerful.Citizen Cash by Michael Stewart FoleyPlease visithttps://thebookvoice.com/podcasts/2/audible/5659to listen full audiobooks.

Title: Citizen Cash

Author: Michael Stewart Foley

Narrator: Michael Stewart, Greg Littlefield

Format: mp3

Length: 11 hrs and 11 mins

Release date: 12-07-21

Ratings: 5 out of 5 stars, 5 ratings

Genres: Politics & Activism

Publisher's Summary:

Johnny Cash was an American icon, known for his level bass-baritone voice and somber demeanor, and for huge hits like “Ring of Fire” and “I Walk the Line”. But he was also the most prominent political artist in the United States, even if he wasn’t recognized for it in his own lifetime, or since his death in 2003. Drawing on...

2021-12-0711h 11

Unlock Top Full Audiobooks in Biography & Memoir, Arts & EntertainmentCitizen Cash: The Political Life and Times of Johnny Cash by Michael Stewart FoleyPlease visit https://thebookvoice.com/podcasts/1/audiobook/499481 to listen full audiobooks. Title: Citizen Cash: The Political Life and Times of Johnny Cash Author: Michael Stewart Foley Narrator: Greg Littlefield, Michael Stewart Format: Unabridged Audiobook Length: 11 hours 11 minutes Release date: December 7, 2021 Genres: Arts & Entertainment Publisher's Summary: A leading historian argues that Johnny Cash was the most important political artist of his time Johnny Cash was an American icon, known for his level, bass-baritone voice and somber demeanor, and for huge hits like “Ring of Fire” and “I Walk the Line.” But he was also the most prominent political artist in the United S...

2021-12-0703 min

Weber State WeeklyFOOTBALL GAME DAY: Montana State vs. Weber State w/ R&R Cat Cast's Thorny & FoleyThe end of the bye has finally come and it's time for the Wildcats to face another top ten opponent at Stewart Stadium. This time, it's the Montana State Bobcats who have been taking care of business this year and come in ranked #9.We chat with fellow Big Sky Podcast Network members Thorny and Foley from the R&R Cat Cast to learn more about what the Bobcats bring to Ogden and where the Wildcats will have to play tough to grind out a dub.For more Bobcats commentary or to hear WSW's take on...

2021-10-1532 min

Appointment TelevisionEpisode 312: Our Problems With Jon Stewart's ProblemsIt's the second installment of 2021's fall Good One / Bad One, this time discussing the new FOX drama The Big Leap, and Apple TV+'s news/comedy/journalism/the fact that we don't know what to call it is part of the problem here/discussion show, The Problem With Jon Stewart. In this episode, Margaret has many problems with Stewart, Kathryn and Andrew have fewer problems, and everybody agrees that there are zero problems with Scott Foley.

2021-10-0744 min

Quiet Please (2020)Twelve to FiveStrange things can happen on the overnight shift at a radio station.Written by: Wyllis CooperDirected & Produced by: Chuck & Megan MarraExecutive Producer & Sound Design: Todd GajdusekCo-Executive Producer & Sound Editing: Cat HammonsProduced by: Foley Marra Studios (thefoleymarrastudios.com)FeaturingSusan Damante - ConnieTodd Gajdusek - HerbieCat Hammons - CronkiteMargaux Mireault - LucyAnton Prather - MiltonChuck Marra - BobQuiet Please Theme & Other Music licensed through Soundstripe"Kingdoms"Written By: Stephen KeechPerformed...

2021-06-1727 min

Family Court VisionEpisode 18: A Regular Foley ArtistEPISODE 18! We discuss Alex Rodriguez and Dwyane Wade getting into the ownership game, Lamarcus Aldridge's retirement, Lamelo Ball, WNBA Draft recap, Breanna Stewart adding to her already long resume, and two WNBA teams hiring new Presidents. Plus, Jack gives a stat about Steph Curry that he apparently made up, that's how incorrect it was. Not even close. All that in our segment, Basketball News of the Week (5:17). Following that, we talk about the LOOOOONG (but important!) documentary, Hoop Dreams (27:45). We close the show by getting ready for the Oscars with our Fictional Players Draft (41:54). We each create our teams...

2021-04-2357 min

AGEISTJohn Foley: Gratitude is a Superpower. Give, Learn, Grow.As a former lead solo pilot for the Blue Angels, John Foley knows how to inspire greatness, and the power of gratitude. His motto is Glad To Be Here. No matter what the circumstance be thankful. John joins us on the SuperAge podcast to discuss shifting our perspective to one of gratitude keeps us open to creative solutions in all situations, how we can strengthen our relationships through trust, and why we need to learn how to compartmentalize to increase our focus, and at the same how to then open one’s vision wide to take in all one’s fe...

2021-04-2145 min

Aye Right Radio PodcastAye Right Podcast # 280 Season 2 Closet RepublicanIt’s the eve of Vaccination Day, the first day of the end of the pandemic (we hope), and the Scottish Government top team appeared at today’s Covid press briefing. The First Minister, the Health Secretary and the Chief Medical Officer radiated a Xmas Eve spirit of expectation. The press wanted early details of any changes to the tiers of Covid restrictions and got none plus more on the roll-out of the vaccination programme, which they got. Our papers review include Stephen Paton in the National, James Foley in the Source, Stuart Campbell in Wings and Ruth Wishart in the Na...

2020-12-0739 min

War Stories with Preston and SayreCPT Robert Foley (A/2-27 IN, 25th ID) Vietnam War 05NOV196605NOV1966: Commanding Alpha Company, 2-27IN, CPT Robert Foley and his men were tasked with moving to the aid of a surrounded American unit to pull them to safety. The unit was involved in Operation Attleboro, a search and destroy mission that came under heavy contact all across their positions early in the mission. With the company commander killed and taking heavy casualties, Foley and his men were called upon to reinforce.

Moving through friendly lines to reach the cut off unit, Foley and his men were barely 40m into the patrol when they came under intense en...

2020-08-2916 min

Glass Onion Minute: A Knives Out Minute PodcastTrailer RecreationEpisode Notes

A recreation of the second Knives Out trailer featuring hosts and guests of the forthcoming Knives Out Minute, a podcast looking at Knives Out minute by minute.

Featuring the voices of

Ross Weisman: Walt Thrombey, Niall Mc Gowan: Joni Thrombey, Emily Aguila: Linda Drysdale, Meghan Griffin: Benoit Blanc, Drew Stewart: Trooper Wagner, Eric Jack Nash: Hugh Drysdale, Joel Torres: Richard Drysdale, Megan Tripp: Meg Thrombey, Sarah Ifft Decker: Marta Cabrera, Ollie Brady: Det Lt Elliott, Amber Stewart: foley work and Fran's scream.

Music: Jo Blankenberg, Play the Ponies. Synchronic - Ooo...

2020-07-2202 min

Free and Fair with Franita and FoleyVoting in the time of the virus: Part 2Beyond causing delays, COVID-19 will impact the many administrative and logistical aspects of the 2020 U.S. presidential election — from staffing to absentee ballot printing to vote counting. How can we prepare if we don’t know what to expect? What happens if there is a second wave of the virus? Is the coronavirus relief bill’s $400 million to protect elections enough? Election scholars Ned Foley (OSU Moritz College of Law) and Franita Tolson (USC Gould School of Law) welcome guests Nathaniel Persily (Stanford Law School) and Charles Stewart III (MIT Political Science) to discuss what needs to be done to prepar...

2020-03-3147 min

The Hockey Betting Podcast03/20/2020 Fri-Sat-Sun NHL Awards, NHL20 Video Game Betting, Bill Foley, Scotty Bowman March 20th, 2020 | The Hockey Betting Podcast On today’s episode of The Hockey Betting Podcast, Brian Blessing and Cam Stewart take a look at betting on EA Sports' NHL20 video game simulations, the status of the NHL Awards, and of course, they tell some great hockey stories. Brian gives us an interesting report about his radio interview with Vegas Golden Knights owner Bill Foley, which makes this an ultimate “Must-Listen” episode. Great hockey discussion and fun stories are also part of today’s show. We’d like to thank BetCris Canada...

2020-03-2052 min

Medium Brown PodcastEP 11: Tyler! Put that wig down bro!Howdy folks, This week Foley tries to understand the many wigs of Tyler Perry. He talks about Tyler’s new film “ A fall from Grace” and has some notes to give for next time. Foley then reviews “ Underwater” Starring Kristen Stewart. Don’t forget to check the podcast on twitter @podcastbrown and check out MBP Swag, now on red Bubble.

2020-01-291h 27

Don't Say...with Paul & DavePirates, CFM Pumps & Find the Vagina - Ep.31Classy as always, the Don't Say gang flies all over the map discussing anything from Rod Stewart to pirate lore. Eban is mincing the pubes.Learn more about your ad choices. Visit megaphone.fm/adchoicesSee omnystudio.com/listener for privacy information.

2019-08-2746 min

Don't Say...with Paul & DaveFrench Stewart, First Jobs and Fannies - Ep. 15The gang gets used to their new digs. French Stewart surprises the guys and they discuss first jobs. Also, Jackie’s childhood memories are dashed by learning the true meaning of a word. Learn more about your ad choices. Visit megaphone.fm/adchoicesSee omnystudio.com/listener for privacy information.

2019-05-0744 min

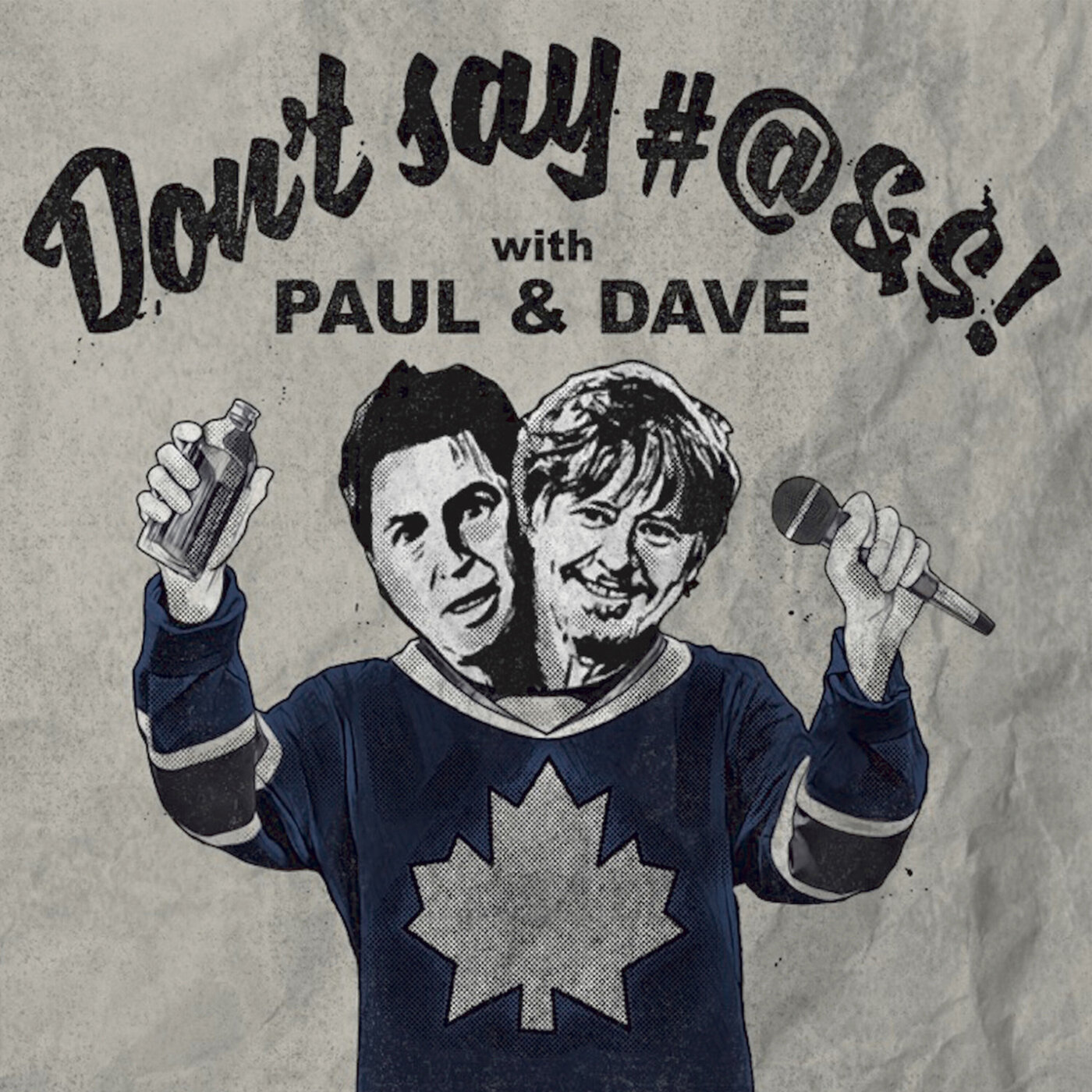

Earth MattersTraditional savanah burning cuts CO2 emissions and earns carbon credits for aboriginal communities.The vision of the Aboriginal carbon foundation is to catalyse life-changing, community prosperity through carbon farming.The main method used is a return to traditional ways of burning off savanna. Savanna burning is about reducing emissions from fire by burning in the early dry season when fires are cooler and patchy.Rowen Foley talks about pioneering this indigenous carbon credit scheme that values culture and 100% indigenous to indigenousways of working; where there is no white guy checking on things.Guest: Rowan Foley is manager of the Aboriginal Carbon FoundationSong: Jimmy Little: White Fella, Black FellaBackground guitar: Winiata PuruWith thanks to David...

2019-04-0700 min

Day DayMick Foley Cosigns Day DayMick Foley is a legendary professional wrestler, turned multi-time best-selling author , turned stand-up comic/spoken word performer. One of the cornerstones of WWE’s meteoric rise in the late 90’s, Mick Foley earned the nickname ‘The Hardcore Legend’ for his ability to absorb seemingly inhuman punishment in some of the most dramatic matches in sports-entertainment history. Already a respected veteran for his 11 physically punishing years wrestling under the name Cactus Jack, Foley’s career soared to new heights in WWE as ‘Mankind’, a character Foley claimed was inspired by a combination of reading ‘Mary Shelly’s Frankenstein’ and listening tothe music of Tori Amos...

2018-05-3001 min

Movie Go RoundIp ManWhy did we cover 2008’s “Ip Man” for our second Around the World movie? Because Donnie Yen is THE Man, not just Ip Man. Known in the West primarily as Bruce Lee’s teacher, Ip Man had a fascinating life story that Donnie Yen portrays with a Zen-like calm and a smoldering strength. This movie covers the period of the Japanese occupation of Man’s city of Foshan, China, and a cinematically exaggerated fight he had with a Japanese general.

Join David, Brett, and Nicole as they dig into this film that includes constant breaking of precious household...

2018-01-2158 min

Earth MattersThe Aboriginal Carbon FundThis episode on Earth Matters we take a look at The Aboriginal Carbon Fund and find out what the fund is doing to assist Aboriginal Traditional Owners with Savannah Burning across some parts of Northern Australia. It’s a new way of working with TO’s to continue caring for country by and to reduce carbon emissions by conducting traditional and small cool burns across savannah country. Thus minimising large unpredictable wild fires that can have a damaging direct impact on biodiversity.Coming up soon you’ll hear interviews with from Lisa McMurray from Caritas Australia and Rowan Foley – General Manager of ...

2017-09-1000 min

Liquid LunchLiquid Lunch 053

Recorded 8- 3- 17. SHADe Texas Craft author Tim Foley joins Catherine and Josh in Stew-dio. Chad shows up and Kennedy is there too.

Support Liquid Lunch

2017-08-031h 15

The New Generation Project PodcastEpisode 74: Raw Is War 2If any arena can be considered the WWF’s ‘home turf’, it’s Madison Square Garden and on September 22nd, 1997 for the first time the promotion bought their flagship Monday night programme to MSG – and what a show they staged! In Episode 74 of ‘The New Generation Project Podcast’ we look at the night Steve Austin and Vince McMahon first got physical and Mick Foley introduced us to another of his personas – it’s “Raw Is War 2”! Want to contribute towards the show? Head over to www.patreon.com/newgenpodcast for details on how to give something back and the various rewards available.

2016-10-262h 48