Shows

The Investment CuddleEpisode 57 FIRE 2 - Literature and PodcastsThis month the Cuddle looks at the FIRE movement. We talk through the different resources available to further understand Financial Independence Retire Early (FIRE) including a book review to inspire your journey.

Music by https://audionautix.com

Information links

US

Mr. Money Mustache (Pete Adeney) - Mr. Money Mustache — Early Retirement through Badassity

Choose FI Podcast: Hosted by Jonathan Mendonsa and Brad Barrett, ChooseFI - Podcast - Apple Podcasts

Tanja Hester: Author of Work Optional – ISBN-13 978-0316450898

UK

The Escape...

2025-11-2725 min

MAPS MEDIA NetworkWallet Activism: Spending with PurposeFeaturing Tanja Hester, author of Wallet ActivismYour wallet is more potent than you think. In this special bonus episode of We Vote Too, we revisit an eye-opening archived interview with Tanja Hester—former political consultant, FIRE movement pioneer, and author of Wallet Activism—to explore how your everyday financial choices can become acts of resistance.Tanja breaks down what wallet activism means, how to tell the difference between good and bad corporate behavior, and why slow change is still powerful. From critiquing philanthropy to unpacking performative travel activism, she helps us reimagine what it mean...

2025-08-1536 min

My Blog » maka13-download Pdf Work Optional: Retire Early the Non-Penny-Pinching Way BY Tanja Hester TextBookLink To Download : https://ebookfoundation.cloud/?book=B07F666N89 To Read or Download Work Optional: Retire Early the Non-Penny-Pinching Way by Tanja Hester Available versions: EPUB, PDF, MOBI, DOC, Kindle, Audiobook, etc. Reading Work Optional: Retire Early the Non-Penny-Pinching Way Download Work Optional: Retire Early the Non-Penny-Pinching Way PDF/EBooks Work Optional: Retire Early the Non-Penny-Pinching Way

2024-10-0400 min

Enthusiastic Encouragement & Dubious AdviceThe Impossibility of Being Perfectly EthicalThis week we chat about how it is impossible to be fully ethical consumers under capitalism, colonialism, patriarchy, and white supremacy. These systems are actually dependent on unethical practices. Folks on the left can absolutely tie ourselves in knots trying to make every single choice be "the right one." We also talk about the weird (and gross) moralizing that sometimes accompanies the privilege of being able to afford the seemingly "most ethical" options. Mentioned on the show: Bookshop Affiliate Storefront How to Find a Therapist, Especially if You're Queer or BIPOC via EEDA...

2024-10-0239 min

The NoSleep PodcastNoSleep Podcast S21E19It's Episode 19 of Season 21. Ride the Sleepless Express into tales about menacing monsters."Tumble" written by Kristin Kirby (Story starts around 00:03:15)Produced & scored by: David CummingsCast: Narrator - Kristin DiMercurio"Down Where It's Wetter" written by Em Starr (Story starts around 00:14:10)Produced by: Jeff ClementCast: Nick - Jeff Clement, Blair - Matthew Bradford, Mermaid - Nikolle Doolin"Out of the Light" written by Douglas Smith (Story starts around 00:29:30)Produced by: Jesse CornettCast: Narrator - Mike DelGaudio, Jan Mirocek - Jake Benson, Detective Garos - Dan...

2024-09-081h 25

Retirement Planning Education, with Andy Panko#108 – Retirement planning chat with "real" people, Ali & Alison WalkerAndy chats with real people (not advisors) doing their own retirement planning. In this episode, Andy talks with Ali & Alison Walker, who live in Arizona currently but lived and traveled abroad for a few years after retiring. They talk about a wide array of retirement planning topics such as when Ali & Alison started getting serious about retirement planning, what they wish they would have known earlier, how they planned for the non-financial aspects of retirement, and a variety of financial topics such as Social Security, investing, portfolio distributions, how they plan to address any potential long term care scenarios...

2024-07-181h 38

Inspired MoneyFinancial Resilience: Building a Strong Foundation for the FutureIn this episode of the Inspired Money Podcast, we discuss the fundamental aspects of building and preserving financial resilience. Host Andy Wang collaborates with experts Lynnette Khalfani-Cox, Tanja Hester, and Denise Li to offer vital strategies that ensure your financial stability through unforeseen challenges. Episode Highlights: Essential Strategies for Financial Stability Our episode, "Securing a Prosperous Future," sheds light on crucial tactics for crafting a strong financial safety net. Our guest panelists explore topics including assessing your financial position, adept cash flow management, and smart debt reduction. They further highlight the importance of insurance and...

2024-04-111h 07

Martinis and Your Money PodcastLife Before and During Financial Independence with Tanja HesterThis December is my final year end month for Martinis and Your Money and around this time every year, I’m always talking to clients about goal setting for the following year. And if you’ve listened to this show before, you know that one of the most important financial goals that I am most passionate about is Financial Independence and that’s the ability to work because you WANT to work and not because you HAVE to work.

Fi is the number one goal we give to all of our clients at Financial Gym and it’s the nu...

2023-12-2259 min

Martinis and Your Money PodcastLife Before and During Financial Independence with Tanja HesterThis December is my final year end month for Martinis and Your Money and around this time every year, I’m always talking to clients about goal setting for the following year. And if you’ve listened to this show before, you know that one of the most important financial goals that I am most passionate about is Financial Independence and that’s the ability to work because you WANT to work and not because you HAVE to work.

Fi is the number one goal we give to all of our clients at Financial Gym and it’s the nu...

2023-12-2259 min

Tanja Mundt_de Podcast#6 Dromen, durven, doen I met Hester van der VeldeGraag introduceer ik mijn gast van deze week: Hester van der Velde-Lensink. Zij startte haar carrière als leerkracht in het basisonderwijs om na 14 jaar de sprong te wagen en van haar hobby haar werk te maken. In 2018 is zij gestart als zelfstandig fotograaf en eigenaar van Moments by Hester.In deze aflevering hoor je hoe Hester stap voor stap haar droom heeft waargemaakt. En hoe ze haar vaste baan in het onderwijs heeft losgelaten voor het ondernemerschap. Een hele mooie en inspirerende reis waarbij ze altijd dicht bij zichzelf is gebleven.Ben jij een (s...

2023-10-251h 04

Crush Your Money GoalsEpisode 5: The Power of Money: How to Use Your Financial Resources to Make a Difference with Tanja HesterIn this episode we come to you live from Fincon’s first Women In Money conferences with the one and only Tanja Hester! Tanja Hester, author of two award-winning books — Work Optional: Retire Early the Non-Penny-Pinching Way and Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change — is best known for retiring from her career at the age of 38, after watching her dad get forced into early retirement by his disability, which she inherited. We focused the majority of our time talking w...

2023-10-1029 min

Money Feels38: Climate Change and Your FinancesEach year, about 13 million people die because of things like pollution and extreme weather caused by climate change. So, on that depressing note, let's talk about how to prepare your finances for the unknowns in this week's episode of Money Feels! We're your hosts, Alyssa and Bridget. Welcome to the podcast, where we talk through our money trauma and create a better understanding of building a healthy relationship with finance.In today's episode, we discuss the following:What's going on with the climate crisis?The changing landscape of our retirementWhy you need good insuranceUsing...

2023-09-2147 min

Everyone's Talkin' MoneyMastering the Money Game: How to Maximize Every Dollar with Tanja HesterIn this episode of Everyone's Talkin' Money, I chat with the awesome guest Tanja Hester about how you can use your money to make a real impact. We talk about challenging the status quo and embracing nuance when it comes to your spending habits. You'll learn how to maximize every dollar you have, how to identify your personal money values, how to align your money values with your choices, practical tips to become a wallet activist, and how to make intentional choices with your money that will get you closer to your money goals.Links...

2023-08-0939 min

A Note of DaringEmily Pauls: Quitting, Hiking, & Making Life UpEmily Pauls quit her accounting job in Chicago in 2022 to do the northbound 2500-mile thru-hike of the PCT. In this lovely conversation, we talk about when a choice that will change your life becomes real, how to transition into self-employment, the financial cost behind the hike, how we are all making up our lives, the comfort of consistency, and the challenges of shifting approaches to work and life. Emily Pauls is currently making it up as she goes along. You can find her on Instagram @emily_pauls_.Mentions:Pacific Crest Trail The Year of Le...

2023-03-1357 min

Inspired Budget#089: Becoming a Money Activist with Tanja HesterYou have more power than you may think when it comes to making positive changes in the world with your money! In this episode of the Inspired Budget Podcast, Tanja Hester discusses her new book, Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change. If you want to feel hopeful, empowered, purposeful and impactful when it comes to the way you approach money management, I suggest you tune in! Follow Tanja: Twitter | Facebook | InstagramBuy Tanja's new book, Wallet Activism h...

2023-01-1935 min

The Long ViewJulien and Kiersten Saunders: ‘How Much Is Enough?’Our guests on the podcast today are Kiersten and Julien Saunders. Together they blog about finance and life at the website richandregular.com. And they’re also the authors of a new book called Cashing Out: Win the Wealth Game by Walking Away. In addition, they co-host the rich & REGULAR podcast. After discovering the Financial Independence, Retire Early movement in 2012, they proceeded to pay off $200,000 in debt and walked away from their corporate jobs before turning 40.BackgroundBiorich & REGULAR podcastMoney on the TableCashing Out: Win the We...

2022-10-2555 min

Staying in the BlackWork optionalIn today's episode Ms. Black talks about "Work Optional Retire: Early the Non-Penny-Pinching Way" by Tanja Hester. Ms. Black, the host of Staying in the Black, is a single mom, homeowner, and public-school educator in NYC. She owns two properties and is one mortgage away from being totally debt-free. She loves traveling the world with her family and has over $500,000 in her retirement accounts beyond her pension.Learn more about Ms. Black:Website: http://www.stayingintheblk.comInstagram:@stayingintheblk

2022-10-0732 min

Big Picture In PracticeInterviewing Tanja Hester: Advising a New Generation of Wallet ActivistsIn this special, live episode of Big Picture in Practice, Julie Willoughby and new co-host Syl Flood interview Tanja Hester on sustainability, wallet activism, and advice for advisors who want to engage with the new generation of investors. Tanja Hester is an award-winning author and activist.

2022-09-0129 min

CharactersDoes Personal Action Matter? Letting Go of Eco-Guilt193: We’re exploring a common sentiment in the sustainability space: eco-guilt, or any feelings of shortfalls around our own environmental action. We’re discussing the causes of these emotions, and how we can rationalize giving ourselves some grace around these self-defined benchmarks of being a “good” environmentalist. We’re also revisiting an excellent example of collective and personal action working together to create change from Tanja Hester of Ep 158.More episodes on eco-anxiety:155: Climate Anxiety + 5 Tips for Burnout126: Climate Anxiety: How to Turn Worry into Compassionate Action with Dr. R...

2022-08-2623 min

Young Money with Tracey BissettEP253 Wallet Activism with Tanja HesterWhen making purchasing decisions, it is becoming apparent that many of us are beginning to take into consideration the ethicality of what we are buying and how it is produced. Spending ethically doesn’t have to be difficult, and it doesn’t mean that you can’t save money while doing so. Our guest today, Tanja Hester, knows this topic very well. Tanya is the author of two award-winning books, Work Optional and Wallet Activism, and is best known for retiring from her career at the age of 38. In this episode, she will be sharing several things to think about ne...

2022-07-1241 min

Martinis and Your Money PodcastWallet Activism with Tanja HesterThese are challenging and stressful times we’re living in. With the recent decisions by the Supreme Court, I know many of you are feeling like you don’t have a voice or you’re frustrated by what’s happening around you and you’re not quite sure what to do about it. Well if you’re feeling like this now might be the perfect time to read the latest book from my guest today, Tanja Hester. Tanja is an author and activist and was previously on the show to promote her book Work Optional, about her journey to fi...

2022-07-0846 min

Anxiety My Friend - Ansiedade Minha Amiga1 Ano De IFRA Em Portugal JUL20221 ano de liberdade financeira - IFRA - em Portugal

1. Quão poupados precisas que os teus amigos sejam?

2. Considerarias emigrar?

3. Quando é que deves pagar os teus investimentos?

4. Qual o teu propósito nesta vida?

5. O que podes ensinar aos outros?

VSO - Voluntary Services Overseas: https://www.vsointernational.org/

O dinheiro ou a vida, (Your money or your life), de Vicki Robin

https://vickirobin.com/books/your-money-or-your-life/

The simple path to wealth, by J L Collins

Reddit português sobre educação financeira: https://www.reddit.com/r/literaciafinanceira/comments/urwtoj/mandamentos_de_um_bom_investidor_um_guia_pessoal/

Calculadora de jur...

2022-07-0131 min

Anxiety My Friend - Ansiedade Minha Amiga1 Year Of FIRE in Portugal JUL20221 year of FIRE in Portugal, 5 questions

1. How frugal do you need your friends to be?

2. Would you consider emigrating?

3. When do you pay your investments?

4. What is your purpose in life?

5. What can you teach others?

VSO - Voluntary Services Overseas: https://www.vsointernational.org/

Your money or your life, by Vicki Robin

https://vickirobin.com/books/your-money-or-your-life/

The simple path to wealth, by J L Collins

Portuguese Reddit about financial independence: https://www.reddit.com/r/literaciafinanceira/comments/urwtoj/mandamentos_de_um_bom_investidor_um_guia_pessoal/

Compound interest calculator: http://moneychimp.com/calculator/compound_interest_calculator.htm

Guia...

2022-07-0125 min

Inspire To FIRE Podcast (Financial Independence Retire Early)Becoming A Wallet Activist On Your Journey To FI With Tanja HesterTanja Hester joins the show to talk about her new book Wallet Activism.Wallet Activism challenges you to rethink your financial power so can feel confident spending, earning, and saving money in ways that align with your values.For a limited time, you can try Audible Premium Plus for 30 days free! (Use this link for 1 free credit that you can use toward any premium selection titles you like—yours to keep!)Using this hack you can enjoy Wallet Activism and thousands of other titles for free....

2022-06-0852 min

Woman Owned: The Growth Podcast for Women EntrepreneursEP503: Wallet Activism with Tanja HesterAs women founders and leaders, we talk often about making money, and lots of it. But are we using the money we make to create the kinds of changes that we want to see in the world? I like to say that money is power, but only if you make it so. Your money becomes a powerful force when you use it in a way that advances your mission, aligns with your values, and brings your vision to life. And this week, I have someone who is a living example of what's possible when you're intentional about...

2022-06-0743 min

Not Your DemographicIs Double or Nothing over yet?Erin & Stella talk about wrestling! They breakdown their Double or Nothing feelings, dunk on MJF and wonder what the hell is going on with Ruby Soho. Plus, Ricky Starks love, a reminder to vote with your money and the books they've been reading and enjoying. Books mentioned: Wallet Activism by Tanja Hester Abolition for the People: The Movement for a Future Without Policing & Prisons edited by Colin Kaepernick Giant Days Volume 1 by John Allison and artists Lissa Treiman and Max Sarin Way of the Househusband Volume 1 by Kousuk...

2022-06-031h 20

The Mental Health and Wealth ShowOn Wallet Activism - Using Our Money for Change: An Interview with Tanja HesterYour money is a tool to support the people and the causes that you care about. In this episode, I talk with Tanja Hester about becoming a wallet activist. Tanja Hester is the author of the award-winning book Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change. She is also, as The New York Times called her, “the matriarch of the women’s FIRE movement.” Listen and learn how to find out what your values are, spend on what matters, and raise your consciousness around how things are made and the impact...

2022-04-0857 min

Northstar Unplugged#082. Tanja Hester: how to use your wallet as a force for changeTanja Hester is the author of Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change and Work Optional: Retire Early the Non-Penny Pinching Way. She’s a former political consultant and journalist turned activist and early retiree.Full show notes at www.northstarunplugged.com

2022-04-041h 04

Yo Quiero DineroHow to be a Wallet Activist | Tanja Hester, Author of Wallet ActivismTanja Hester is the author of Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Changeand Work Optional: Retire Early the Non-Penny-Pinching Way. After spending most of her career as a consultant to Democratic politics and progressive issue campaigns, and before that as a public radio journalist, Tanja retired early at the age of thirty-eight. She documented the process on her award-winning financial independence/retire early (FIRE) blog, Our Next Life.She's been an outspoken voice in the personal finance media community to consider systemic barriers and opportunity gaps, rat...

2022-04-0338 min

Your American MoneyWallet Activism with Tanja HesterIn this episode author Tanja Hester and I discuss her new book "Wallet Activism" and the power behind every financial decision.

2022-03-2155 min

Queer Money®: How Gay People Do MoneyHow Wallet Activism Can Hasten LGBTQ Activism - Queer Money Ep. 305Frustrated with the state of our economy, the culture, environment and LGBTQ rights? Here’s how ‘Wallet Activism’ can hasten LGBTQ activism. Today, we’re talking with Tanja Hester of the blog Our Next Life and the author of Work Optional and the new book, Wallet Activism. Tanja shares how voting with your dollar can apply to so much more than just when you’re at the checkout counter. And, don’t worry, you can still live frugally and FI/RE. Remember to subscribe to the weekly show notes newsletter for a chance to win a copy of Ta...

2022-03-1552 min

Progressive Pockets: a podcast about the untapped power of our wallets to build the world we want25. What should I be reading?Send us a textHere’s today’s letter:I’m looking for some reading material to learn about how I might better walk the talk in my own life. Like, I have all these strong beliefs about things, but I’m not always sure I’m living in alignment with those values. Do you have any recommendations for where to start?Today we discuss books for adults and kids, including:Decolonizing Wealth: Indigenous Wisdom to Heal Divides and Restore Balance by Edgar VillanuevaWinners Take All: the Elite Charade of...

2022-02-2208 min

3 Spooked Girls304: January's Listener Encounters 2022Hey Spooksters! Today we are bringing you four spooky haunt stories that were submitted in to us!

Thank you to our newest Patrons: Tonua, Alexandria, Myla, Tanja, MaKayla, Amanda, & Melinda!

Check out the following link for TICKETS TO OUR LIVE SHOW!, our socials, Patreon, & more https://linktr.ee/3spookedgirls

Have a personal true crime story or paranormal encounter you'd like to share with us? Send us an email over to 3spookedgirls@gmail.com

Thank you to Sarah Hester Ross for our intro music!

2022-01-3113 min

Solve For NatureMaking Your Voice (And Wallet) Heard w/ Tanja HesterTanja Hester is the author of Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change and Work Optional: Retire Early the Non-Penny-Pinching Way. She spent most of her career as a consultant to Democratic politics and progressive issue campaigns, and before that as a public radio journalist. Tanja retired early at the age of thirty-eight. She documented the process on her award-winning financial independence/retire early (FIRE) blog, Our Next Life. Today, we're going to be talking about how every purchase you buy matters, and how every one counts as a...

2022-01-3058 min

The Long ViewPaula Pant: A Different Path to Financial IndependenceOur guest on the podcast today is Paula Pant, host of the popular Afford Anything podcast. She is also the founder of affordanything.com, a personal finance website. Paula is a frequent public speaker and is a leading voice in the “Financial Independence, Retire Early” movement, better known as FIRE. She is a graduate of the Honors Program at the University of Colorado at Boulder.BackgroundBioAfford AnythingAfford Anything podcastFIRE“Why the FIRE Movement Is Misunderstood,” by Paula Pant, affordanything.com, Oct. 17, 2018.The...

2022-01-1848 min

The His and Her Money ShowHow to Use Every Dollar You Spend, Earn, and Save as a Force for Change with Tanja HesterOn this episode of the His & Her Money Show, Tanja Hester is with us! The former political consultant is no stranger to the show. And we've got her back AGAIN to drop more truths for everybody listening at home. Today she's speaking on her newest book, WALLET ACTIVISM, and handing out tips and advice for taking up the reins and taking charge of your life -- financially, socially, and beyond! From politics to personal finance, Tanja has worn multiple hats across her career and has drawn so much wisdom from it all that she can't w...

2022-01-0529 min

Popcorn FinanceHow to Make an Impact Through DonatingMany of us would like to make a differrence through donating, but it can often feel daunting to find the right place to give. Tanja Hester, author of Wallet Activism, joins us once again to help us understand the best ways to donate. Giveaway Details! To enter to win 1 of the 2 copies of Wallet Activism I am giving away, just send me an email to Questions@PopcornFinance.com or send me a DM on instagram @PopcornFinancePodcast and tell me why you'd like to win a copy. Connect with this we...

2021-12-2307 min

ChatChat - Claudia CraggFor The Holidays, Become a 'Wallet Activist' with Tanja Hester, @TanjaHester is the author of (November 2021). Clear-eyed and practical, #WalletActivism helps angry, overwhelmed, and disillusioned consumers cut through the marketing lies of companies that have rebranded their problematic practices as “green,” “woke,” and “ethical” to learn how to use their financial power to fight back. Hester doesn’t offer easy solutions or simple answers. Instead, she helps readers (1) understand the complex, nuanced impact their financial decisions have on both people and the planet, (2) define their own personal financial values, and (3) begin to make better (not perfect), more intentional money moves (from deciding where you live to where you bank and more). Hester...

2021-12-0940 min

Popcorn Finance274: How to Make Real Change With Your WalletI think we would all like to make a positive impact on this world, but often it can difficult to know how. This week I'm joined by Tanja Hester, author of Wallet Activism, to learn how we can use the money we earn to make real lasting change. Connect with this week’s guest! Follow Tanja on Instagram @OurNextLife or check out her amazing work at https://ournextlife.com Grab a copy of Wallet Activism at https://bookshop.org/a/2450/9781953295590 Have a Question? Send me a message at...

2021-12-0613 min

The Vermont Conversation with David GoodmanHow to spend money and not wreck the world'Tis the season of American capitalism. Online shoppers spent $9 billion on Black Friday and $11 billion on Cyber Monday this year.What is the impact of all this spending? And while everyone loves a bargain, is it possible that some items are just too cheap?Author Tanja Hester argues that while Americans buy a lot, we may be leaving something on the table: our power to leverage change based on how we use our money.Hester is a former progressive political consultant who the New...

2021-12-0228 min

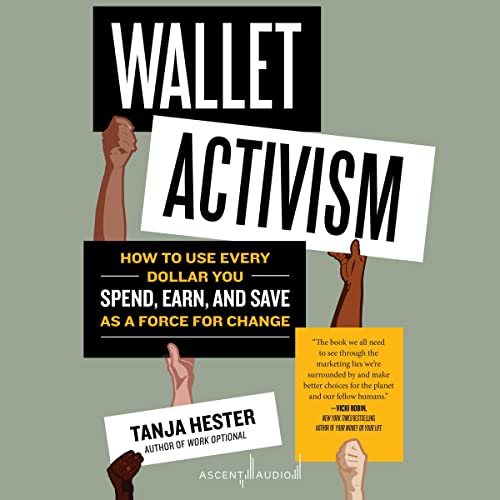

Begin The Full Audiobook Everyone Is Talking About — So Breakthrough!Wallet Activism by Tanja HesterPlease visithttps://thebookvoice.com/podcasts/2/audible/98150to listen full audiobooks.

Title: Wallet Activism

Author: Tanja Hester

Narrator: Tanja Hester

Format: mp3

Length: 9 hrs and 8 mins

Release date: 11-23-21

Ratings: 4.5 out of 5 stars, 11 ratings

Genres: Consumer Behavior & Market Research

Publisher's Summary:

Wallet Activism challenges you to rethink your financial power so can feel confident spending, earning, and saving money in ways that align with your values.

2021-11-239h 08

Journey To LaunchHow To Use Every Dollar You Spend, Earn And Save As A Force For Change With Tanja HesterTanja Hester, author of Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change and Work Optional: Retire Early the Non-Penny Pinching Way, joins the podcast to talk about her upcoming book and how you can use the power of your money for change. Tanja is a former political consultant and journalist turned activist and early retiree, retiring at the age of 38. Tanja also blogs over at OurNextLife.com If you are interested in learning how you can make an impactful difference with your money right now, this...

2021-11-1747 min

The MapleMoney ShowHow to Use Your Wallet to Create Social Change, with Tanja HesterFor most of us, price is the driving factor behind our spending decisions. But should we be looking deeper into the things we buy? My guest this week joins the show to explain how we can use our wallets to affect change in the world around us. Tanja Hester retired early from a career in political and social change communications to devote all her time to purpose-driven projects. Tanja is the author of the award-winning book, “Work Optional: Retire Early the Non-Penny-Pinching Way”, called “the best step-by-step guide to retire early” by MarketWatch. She’s used her l...

2021-11-1746 min

Sustainable MinimalistsThe Power Of The PurseInstead of legitimate reform, companies often rebrand their problematic practices as "green," "woke," and "ethical." Not surprisingly, we consumers are both angry and disillusioned by these marketing lies. But when we use our collective purchasing power to fight back, we show our strength. Hence, the power of the purse.Today I speak with author Tanja Hester. While Tanja doesn't offer easy solutions or simple answers in our conversation, she does lay a roadmap for making better (not perfect!) money moves that positively impact both people and the planet. Here's a preview:[4:30] Tan...

2021-11-1626 min

Wellness for Financial GrownupsMoney Tips to be a Wallet Activist with author Tanja HesterWant to have more money AND a better planet? Learn what we can control that really matters- and what we are over stressing about when it comes to climate change, waste, carbon offsets, plastic straws and all those questions about which milk to order from Wallet Activist author Tanja Hester. For more information, visit the show notes at https://www.bobbirebell.com/podcast/tanjahesterwalletactivism

2021-11-1622 min 2021-11-1500 min

2021-11-1500 min

Characters158: Wallet Activism | Tanja Hester

Is ‘conscious consumerism’ enough? This week we’re exploring what it means to truly use your dollars to influence change with author and activist Tanja Hester. Tanja’s upcoming book, Wallet Activism: How To Use Every Dollar You Spend, Earn, and Save as a Force for Change bridges the knowledge divide between environmental and social activism, and acts as a through, no-BS handbook to navigate the nuances of thoughtful spending (and saving!). Our conversation explores case studies of the power of collective *and* policy action, consumer guilt, and how to do your best in a (broken) capitalist society.

...

2021-11-1139 min

Earn & InvestHow to be a Wallet Activist w/ Tanja HesterHow do we use all this knowledge and economic fuel we have gained by being financially savvy? This week we discuss with Tanja Hester how to be a wallet activist and use our financial power to do less harm and improve the world. Learn more about your ad choices. Visit megaphone.fm/adchoices

2021-11-111h 01

How To MoneyMaking an Impact With Your Money | Feat. Tanja HesterDo you want to use your money and time to challenge the status quo?In this episode of How To Money, Kate Campbell chats to the wonderful Tanja Hester from the US, who is an influential figure in the financial independence and work optional movement. She's the author of Work Optional, and her latest book Wallet Activism is being released in late 2021.Money doesn't exist in a vacuum, and in today's episode Tanja talks about ways we can be more intentional with our money. This includes some new ideas...

2021-11-0734 min

A Thousand Natural Shocks With Gabe S. DunnFinancial Independence: Does FIRE Even Work?This week, Gaby investigates the controversial FIRE (Financial Independence Retire Early) movement. They are joined by Tanja Hester, author of Work Optional: Retire Early the Non-Penny-Pinching Way, to discuss who the FIRE movement works for and what sacrifices it requires. Can someone without starter money or a large income really ethically retire early? Then, Gaby talks to FIRE skeptic Michelle Jackson, of the "Michelle is Money Hungry" podcast, about making FIRE realistic and accessible for anyone other than white, straight, cis finance bros.

For a transcript of the show visit: bit.ly/BWMS9E4Transcript

Vox article: https://www.vox.com...

2021-11-0336 min

Everyone's Talkin' MoneyHow to Use Every Dollar You Spend, Earn & Save to Create Change

Whether you know it or not, you are making a statement with every dollar you spend, earn and save. What if your money could actually create change? Let me introduce you to a connect called Wallet Activism. Our guest, Tanja Hester, Tanja Hester, author of Work Optional: Retire Early the Non-Penny-Pinching Way and the forthcoming title Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change, is best known for retiring from her career at the age of 38, after watching her dad get forced into early retirement by his disability...

2021-10-1941 min

So Money with Farnoosh Torabi1262: Wallet Activism and How to Spend, Earn and Save as a Force for ChangeFinancial expert Tanja Hester joins to talk about her new book called Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save as a Force for Change.

Clear-eyed and practical, Wallet Activism helps angry, overwhelmed, and disillusioned consumers cut through the marketing lies of companies that have rebranded their problematic practices as “green,” “woke,” and “ethical” to learn how to use their financial power to fight back.

Learn more about your ad choices. Visit podcastchoices.com/adchoices

2021-10-0628 min

Ways to Means1. Renai's RetirementRenai is ready to retire at the age of 36. No, she’s not a tech founder who just sold her company; she was raised working class by a single mom and has worked in non-profits most of her life. We asked Renai to come on the podcast and share how she was able to reach financial independence so early in her career, because unlike many such stories, hers is as attainable as it is aspirational.

A few things that come up in the episode:

-- We discuss the FIRE lifestyle movement. FIRE stands for Financial In...

2021-09-2233 min

MAPS MEDIA NetworkAction Not Reaction1. Intro (1min 35 sec)

2. Interview with Tanja Hester (10 min 52 sec)

3. Top Ten Trending Topics (42 min 28 Sec): The U.S. State Department warned the Taliban to keep their word on allowing evacuees to depart Afghanistan, How 9/11 changed how we travel, Netflix show Turning Point, Beyonce Birthday, Aaliyah one in million #1 digital, Lil Nas X Photoshoot, Drake leaked a Kanye Diss, Uzi Vert lost a diamond, Naomi Osaka takes a break, Ida Left deadly path.

4. Outro (1hr 6min 05 sec)

2021-09-061h 07

Bossed UpHow to Harness Your Financial Power to Make Your Money MatterIn today’s episode, Emilie sits down with Tanja Hester, author of Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save As a Force for Change, all about how to be a more socially conscious citizen and financial activist. Related Links:Learn more about Tanja’s workGrab one of Tanja’s books:Wallet Activism: How to Use Every Dollar You Spend, Earn, and Save As a Force for ChangePrevious Book - Work Optional: Retire Early the Non-Penny-Pinching WayEp 64: Feminist Take on F.I.R.E.Ep 253: How to get Involved in Activism in 2020Smile.A...

2021-08-3140 min

The Long ViewLeif Dahleen: Finding Financial IndependenceOur guest on the podcast today is Leif Dahleen, who heads up the popular Physician on FIRE blog. Leif retired from his career as an anesthesiologist at age 43. Since that time, he has been blogging about his own financial independence, retire early journey, sharing early retirement and investing guidance with other professionals who might also wish to retire early. He attended the University of Minnesota for his undergraduate and medical school education, completed an internship at Gundersen Lutheran in La Crosse, Wisconsin, and finished his residency at the University of Florida.Background

2021-07-0651 min

FMN Podcast#19 - Onderwijs en COVID-19: Wat leren we? Terug naar normaal, terug naar school!In deze aflevering van de FMN Podcast zoomen we in op het facilitaire onderwijs in tijden van Corona. Hoe hebben zij de Pre-, en de In-COVID periode ervaren, en hoe komt straks tijdens de (hopelijk) Post-COVID periode alles weer in ‘echte’ verbinding met elkaar? Een wereld waarbij student, docent en gebouw aan de ene kant van elkaar vervreemden, maar waarbij de digitale mogelijkheden ook handige ‘afstands’ hulpmiddelen kunnen zijn. De kant van opdrachtgevers en aanbieders moet nog in gaan zien dat de markt van FM’ers krap gaat worden en waarbij meer samenwerken efficiëntie kan oplever...

2021-04-1334 min

Making it with the Mayers#18- You Can't Retire EarlyYou can't retire early....

Wait, isn't that what this podcast is about?!

So, now that we've got your attention, this episode goes into an article we read about why Kevin O'Leary, business man and investor on CNBC's "Shark Tank," says that FIRE doesn't work and you SHOULDN'T do it. But what O'Leary is saying, is exactly why we're doing what we're doing!

On my list this week... ventricles and pigskins. Also, Vanessa woos Jackson with a few Valentine's Day haikus she wrote for him.

Here's the article we referenced:

2021-02-0824 minMarathon Author: A creative career is a marathon, not a sprintSW 028 - The Last and First EpisodeSpeculative Work is transitioning to Marathon Author!

Why? Because "speculative" is hard to say when you're tired and tongue-tied.

Topics in this episode include consistency and using Healthcare.gov.

Check out the Healthcare enrollment episode of the Afford Anything Podcast for a really great breakdown of health insurance options on the ACA marketplace: https://affordanything.com/psa-thursday-the-affordable-care-act-with-tanja-hester/

2020-11-0333 min

Afford AnythingPSA Thursday - The Affordable Care Act, with Tanja HesterWith the uncertainty of the Affordable Care Act (ACA) looming before us, many are asking: How can we plan for healthcare - now and in the future? How much will I need to save to cover healthcare in retirement? What can I do if I can't afford the expensive premiums? As a community of entrepreneurs and early retirees, this is a major concern. To help us understand the healthcare landscape, Tanja Hester, author of Work Optional and the blog Our Next Life, joins us. For more information, visit the show notes a...

2020-10-3148 min

The Long ViewKarsten Jeske: Cracking the Code on Retirement Spending RatesOur guest on the podcast today is Karsten Jeske, the founder of the website EarlyRetirementNow and a thoughtful and technically proficient member of the Financial Independence, Retire Early (FIRE) community. In 2018, Karsten retired in his early 40s, after a career in the financial world. He served as Director of Asset Allocation Research for Mellon Capital Management from 2008 through 2018, and before that, was a research economist at the Federal Reserve Bank of Atlanta for a decade. Karsten has his PhD in economics from the University of Minnesota and has taught undergraduate and PhD-level economics at Emory University. He's also a...

2020-10-1448 min

The Curious One021: All Things Financial Independence, The F.I.R.E. Movement, and Defining Your Values // Jolie Viguers (Well Bean Coaching)Hello my friends and welcome back to TCO podcast! Today’s guest is with personal finance advisor Jolie Viguers. Jolie is the owner of Well Bean Coaching - coaching confidence for financial independence. Check out Jolie's KICKSTARTER Program!During our conversation Jolie and I chatted about:-Financial Independence & the F.I.R.E. Movement-Jolie’s personal journey to achieving FI-is the FI movement for everyone & pros and cons of FI-defining our values and spending in alignment with our values-tips for individuals at the begi...

2020-07-1558 min

Earn & InvestHow To Fight Injustice as a non person of color w/ Tanja HesterIn this very important episode I talk to Tanja Hester (author of Work Optional: Retire Early The Non Penny Pinching Way) about how non people of color can fight injustice, racism, sexism, and bias in our society. Learn more about your ad choices. Visit megaphone.fm/adchoices

2020-06-181h 00

FI after 40 PodcastOvercoming Limiting Beliefs to Find Financial Freedom with Jessica from The FioneersToday we have Jessica from The Fioneers. She’s a co-founder of https://thefioneers.com/ along with her husband Corey. Their financial independence blog was a 2019 Plutus Award Winner for Best New Personal Finance Blog. We discuss a wide range of topics, including an overview of the Slow FI concept she developed with her husband. We also dive into how she overcame several limiting beliefs in order to become an entrepreneur and launch a new business. Finally, Jessica shares why Slow FI is an ideal option for people pursuing financial freedom later in life.

Jessica lives in Boston an...

2020-06-0850 min

The Long ViewTanja Hester: The Pandemic Will Stoke Interest in Early RetirementOur guest this week is Tanja Hester, whom The New York Times referred to as the matriarch of the FIRE movement. For the uninitiated, FIRE stands for financial independence/retire early. Tanja is the author of the Our Next Life blog, and she is also author of the book Work Optional: Retire Early the Non-Penny-Pinching Way. Tanja and her husband Mark retired in 2017 at the ages of 38 and 41. Her blog is devoted to chronicling their journey and sharing guidance for others who might be considering an early retirement.BackgroundTanja Hester’s...

2020-06-0347 min

How You Spend Your DaysPersonal Finance during the CoronavirusIncomeUnemploymentPandemic Unemployment Assistance ProgramSpendingTaking stock in where your money is goingTackling DebtNegotiate your debtsSavingEmergency FundHow to Build an Emergency Fund during an Emergency from Paula Pant, Afford AnythingLife Happens Fund from Tanja Hester, Our Next LifeInvestingTips from Tanja Hester, @our_nextlifeDon't try to time the marketInvest consistently over time, no matter what the markets are doingAvoid making panicked decisions with regards to the marketThink Long-TermIndividual StimulusEconomic Injury Disaster Loan (EIDL)Paycheck Protection Plan (PPP)

2020-04-2227 min

More Money PodcastMy Top F.I.R.E. Book Picks You Need to Read - Money Minute with Jessica MoorhouseSince this week’s episode featured another guest who was able to achieve F.I.R.E. in his 30s, I thought it would be a great topic for this week’s Money Minute! Since we are currently in a bear market, similar to the one that happened from 2007-2009, this is actually the best time to build wealth. From all the guests I’ve had on my show, that’s how they were able to achieve financial independence and retire early…they invested during the last recession and reaped the rewards. If you have dreams of reaching financial independen...

2020-03-2704 min

this is investingTanja achieved FIRE status (retired) by age 38... what's the catch? 🔥I catch up with Tanja Hester from The Fairer Cents podcast and she shares how she retired at age 38. We discuss the concepts of F.I.R.E and how she got there.Is Financial Independence Retire Early possible in your situation?👇👇👇👇👇👇👇👇Things you need to know & places you need to go!➡Check out The Glen James Spending Plan here: https://www.sortyourmoneyout.com/online-course/ (use coupon code "m3x" to get this for under $50... save $20)➡Need personal help? Get it here: https://www.sortyourmoneyout.com/reach-out➡Insta https://www.instagram.com/mymillennialmoney/➡Our private facey group for list...

2020-02-2337 min

Your Money, Your WealthTanja Hester on the Flexibility of Financial IndependenceTanja Hester (called the Matriarch of the women's FIRE movement by the New York Times) returns to YMYW to discuss the value of our time, how it's connected to our money, and the options financial independence provides for a life well-lived. Plus, Joe and Big Al answer questions about the balanced asset allocation strategy, taking a pension and another job AND Social Security, and what to do when your company changes 401(k) custodians. Ask money questions, read the transcript & access free financial resources: http://bit.ly/YMYW-250

2019-12-0345 min

Young House Love Has A Podcast#157: How You Can Achieve Even Your Biggest Financial GoalsDon't we all want mo money without mo problems? Today we're talking with personal finance expert Tanja Hester about how value-driven spending and setting a "money mission statement" can help you reach even your biggest financial goals - whether you're saving up for a home in your dream neighborhood, a big renovation, or even early retirement, which Tanja herself has accomplished. She's sharing easy ways to trim your budget, painless ways to put more in the bank, and why she thinks most of us have more financial freedom than we think. Plus, we're discussing a new holiday decorating epiphany...

2019-12-0237 min

Journey To LaunchSaving 50% of Your Income on $60,000 While Navigating a Health Condition with ZeroIn this week's podcast episode, Zero shares her amazing story of adversity and triumphs. She saved half her income when she made $60,000 a year in New York while also navigating health challenges. In her twenties, she had brain surgery and doctors told her she may not be able to work or live independently. Instead of surrendering to her prognosis, she got through her recovery and moved to New York City. Not only did Zero find a job, but she went from making $37,000 a year to $75,000 in a short period. Zero maximized her income when she was making l...

2019-11-201h 01

The Personal Finance Show100 - Financial Privilege

This is the 100th episode of The Personal Finance Show!

My special guests today are Tanja Hester and Kara Perez, the hosts of my favourite podcast, The Fairer Cents, and James Mwombela, who is a CFP and Associate Planner at Grid 202 Partners.

Episode 100 isn’t about someone’s personal finance story. It’s about an important personal finance topic.

Today’s topic is financial privilege.

My goal with this episode was to encourage you to think about privilege and how it affects your life and your finances.

Mos...

2019-09-1900 min

The Personal Finance Show100 - Financial Privilege

This is the 100th episode of The Personal Finance Show!

My special guests today are Tanja Hester and Kara Perez, the hosts of my favourite podcast, The Fairer Cents, and James Mwombela, who is a CFP and Associate Planner at Grid 202 Partners.

Episode 100 isn’t about someone’s personal finance story. It’s about an important personal finance topic.

Today’s topic is financial privilege.

My goal with this episode was to encourage you to think about privilege and how it affects your life and your finances.

Mos...

2019-09-1947 min

The Personal Finance Show99 - Beth MacMillan

Beth MacMillan wants you to prioritize travel.

In 2011, Beth and her husband, Mark, decided to use their saved up money and take a 6 month honeymoon around the world.

You don’t have to save $20,000 and buy round-the-world tickets like Beth did, but if you’re interested in travel at all, you can pick up a lot of tips by listening to Beth’s story.

To be able to travel, you need 2 things, time and money.

Maybe you have the time, but not the money, so you feel like you can’t...

2019-09-1200 min

The Personal Finance Show99 - Beth MacMillan

Beth MacMillan wants you to prioritize travel.

In 2011, Beth and her husband, Mark, decided to use their saved up money and take a 6 month honeymoon around the world.

You don’t have to save $20,000 and buy round-the-world tickets like Beth did, but if you’re interested in travel at all, you can pick up a lot of tips by listening to Beth’s story.

To be able to travel, you need 2 things, time and money.

Maybe you have the time, but not the money, so you feel like you can’t...

2019-09-121h 00

The His and Her Money ShowEasy Steps to Take to Retire Early without Pinching Pennies with Tanja HesterOn today’s episode of The His & Her Money Show, we talk with Tanja Hester from Our Next Life and author of the phenomenal new book Work Optional (Retire Early The Non-Pinching Penny Way), and she shares her secrets to achieving early retirement. She retired at age 38 and her husband at the age of 41. What You Will Learn In This Episode How you can save money without being a penny pincher You can start the process at any age How to trick yourself into saving What is your vision What do you want your life...

2019-07-2531 min

UNGENTRIFIED with Kent JohnsonThe F.I.R.E. This Time with Kiersten & Julien Saunders of rich & REGULARWhat would you give up if it meant that you could retire now? On this episode of UNGENTRIFIED, I am joined by Kiersten & Julien Saunders of rich & REGULAR (), financial power couple featured on CBS This Morning, the NY Times, and Essence Magazine to talk about F.I.R.E., the aggressive financial lifestyle many are turning to so that they can retire early and live their best lives. We discuss the basics of F.I.R.E., the Black community’s relationship with money & finances, some of the things they do to save (they paid off $200K of debt in 5 ye...

2019-06-1347 min

How You Spend Your DaysEp22: “Life Happens” with Tanja HesterTanja Hester is back this week to join us for Episode 22. We spend this episode going through updates on what is going on in our lives. Check out the bulleted list of topics below.

Cashflow as a Freelance

Adding to the Emergency Fund with a “Life Happens” fund (idea from Suze Orman)

Setting a new floor for your finances

Tax Season & Business Entities

Tanja’s life after releasing Work Optional

Creating a Money Mission Statement

Expectations vs Reality

Uber Frugal Month Challenge with The Frugalwoods

Our Guest This Week

Tanja Hester...

2019-04-1034 min

Love, your Money - Wealth, Money, and Financial Advisor for WomenPBR 137 | FIRE: Financial Independence Retire Early with Tanja HesterEP 137 | Profit Boss® Radio Welcome to episode 137 of Profit Boss® Radio! In this episode, we are discussing the FIRE movement with Tanja Hester. The word FIRE is an acronym for Financial Independence, Retire Early. There are plenty of reasons why people want to leave the workforce and retire early, but how much do you need to have saved up in your nest egg to make that a reality? That is just one of the important questions Tanja and I cover in today’s show. You won’t want to miss this week’s show where Tanja ta...

2019-03-2157 min

The MapleMoney ShowHow Strategic Frugality Helps You Save Money and Still Enjoy Life, with Tanja HesterLiving frugally is a great way to get your spending under control and set a base to improve your personal finances. However, what's the point of cutting every expense and possibly retiring early if you aren't able to put your money to good use on the things you enjoy in life? Tanja Hester is the writer behind the blog Our Next Life and the new book Work Optional, and she's joining us to share her views on how we can be selectively hardcore in our money saving ways but be able to spend on quality items or...

2019-03-1323 min

Your Money, Your WealthRetire Early Without Pinching PenniesTanja Hester (OurNextLife.com, award-winning financial independence blog) talks about her new book, Work Optional: Retire Early the Non-Penny-Pinching Way. Joe and Big Al answer questions about whether kids will inherit a Roth IRA tax-free, the rules around a traditional IRA rollover, investing in a Vanguard target date fund, and where to safely invest for growth. Transcript and show notes: http://bit.ly/YMYW-211

2019-03-0545 min

Wellness for Financial GrownupsFinancial Grownup Guide - Top new money books for grownups right nowBobbi reveals her favorite new money books, and how to know if they are right for you. This month's picks include: The Dumb Things Smart People Do With Their Money. Thirteen Ways to Right Your Financial Wrongs by CBS News Business Analyst and Certified Financial Planner Jill Schlesinger Startup Money Made Easy: The Inc. Guide to Every Financial Question About Starting, Running and Grownup Your Business by Inc magazine Editor at Large Maria Aspan Work Optional: Retire Early the Non-Penny Pinching Way by Our Next Life blogger and podcaster Tanja Hester. For more information...

2019-03-0209 min

Martinis and Your Money PodcastWork Optional with Tanja HesterWhen I last had this guest on the podcast, she was still an anonymous blogger who was just on the verge of making the leap to a public outing and declaring financial independence with her husband. Fast forward over a year and now she has written a book to discuss her experience leading up to financial independence and why she’s not a typical FIRE (Financial Independence Retire Early) persona. I’m excited to have back on the show, and for the first time publicly, Tanja Hester, author of Work Optional: Retire Early the Non-Penny Pinc...

2019-03-0157 min

More Money PodcastHow to Make Work Optional - Tanja Hester, Author of Work Option & Blogger at Our Next LifeI had Tanja Hester from Our Next Life on the show back in November 2017 for episode 133. Back then, Tanja was still an anonymous blogger who hadn’t yet quit her job yet to retire early with her husband. Well, a few months after we recorded that episode she left her job and has been officially retired ever since! Not only that, she finally revealed her full name on her blog and the news literally went viral, being picked up by MarketWatch. Because of this, Tanja has had a very busy retired life, that includes doing speaking, writing for MarketWatch, and of...

2019-02-2739 min

Afford AnythingHow to Make Work Optional, with Tanja Hester#178: Tanja Hester retired at age 38. She had a negative net worth until her late 20's, thanks to a combination of student loans, buying expensive cocktails and clothes, living far beyond her means, and not paying attention to her money. If you were to have met the 27-year-old version of Tanja, you wouldn't guess that she'd be a likely candidate for retiring early. Yet a decade later, she's saved 40x of her annual cost of living. How? Tanja worked as a political consultant in Los Angeles, and during her career, ascended to important high-ranking...

2019-02-181h 08

Living With MoneyTanja Hester - Work Optional: Retire Early the Non-Penny-Pinching WayIn Ep. 57, Tim talks with Tanja Hester. Tanja is the creator of the Our Next Life blog, and the author of the recently released book 'Work Optional: Retire Early the Non-Penny-Pinching Way'. They talk about how Tanja's book outlines ways for people of all living situations to retire early and spend more time doing what they love. Tanja debunks a few myths about the early retirement/FIRE movement, and how this lifestyle isn't just for the extremely frugal. Tanja talks about her experience retiring early, and how others can achieve their financial and non-financial goals too!

2019-02-1435 min

Journey To Launch084- How To Achieve A Work-Optional Life & Retire Early with Tanja HesterHow do you create a life where work is optional? Are you interested in early retirement but not a fan of super frugality? On today's podcast, I have Tanja Hester, creator of the Our Next Blog, who retired early at the age of 38 to talk about her new book, Work Optional, where she answers those questions and more. In this episode we discuss: The three stages of work optional living; full early retirement, semi-retirement & career intermission The concept of Hedonic Adaptation and how it impacts the way we spend money Why we should all have a m...

2019-02-1350 min

Wellness for Financial GrownupsQuitting your side hustle with Work Optional author Tanja HesterTanja Hester explains why she had to call it quits on the side hustle she loved in order to create new opportunities at her primary job. Plus her big money tip on how to save big on medical expenses while traveling the world. For more information, visit the show notes at https://www.bobbirebell.com/podcast/tanjahester

2019-02-1114 min

ChooseFI113R | Making your Retirement Plan Bullet Proof | Tanja Hester113R | Tanja Hester retired early 15 months ago and joins the show to share her experience of being work optional, Brad makes a decision about solar panels, and a review of Monday's episode with Grant Sabatier. Brad shares some updates with his car malfunctions and follows up about his solar panel cost analysis. Brad anticipates a 9.6% return on his solar panel investment, compared to Brian's 12.5% return in Rhode Island. Solar panels are expected to last for about 25 years. Message from Dan, who realized while listening to Monday's episode with Grant Sabatier, that he is charging too little f...

2019-02-081h 07

Earn & Invest4. How Does Your Physical Health Impact Your Path to Financial Independence? w/Dragon Guy and Gal, and Tanja HesterOur guests share how dealing with their health has impacted their pursuit of financial independence and how it changes the equation when deciding to retire early.Tonya blogs at Our Next LifeThe Dragons blog at The Dragons on Fire Learn more about your ad choices. Visit megaphone.fm/adchoices

2018-11-1955 min

Bossed UpA Feminist Take on F.I.R.E.In today’s episode, I’m digging into the F.I.R.E. (financial independence, retire early) movement with Tanja Hester, whose award-winning blog chronicles how she made early retirement a reality, and how you might, too. Related Links: NY Times' article: How to Retire in Your 30s With $1 Million in the Bank Learn about Tanja's FIRE journey at OurNextLife.com Get Money: Live the Life You Want, Not Just the Life You Can Afford by Kristin Wong Broke Millennial: Stop Scraping By and Get Your Financial Life Together by Erin Lowry Episode 54: What Matters More: Flex...

2018-10-231h 07

How You Spend Your DaysEp0: Introducing HY$YDHow You Spend Your Days: Candid conversations about debt, the stigma around money and follow Colin’s journey toward debt freedom. Hosted by Colin Loretz and Tanja Hester.How We Spend Our Days Is How We Spend Our LivesMore to come in Episode 1!

2018-10-2305 min

Journey To LaunchFinding Adventure and Happiness on Your Journey to Financial Independence w/ Tanja from Our Next LifeOne of the best things about the journey to Financial Independence is that while planning for early retirement, it is not always a requirement to forsake your other life goals. Tanja Hester, the blogger behind the Plutus Award-winning early retirement blog, Our Next Life, set out on the journey with her husband Mark to retire at the end of 2017. Our Next Life, places a huge focus on putting life goals first and then building money goals around them–not the other way around. In fact, Tanja Hester became financially independent at the age of 36 and retired early at...

2018-07-0457 min

Marriage Kids and Money: Personal Finance for FamiliesHow Early Retirement Can Enhance Your Marriage - with Tanja Hester & Mark BungeIf you’ve been married and working full-time for a while, you know the importance of quality time spent with your spouse. This is a chance to catch up, talk about fun memories, and make new ones together.Unfortunately, our busy careers can make these quality get-togethers really difficult most days. There are late nights at work, deadlines, and out-of-town trips.

What if you woke up on Monday morning and you didn’t have to go into the office?

What if there were no more business trips and no more work-related deadlines?

How would that enhance your...

2018-02-261h 02

Chain of Wealth - Debt, Investing, Entrepreneurship, Wealth & MoreRetire Early with Tanja Hester (38 years old!)Visit www.chainofwealth.com to grow your wealthSupport this podcast at — https://redcircle.com/chain-of-wealth-debt-investing-entrepreneurship-wealth-and-more/donationsAdvertising Inquiries: https://redcircle.com/brandsPrivacy & Opt-Out: https://redcircle.com/privacy

2018-02-2225 min

Afford AnythingHow We Retired at Age 38 and 41 -- with Tanja Hester & Mark Bunge#111: Tanja Hester and Mark Bunge used to have demanding but fulfilling careers as political and social cause consultants. While they loved the mission behind their work, they grew tired of the exhausting hours and grueling travel. Their home felt like a weekend crash pad. They had no time or energy to pursue outside passions like skiing, biking and volunteering. Six years ago, they read a book that changed the course of their lives. The book, How to Retire Early, set the couple on the path of financial independence. They moved from pricey Los...

2018-01-0855 min

Det beste fra Radio NovaLønsjpod - 22.05.16Smakebiter fra den sista tida på Radio Nova

Sorgenfri fordyper seg i den ville vesten. Matchet populærkulturens westernfilmer de faktiske forholdene i Amerika? // Snakker Ikke Norsk gir deg noen anbefalinger for hva du kan gjøre i hovedstaden // Nova Amor fikk denne uka et stappfullt studio da Hester V75 gjestet programmet // Skumma Kultur minnes den gamle nettjuvelen promp.no // Nils Tanja Olsen går hands-on med kollektivtrafikken i ukas Radiotjenesten

2016-05-2221 min