Shows

Out On LoanOut On Loan: EP 8 | The Big 3 ReuniteSt. Bonaventure roomates unite for the latest episode of the Out On Loan Podcast! The Big 3!A Stone Pictures production.Follow us on Instagram @out_on_loan_podand TikTok at out.on.loan

2025-09-261h 24

Out On LoanOut On Loan: EP 7 | Madrid-Spurs Recap, Bellingham BackCiaran Conneely makes his debut on the pod alongside Jef and Colby to talk Real Madrid, Tottenham, and the Bellingham vs. Pedri.Out On Loan Podcast | Watch/listen to full episodes on- Youtube- Spotify- Apple PodcastsProduced by Stone Pictures

2025-09-2457 min

The TreppWire Podcast: A Commercial Real Estate Show351. CMBS Loan Workouts Unfiltered with Shlomo ChoppIn this special episode of The TreppWire Podcast, we’re joined again by Shlomo Chopp, Managing Partner of Case Equity Partners, to discuss commercial mortgage-backed security (CMBS) loan workouts and distressed property situations. Shlomo offers a deep dive into his firm’s strategic approach to navigating complex loan restructurings and asset management. He breaks down the dynamics between small and large borrowers, outlines why CMBS loans often present more flexible workout options than traditional bank financing, and stresses the value of early engagement and negotiation. We also explore current market trends in distressed deals and the challenges in today’s appr...

2025-09-0945 min

Wealth Wave PodcastStudent Loan Relief in 2025: Your Guide to Forgiveness, Cancellation & Discharge 💰Enjoying the show? Support our mission and help keep the content coming by buying us a coffee.Student loan debt is a massive burden for millions, with Americans collectively owing over $1.77 trillion. But for many, there are real pathways to cutting down that debt—or even wiping it out completely—through various programs for forgiveness, cancellation, and discharge.In this episode, we're cutting through the jargon to give you a clear, actionable guide to these options in 2025. We'll start by clarifying the key differences: forgiveness and cancellation are often tied to your job, while discharge is r...

2025-09-0808 min

Bavarian Podcast WorksBavarian Podcast Works — Special Edition: Bayern Munich’s Transfer Window Review and RatingsBayern Munich’s summer transfer window is over, but the assessments can now finally begin.There were big acquisitions, important sales, and devastating misses. This transfer window pretty much had it all, so let’s break it down.The fine folks at @iMiaSanMia compiled a list of the incoming and outgoing transfers:I𝗻𝗰𝗼𝗺𝗶𝗻𝗴𝘀:Luis Díaz (€70m), Liverpool - 8.00/10.00Jonathan Tah (€2m), Bayer Leverkusen - 6.00/10.00Tom Bischof (€300k), Hoffenheim - 7.00/10.00Nicolas Jackson (initial loan - €16.5m), Chelsea - 6.00/10.00Total expenditure: €88.8m𝗢𝘂𝘁𝗴𝗼𝗶𝗻𝗴𝘀:Mathys Tel (€35m), Tottenham Hotspur - 10.00/10.00Kingsley Coman (€25m), Al Nassr - 8.00/10.00Paul Wanner (€15m), PSV Eindhoven...

2025-09-031h 05

Escape Student Loan Debt PodcastLIVE Student Loan Review with Avon BarksdaleIn this episode, we review a student loan case whose strategy required changes less than 60 days out from the recording.It highlights the importance of staying updated with legal and policy changes. For those who want to have their loan strategy reviewed for free on the podcast, they can visit EscapeStudentLoanDebt.com/review. Those seeking a one-on-one session can schedule at EscapeStudentLoanDebt.com/session.00:55 Case Study Introduction04:31 Federal vs. Private Loans09:54 Income and Repayment Calculations18:18 Repayment Strategies and Recommendations

2025-08-1535 min

Cherokee Tribune-Ledger PodcastFederal loan to help finance Georgia 400 toll lanesCTL Script/ Top Stories of August 8th Publish Date: August 8th Pre-Roll: From the Ingles Studio Welcome to the Award-Winning Cherokee Tribune Ledger Podcast Today is Friday, August 8th and Happy Birthday to Roger Federer I’m Peyton Spurlock and here are the stories Cherokee is talking about, presented by Times Journal Federal loan to help finance Georgia 400 toll lanes Mass shooting wounds five soldiers at Fort Stewart Developer looking to build industrial park near Ball Ground Plus, Leah McGrath from Ingles Markets on p...

2025-08-0811 min

At The Bridge Pod: A Chelsea FC PodcastKeep, Sell or Loan: Forwards ft Nicolas Jackson, Jorrel Hato And Xavi Simons Deals Close & Jose Mourinho's Surprising Comments #CFCIn this episode, we wrap up the grand finale of our Keep, Sell or Loan trilogy — and this time, it’s all about Chelsea’s forwards. We’re diving into performances, potential, and whether each attacker truly fits the project… or should be politely shown the door with a complimentary Uber.The team also talk the latest from this week's news and as always also answer some listener questions.RUNNING ORDER:00:00 The Start & Shevva's Shoutouts15:25 News: Xavi Simons, Jorrel Hato & Jose Mourinho 24:03 Keep, Sell or Lo...

2025-07-241h 08

The TreppWire Podcast: A Commercial Real Estate Show333. Trading Through Cycles: Whole Loan Market Insights with John Toohig, Raymond JamesIn this special guest episode of The TreppWire Podcast, we are joined by John Toohig, Managing Director and Head of the Whole Loan Trading Group at Raymond James. We explore how his experience through multiple market cycles, including the great financial crisis, has shaped his perspective on risk and opportunities in today's lending landscape. John shares insights on the current state ofsecondary loan markets, regulatory impacts on bank lending, and macroeconomic trends affecting different asset classes. We discuss the challenges facing residential mortgages, emerging opportunities in commercial real estate, return-to-office dynamics, and his outlook for the remainder of 2025. Tune...

2025-06-1030 min

Loan Officer Team Training with Irene DufordThe Power of Customer Experience for Loan Officers with Trevor YorkIn this episode, I sit down with Trevor York—Loan Officer and founder of Lynkspot—for a truly inspiring conversation. Trevor shares his journey through the mortgage industry and talks about how focusing on the customer experience, dialing in your messaging, and using social media effectively can make a huge difference in your business. He walks me through what Lynkspot is all about and how it’s helping loan officers simplify their marketing in one easy-to-use platform.We also chat about mindset, the ups and downs of growing through adversity, and how personal growth plays a big role i...

2025-05-2954 min

Ol' College TryStudent Loan Defaults, Post-Decision Day Aid Boosts & College Cost Strategies Every Parent Needs to KnowAre student loan payments coming back? What happens if your child—or you—are in default? In this timely episode of the College! podcast, Matt and Peg break down the urgent changes to federal student loan repayments, what to do right now if you’ve fallen behind, and how it can impact everything from your credit score to your job search.Plus, if your high school senior just committed to college on May 1, don’t close the door just yet—many colleges are offering bigger financial aid packages even after the deadline. Learn how to appeal, renegotiate, and make l...

2025-05-0843 min

The Grow Givers Project PodcastYou got the Bag. You Secured the Loan. You’re Winning!! Until You’re Not.🎙️ The Grow Givers ProjectEpisode Title: You Got the Bag. You Secured the Loan. You’re Winning!! Until You’re Not.Episode Overview:You secured the loan. You got the capital. You’re finally up... until you realize you’re not.In this eye-opening episode, we peel back the curtain on one of the most common traps entrepreneurs fall into: thinking that access to capital is the finish line. We dig into why acquiring a loan is just the beginning—and how failing to build the right systems can turn that "bag" into a burden.Lenders want...

2025-04-3006 min

The TreppWire Podcast: A Commercial Real Estate Show322. Data Tells All: Powell’s Play, Market Uncertainty, Loan Spreads, & CRE TransactionsIn this week's episode of The TreppWire Podcast, we break down the latest inflation data, analyze Federal Reserve Chair Jerome Powell’s message, and explore shifting Fed expectations while assessing what all this means for market uncertainty ahead. We unpack the consumer impact of the US-China trade war, even as retail sales exceed forecasts. In financial markets, we dive into balance sheet loan spreads from Trepp’s weekly spread survey and examine Q1 2025 bank earnings. Turning to the property stories of the week, we share two trading alerts on mall loan defaults while also spotlighting an enco...

2025-04-1849 min

Finovate PodcastEP 253: Walter Mendenhall, Help With My LoanFormer pro athlete and founder of the Male Mogul Initiative Walter Mendenhall on the recent acquisition of Help With My Loan, and the importance of fair access to credit.

Detailed Summary:

In this episode of the Finovate Podcast, host Greg Palmer talks with Walter Mendenhall, founder of the Male Mogul Initiative, a Chicago-based nonprofit aimed at empowering young men through leadership, entrepreneurship, and workforce development. Walter shares his unique path from the NFL to teaching, and eventually to founding his organization in response to systemic issues he witnessed in his community. What began with a handful of students in 2018 has...

2025-04-0920 min

Ol' College TryWhat Parents Need to Know About FAFSA Chaos, Loan Forgiveness & College Costs in 2025In this timely episode, Matt Carpenter and Peg Keough break down the latest chaos in the world of student loans and college financial planning. With recent announcements about the Department of Education’s restructuring—including the controversial shift of the Office of Federal Student Aid under the SBA—families across the country are left wondering what this means for their financial aid, loan forgiveness programs, and college affordability.Matt and Peg discuss the real-time impact on current borrowers, the challenges of FAFSA system failures, and offer crucial insights into why keeping meticulous loan records is more i...

2025-03-2745 min

The Sugar Daddy Podcast75: How to Navigate Student Loan Debt with Attorney Stanley TateKnown for his practical and accessible guidance, Stanley Tate, an expert attorney in student loan law, has become an indispensable resource for student loan borrowers of diverse backgrounds. In this conversation, Jessica and Brandon dive into the complexities of the student loan debt landscape and its emotional toll on borrowers. From navigating federal, private and Parent PLUS loans, to strategies for finding relief through repayment options and bankruptcy, this episode is packed with expert insights and practical steps you can take to reassess your decisions regarding student loans, repayment and the ROI of college.Watch this episode in...

2025-02-051h 03

Loan Officer Team Training with Irene DufordWhat Separates a Good Loan Officer Team from a GREAT Loan Officer TeamIn this solo episode of Loan Officer Team Training, I break down what truly separates a good Loan Officer Team from a GREAT one. We’ll explore the key habits, that elevate top performers in the industry. Today, I share actionable tips to help you take your career to the next level. Whether you’re just starting out or striving to improve, this episode will provide valuable insights to help you stand out as a great loan officer who consistently delivers exceptional results.If you’ve enjoyed this episode please share it with your friends. If you haven’...

2024-11-2611 min

At The Bridge Pod: A Chelsea FC PodcastChelsea Loan Report ft Andrey Santos, Alfie Gilchrist And Raheem Sterling, Caoimhin Kelleher vs Robert Sanchez & Another Reece James Injury #CFCIn this episode, we’re diving into Chelsea’s legendary Loan Army to see how our loanees are faring this season. We’ll be breaking down their performances, debating who’s thriving, who’s struggling, and who might have a shot at breaking into the first team next year.

Who are the standout stars lighting it up abroad? Who’s having a season to forget? And which names will spark the spiciest debates?

The team also discuss the links surrounding Caoimhin Kelleher and as always also answer some listener questions.

2024-11-211h 04

Real Estate Power PlayEP 139 | Loan Servicing & Compliance with Expert Sohail Badruddin📢 New Podcast Alert! Episode 139 of Real Estate Power Play!Sohail Badruddin joins us for Episode 139 of Real Estate Power Play! As an expert in loan servicing and compliance, Sohail brings a wealth of knowledge that every real estate investor needs to hear. Get ready for insights that can help you manage loans effectively and stay compliant in a changing market!🎙️ In this Episode:Key elements of loan servicing and why it’s essential for investorsCompliance insights that can save time and reduce...

2024-11-1251 min

Prepare to Compete PodcastThe 3 Biggest Fears Veterans have about the VA LoanAre you a veteran feeling uncertain about using your VA loan benefits? You're not alone. In this video, we dive into the three biggest fears veterans have about the VA loan and provide clear, practical solutions to overcome them. Our expert speaker will guide you through the complexities of the VA loan process, debunk common myths, and offer tips to help you confidently navigate your home buying journey. In this video, you'll learn: The most common fears veterans have regarding the VA loan. How to address concerns about eligibility and qualification. The truth about VA loan costs and hidden...

2024-08-1412 min

At The Bridge Pod: A Chelsea FC PodcastKeep, Sell or Loan: Forwards, Time To Sell Mudryk?, Kiernan Dewsbury-Hall to Chelsea, Here We Go! & The Jackson For Isak Swap Deal #CFCIn this episode, the team dives into the final part of their Keep, Sell, or Loan series for 2024 and it is all about Chelsea's forwards. We analyze the performances and potential of players like Cole Palmer, Raheem Sterling, Mykhailo Mudryk, Noni Madueke, Nicolas Jackson, Christopher Nkunku, Deivid Washington, Armando Broja, and Romelu Lukaku. Who should stay at Stamford Bridge, who should be moved on, and who could benefit from a loan spell?

The team also discuss the news that Chelsea have agreed a deal with Leicester City for Kiernan Dewsbury-Hall and as always also...

2024-07-0150 min

Escape Student Loan Debt PodcastEmergency Student Loan Update! #ESLD Tune in for an emergency student loan update on the SAVE plan and the pending end of the IDR Waiver and Pay As You Earn payment plan!EPISODE RESOURCESDirect Consolidation Applicationhttps://studentaid.gov/loan-consolidation/When PAYE Beats SAVEhttps://podcasts.apple.com/us/podcast/when-pay-as-you-earn-beats-the-save-plan/id1641942083?i=1000644748013 And if you haven't already, join our email list at escapestudentloandebt.com!

2024-06-2817 min

At The Bridge Pod: A Chelsea FC PodcastKeep, Sell or Loan: Midfielders, Chelsea Move For Leicester's Kiernan Dewsbury-Hall & Todd Boehly Confirms Chelsea's Future #CFCIn this episode, the team dives into the intricate decisions Chelsea must make regarding their midfield roster. It's time for a comprehensive "Keep, Sell, or Loan" analysis of the Blues' midfielders. We'll debate the merits of retaining Enzo Fernandez's dynamism, the potential of young talents like Lesley Ugochukwu and Carney Chukwuemeka, and whether Conor Gallagher's tenacity still fits into Chelsea's plans.

The team also discuss Chelsea's move for Leicester's Kiernan Dewsbury-Hall and as always also answer some listener questions.

RUNNING ORDER:

00:00 The Start & Shevva's Shoutouts

07:53...

2024-06-2758 min

At The Bridge Pod: A Chelsea FC PodcastKeep, Sell or Loan: Goalkeepers And Defenders & Why We Are Glad Michael Olise REJECTED Chelsea For Bayern Munich & Best Pitch Invasion At Euro 2024 #CFCIn this episode, the team tackles the pressing question of who Chelsea should keep, sell, or loan from their roster of goalkeepers and defenders. We’ll break down each player’s performance, potential, and fit within the squad. From Kepa’s return after a loan move to Real Madrid and whether he deserves another chance or if it’s best to get his wage off the books, to the future of Fofana and Disasi, join us as we analyze the best moves for the club. We’ll also discuss whether Gilchrist should be loaned out for more experience or kept in th...

2024-06-2455 min

The TreppWire Podcast: A Commercial Real Estate Show260. Stick to the Economic Data or Trust Your Gut?; Analyzing Loan Modification TrendsIn this week's episode of The TreppWire Podcast, we tackle a mixed bag of data as Treasury Yields rise. As we approach new theses week over week, do you stick to the data or trust your gut? We also unpack our latest loan modification trends report, dive into the upcoming volume of office loan maturities, and explore recent transaction and CMBS stories across property types. Tune in now.

This episode is sponsored by AEI Consultants: https://aeiconsultants.com/

Episode Notes:

- Economic update: Treasury yields pushed higher (0:23)

- Consumer confidence reading (6:48)

- Loan modification trends (9:05)

- Maturing office loans (13:10)

- O...

2024-05-3156 min

Real Estate Power PlayEP 123 | Seller Finance Loan ServicerJoin us for an insightful episode of Real Estate Power Play Podcast featuring Sadhna Cordell, an expert in seller finance loan servicing!In this episode, John reveals:The critical role of a loan servicer in seller-financed dealsHow professional loan servicing can streamline your real estate transactionsThe key tasks a loan servicer handles to ensure smooth operationsTips for selecting the right loan servicer for your needsInsights into navigating compliance and legal challengesHosted by Mark Monroe, this episode is packed with valuable knowledge and practical tips to elevate your seller financing strategy to new heights. Don't...

2024-05-2947 min

AIME Podcast NetworkThe Loan-Processing Mindset: Selflessly Doing What Retail Can’t (With Cheryl Dempsey, CEO of Coastal Breeze Processing) – Episode 186

This episode is sponsored by The Loan Store

This episode, we flipped the format. For the first time this year, the show goes from ‘Broker to Broker’, to ‘Broker to Processor’ as host Marc Summers is joined by beloved wholesale community member, and the CEO of Coastal Breeze Processing, Cheryl Dempsey.

Though she is a Processor, Cheryl is one of the most active and selfless members of the Broker community, setting the example by putting so much of her time and efforts towards supporting her Broker peers across the country. She takes this energy back to her o...

2024-04-3028 min

Prepare to Compete PodcastThe VA Loan Myth: Why It Might Not Be Your Golden Ticket in 2024Welcome to another enlightening episode of the Prepare to Compete Podcast, where we dive deep into VA benefits, real estate, entrepreneurship, and beyond. In this episode our esteemed hosts delve into the pivotal subject of home ownership, especially tailored for our veteran community as we embark on the year 2024. As we navigate through the complexities of the real estate market, this episode sheds light on the long-term benefits of owning a home. We discuss the significant impact of recent and upcoming Federal Reserve interest rate adjustments and how they could affect mortgage affordability and the real estate landscape for...

2024-03-0324 min

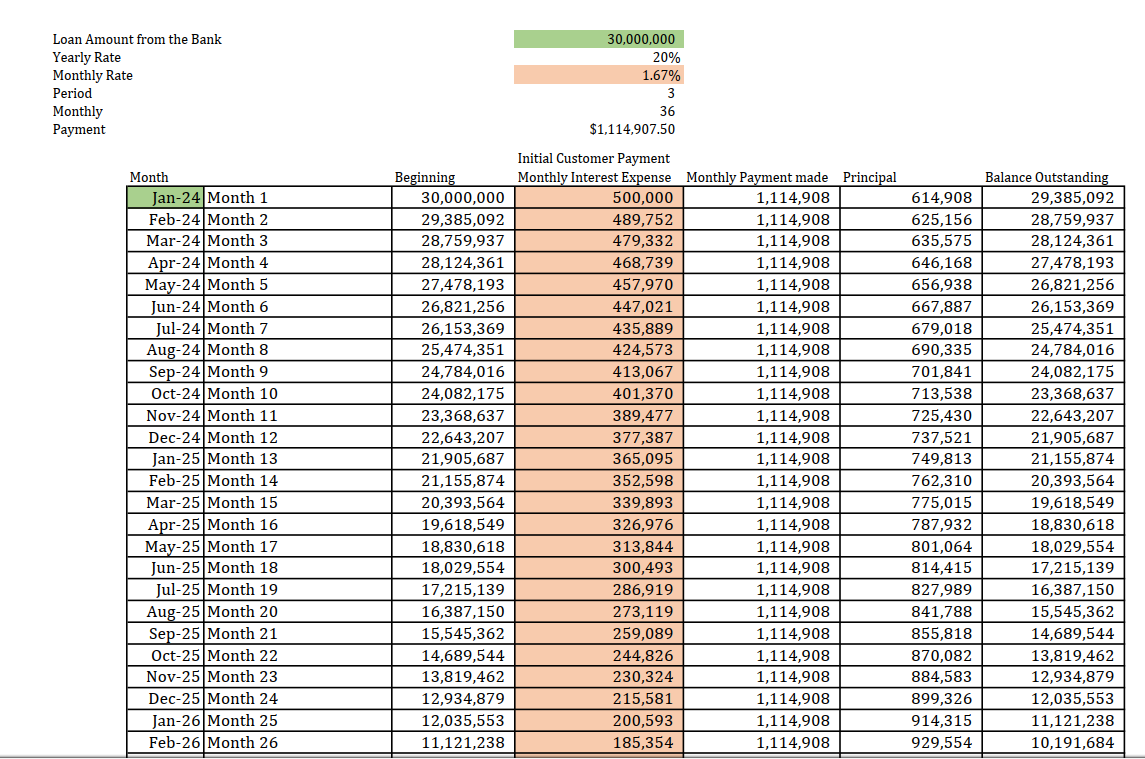

Kakande's Investments PodcastUnderstanding Loan Repayment Schedules.In this Episode we break down the importance of planning your loan cashflows and the advantages of Early repayment of whole or part of the loan. “loan repayment schedule. Every lender will provide a detailed document outlining exactly when payments are due, usually on a monthly basis. In the document, three components will dictate your loan management strategy which are very important to understand: the principal loan amount outstanding at any point in time, the interest charged at each interval, and whether these interest charges are determined by a reducing balance method or a fixed rate.”Th...

2024-02-2625 min

DiversifyRx2024 SBA Loan Changes with Live Oak Bank | DIR Apocalypse 2024 Series | Becoming A Pharmacy Badass**In this Episode of the Becoming a Badass Pharmacy Owner Podcast; Dr. Lisa Faast with guest Greco De Valencia will talk about SBA loan changes**

**Show Notes:**

1. **Greco Introduction** [3:25]

2. **SBA Loan Changes** [5:01]

3. **Pharmacy Ownership** [10:15]

4. **Live Oak Bank Loan** [13:56]

5. **Cash Flow** [19:03]

Websites Mentioned:

Live Oak Bank: https://www.liveoakbank.com/

Contact Info:

Email Address: greco.devalencia@liveoak.bank

-----

#### **Becoming a Badass Pharmacy Owner Podcast is a Proud to be Apart of the Pharmacy Podcast Network**

2024-01-1323 min

The Collective Mindset PodcastUPDATE! 2024 Max Loan Amount $766,550Breaking New 2024 Conventional Loan limits! Our Max loan amount is $766,550!Jordan and Gavin discuss what this new loan limit means for the Real Estate market as well as discuss the most Recent Case Schiller index report for Home Price appreciation that came in at Year over Year at 3.9% appreciation!

2023-12-0115 min

The FI Investors Podcast#29 New Conventional Loan Rule/The FI Investors Podcast/FFFOn this episode of The FI Investors Podcast FFF edition, our hosts Diego Corzo and Ward Mahoney talk about the new conventional loan rule that will benefits current and future real estate investors. Diego and Ward direct the pros and cons of using the new 5% down conventional loan, as well as what to do and not to do when applying.

Make sure to enjoy our free education and sign up to “The 6 Keys To Financial Independence” by visiting

www.keystofi.com

Join The Fi Inve...

2023-10-2020 min

Business News - EnglishHousing loan interest subsidy: Centre to spend Rs 60,000 crore over the next five yearsThe Centre is mulling spending Rs 60,000 crore to provide subsidised loans for small urban housing over the next five years, reported Reuters. As per the report, the banks are likely to roll out the scheme in a couple of months, ahead of key state elections later this year and general elections due in mid-2024. During the Independence Day speech in August, Prime Minister Narendra Modi had announced the plan to provide relief in bank loans for first-time homebuyers. "We are coming up with a new scheme in the coming years that will benefit those families that live in cities but...

2023-09-2500 min

Le Show - Loan Bouchet#66 Les Fondamentaux de l’entraînement | Quentin Randis & Loan BouchetDans cet épisode, mon invité est Quentin Randis ! Quentin est coach sportif et fondateur du Hybrids Training Club. Il a également co-créé la marque de supplément végane Syncprotein.

Rejoignez-nous pour des discussions franches et sans filtre sur l'entraînement, la transformation physique et les méthodes d'entraînement. Préparez-vous à démystifier les fausses croyances et à découvrir la vérité sans aucun "bull shit".

Avec Quentin Randis comme guide expert, nous explorerons les secrets de l'entraînement efficace, les astuces pour atteindre vos objectifs de transformation physique et les mythes courants qui entravent souvent notre progression. Préparez-vous à êt...

2023-09-151h 08

Le Show - Loan Bouchet#62 Gérer la réussite après les échecs | Quentin Randis & Loan BouchetAujourd’hui, je suis l’invité du Podcast de Quentin Randis, j’ai été son premier "coach business".

Dans cette discussion, nous aborderons mon parcours en tant qu'ancien coach sportif. J'ai traversé différentes étapes, essayé diverses approches, mais j'ai toujours réussi à m'en sortir en me posant les bonnes questions. Nous explorerons les moments clés de mon cheminement et les leçons apprises tout au long de cette aventure enrichissante.

C'est ce dont on va parler aujourd'hui.

De quoi en ressortir une grosse motivation 💥

Invité : Quentin Randis

► Instagram : https://www.instagram.com/quentinrandis/

...

2023-08-041h 23

Craft Brewery Financial Training PodcastSBA Loan Basics for BreweriesToday we learn all about SBA loans with Scott Birkner from Dogwood State Bank. If you need to borrow money to start or grow your brewery, then you need to listen to this podcast.Scott breaks down all the details of SBA 7A and 504 loans and shares his advice on how to best prepare for the loan process. Key TopicsFinancing trends in the brewing industryHow to prepare for an SBA loan: When to start and what information you'll need to finishLoan requirements for start-up breweriesResourcesLearn...

2023-07-3141 min

Le Show - Loan Bouchet#60. Vendre ses services sur Internet en 2023 | Angelo D'acunto & Loan BouchetDans cet épisode, mon invité est Angelo D'acunto, expert en recrutement, gestion et amélioration des performances commerciales pour les entreprises du High Ticket. Angelo a aidé de nombreuses entreprises à atteindre des chiffres d'affaires à six, sept voire huit chiffres !

Dans cet épisode de podcast, nous allons explorer le sujet passionnant de l'investissement en soi-même. Angelo partagera son expertise et ses conseils sur l'importance de maîtriser l'aspect crucial de la vente. Il nous rappellera que la vente ne se limite pas à un simple appel téléphonique. Il s'agit d'un domaine puissant et impactant qui nécessite une compréhension...

2023-07-191h 03

Triad Podcast NetworkWhat Should I Do to Prepare for the Resumption of Student Loan Payments?The Student Loan Forgiveness Plan was rejected by The Supreme Court and now millions of people will have to resume paying on their student loans very soon. Jennifer Johnson from Three Magnolias Financial Advisors is here to provide some advice for those that are about to restart those payments. If you don't know who that is or how to access your account you can visit this website: https://studentaid.gov/manage-loans/repayment/servicers

Student loan borrowing source: https://www.bestcolleges.com/research/student-loan-forgiveness-statistics/

Loan simulator source: https://studentaid.gov/

Jennifer Johnson, CFP jennifer@3-magnolias.com...

2023-07-1432 min

Le Show - Loan Bouchet#59 Réussir en tant que femme entrepreneur | Alexia Cornu & Loan BouchetDans cet épisode, mon invitée est Alexia Cornu, une entrepreneuse audacieuse qui a embrassé le défi de vivre son rêve américain et a transformé son expérience en une véritable réussite.

Après avoir passé huit années aux États-Unis, Alexia a saisi l'opportunité de développer des programmes en ligne, désireuse de rendre son accompagnement accessible à un public plus large. Sa volonté était de proposer un suivi personnalisé et abordable, dépassant les limites du coaching individuel traditionnel. Grâce à ses offres en ligne en constante évolution, Alexia a pu toucher et aider un grand nombre...

2023-07-141h 03

Le Show - Loan Bouchet#57 De fauché à libre financièrement | Nolwen Yann & Loan BouchetDans cet épisode, mon invité est Nolwen, un entrepreneur passionné qui a réussi à passer de zéro à 600 000 euros de chiffre d'affaires en moins d'un an, en partant de zéro !

Accompagnez Nolwen dans son parcours hors du commun, depuis l'idée initiale jusqu'à la mise en œuvre de son projet. Vous découvrirez les étapes essentielles qu'il a suivies pour préparer le terrain avant le lancement. Nolwen partagera ses réflexions sur la recherche de marché, l'étude de la concurrence, le développement d'une stratégie de vente efficace et bien d'autres aspects clés qui ont jeté les bases d...

2023-06-291h 05

In Wheel Time Podcast: Your Go-To Automotive Talk ShowUncovering Hidden Biases in Auto Loan Lending: Revolutionizing Loan Quality Control with InformedIQ's Tom OscherwitzAre you getting a fair deal on your auto loan? In our latest episode, we sit down with Tom Oshavits, VP of Legal for Informed IQ, to shed light on the hidden biases in auto loan lending and how they might be impacting you. Discover how bias manifests in both data and people's discretion, the role of dealers in loan manipulation, and the crucial importance of FICO scores in determining your financial fate.As we continue our conversation, Tom offers a fascinating glimpse into how Informed IQ is revolutionizing loan quality control by automating the verification process...

2023-06-2231 min

The Untangled PodcastThe New Nigerian Student Loan Bill: Empowering Education or Burdening the Future?Join hosts Yemisi, Tonye, and Michael on a compelling episode of "Untangled" as we delve into the recent groundbreaking development in Nigerian education—the newly signed Student Loan Bill.

In this episode, we aim to untangle the complexities surrounding this legislation and its potential impact on the lives of Nigerian students. We will discuss the provisions of the bill, its objectives, and the anticipated benefits for students seeking higher education opportunities.

Our engaging conversation will touch on various aspects, including eligibility criteria, loan repayment terms, interest rates, and the ap...

2023-06-1938 min

Afford AnythingThe End of the Student Loan Pause: What You Need to Know#444: The student loan pause is coming to an end.A moratorium on student loan repayments has been in place since the start of the pandemic, but starting Sept. 1st, millions of borrowers will be required to start making payments on their loans again.What does this mean for borrowers? In this episode, we'll discuss what borrowers can do to prepare, including an in-depth look at the variety of repayment plan options.We’ll also talk (in general terms) about how to handle ANY surprise new monthly bill – whether it’s a medical bill, a fami...

2023-06-0229 min

Escape Student Loan Debt PodcastHow (and Why) to Review Your Student Loan History As student loan guidelines change and they apply past credit to borrowers' accounts, it's important you know how to review your loan history.In this episode, we discuss how to download and review your NSLDS data file, and easter eggs in the document that could lead to faster loan forgiveness than you think. EPISODE RESOURCESStudent Aid Website And if you haven't already, subscribe to the podcast and join our email list at escapestudentloandebt.com!

2023-05-0514 min

Heard at HeritageEvents | Income-Driven Repayment Overhaul: The Backdoor Student Loan “Forgiveness” the Media Isn’t Talking AboutEven with the Supreme Court poised to potentially strike down the Biden administration’s blanket student loan cancellation plan, the Biden Education Department has proposed a consequential, expensive, and regressive regulation in the Title IV student loan program, “Income Driven Repayment” (IDR). Proposed regulatory changes to IDR would reduce a borrower’s required monthly payments from 10% to 5% of discretionary income, increase the amount of exempt income from 150% to 225% of the federal poverty line, and reduce the time to ultimate student loan “forgiveness” from 20 years to just 10 years. As such, it would create perverse incentives that would effectively enact "free" college thro...

2023-05-0259 min

Heard at HeritageEvents | Income-Driven Repayment Overhaul: The Backdoor Student Loan “Forgiveness” the Media Isn’t Talking AboutEven with the Supreme Court poised to potentially strike down the Biden administration’s blanket student loan cancellation plan, the Biden Education Department has proposed a consequential, expensive, and regressive regulation in the Title IV student loan program, “Income Driven Repayment” (IDR). Proposed regulatory changes to IDR would reduce a borrower’s required monthly payments from 10% to 5% of discretionary income, increase the amount of exempt income from 150% to 225% of the federal poverty line, and reduce the time to ultimate student loan “forgiveness” from 20 years to just 10 years. As such, it would create perverse incentives that would effectively enact "free" college thro...

2023-05-0259 min

Le Show - Loan Bouchet#45 Echouer vite pour réussir | Gérald Faure & Loan BouchetDécouvrez l'homme qui se cache derrière les plus grands succès entrepreneuriaux de ces dernières années. Gerald, le créateur du podcast "Les Gros Mots", ou encore “l'incubateur entreprendre” un Bootcamp pour se lancer dans la vie entrepreneuriale.

Il partage avec nous son expérience et ses conseils pour réussir dans le monde de l'entrepreneuriat.

Ne manquez pas cette occasion de découvrir les secrets de la réussite de Gerald …

Bonne écoute 🎧

____

📱Instagram : https://urlgeni.us/instagram/loan

Je te partage au quotidien des conseils pour développe...

2023-04-251h 07

Le Show - Loan Bouchet#43 Echouer vite pour réussir | Gérald Faure & Loan BouchetDécouvrez l'homme qui se cache derrière les plus grands succès entrepreneuriaux de ces dernières années. Gerald, le créateur du podcast "Les Gros Mots", ou encore “l'incubateur entreprendre” un Bootcamp pour se lancer dans la vie entrepreneuriale.

Il partage avec nous son expérience et ses conseils pour réussir dans le monde de l'entrepreneuriat.

Ne manquez pas cette occasion de découvrir les secrets de la réussite de Gerald …

Bonne écoute 🎧

____

📱Instagram : https://urlgeni.us/instagram/loan

Je te partage au quotidien des conseils pour développe...

2023-04-141h 09

✨The Black Creator Podcast ❤️✊🏽S1, Ep65 ✨Consumer Law & Mortgage Loan Origination Fraud - Interviewing Bryan from Stand Strong on The Black Creator Podcast Episode 65Support this Platform by Clicking Leaving a 5-Star Rating & Subscribing, Thank you & I appreciate you! ❤️🙌🏽

Today’s special guest is Bryan from Stand Strong (@_stndstrng_ on IG), he discusses his journey to eventually getting his mortgage loan discharged.

Bryan is a Entrepreneur, Electrician, Inventor, Investor, & Generational Wealth Strategist.

In this episode, Bryan helps explain where fraud can occur in the origination of mortgage loans. This knowledge is backed by understanding laws like the Truth in Lending Act, the Fair Debt Collection Practices Act, the Consumer Fin...

2023-03-2437 min

Not Your Average Financial Podcast™Episode 286: Policy Loan Interest Rates are Rising… Party at My House!In this episode, we ask:

Who needs to hear this?

Where else can you get an asset that grows every single year?

What did Pamela Yellen say?

Would you like to take her up on the challenge?

Where is the loan coming from?

What are the benefits?

What about getting the money out tax free?

Why does the insurance company charge interest in the first place?

How much interest do you have to pay on a policy loan?

When do you owe the interest to the insurance company?

What are the tax benefits of loan interest?

When you...

2023-02-2424 min

The TreppWire Podcast: A Commercial Real Estate Show182. Expiring Leases and Office Maturities, Multifamily Loan Moves, Healthy Travel EarningsIn this week's episode, we cover the latest jobs and housing data, travel earnings, and share takeaways from the MBA CREF conference. We also talk about Brookfield’s defaults and office crabgrass, then share some large multifamily loan moves.

In case you missed it, Trepp and CompStak released a report examining office loan maturities and lease expirations. Trepp’s Director of Research, Stephen Buschbom, and, CompStak's Director of Real Estate Intelligence, Alie Baumann, talk through some of the findings. Tune in now.

Episode Notes:

• Economic news of the week (0:23)

• Travel earnings (7:27)

• Negative stories: train derailment (9:19)

• MBA CREF conference takeaways (12:12)

• Office: construction...

2023-02-1746 min

TDJ Equity Funding Insiders PodcastEp #1 "What Should We Be Doing To Get A Commerical Loan?"Jacquelyn Jackson, a Texas Loan Broker, and Philip Brewer, a 21-year veteran of Commercial Lending, discuss the ins and out of securing commercial loans. Philip, our guest host, is a renowned commercial loan officer with over two decades of experience in the field. They are well-respected figures in the financial industry and have helped numerous businesses achieve their financial goals. Tune in to hear their valuable advice on this critical financial process. Don't miss out! Get your commercial loans secured today with the help of Jacquelyn and Philip. Trust them to provide you with the best possible loan options f...

2023-02-1028 min

Money Sex Gen XSeason 6: Episode 43 - SEASON FINALE Should You Take Out a Student Loan?Send us a textMaking the decision to take a student loan:-Is there another way?-Will this degree increase my earning potential? What is the outlook for the career I’m investing in?-What are the interest rates on the debt? 4.99% undergrad, 6.54% grad loan rates, plus loan rates -What personal development will you need other than the degree?-Will the debt stop me from building wealth? (Buying real estate, saving, investing)-intangibles (credibility, confidence)Follow MSG on IG @https://www.ins...

2023-01-261h 19The Multifamily 5 PodcastEp. 68 - Foreclosure Or Loan Modifications? -with Ann HamblyAre you potentially going to have to come out of pocket to service your debt? Ann Hambly, CRE should be your first call!

On today’s episode, Ann will share the process of negotiating and finalizing a loan restructuring agreement and some challenging multifamily loan modications she has dealt with in the past.

Ann is not a stranger to our podcast; she joined us in Ep. 26 to discuss how to navigate loan assumptions. 1st Service Solution was founded in 2005 and was the first firm dedicated to serving exclusively as a borrower advocate for surveillance, loan assumptions and loan workouts within CM...

2023-01-1932 min

Escape Student Loan Debt PodcastNew Year's Tips for Your Student Loan Debt There are several key upcoming dates for student loans in 2023.Check out our episode to know what steps are needed to keep your loans in check in the new yearEpisode ResourcesFederal Student Aid WebsiteDirect Consolidation Loan Application Subscribe to the podcast and learn more about our flagship student loan course, Escape Student Loan Debt, at https://www.escapestudentloandebt.com/

2023-01-1914 min

Escape Student Loan Debt PodcastHUGE Public Service Loan Forgiveness Updates for CA and TX Physicians!! Since the launch of Public Service Loan Forgiveness, state employment laws have made it difficult for many physicians in Texas and California to qualify. But a HUGE update recently announced by the Department of Education could mean these docs are much closer to loan forgiveness than ever before.Join us as we recap these changes and how they might impact you!!EPISODE ResourcesFuture of PSLF Fact Sheet PSLF Help Tool IRS Corporate Practice of Medicine Explainer Direct Consolidation Loan Application Subscribe to the p...

2022-12-1612 min

Escape Student Loan Debt PodcastStudent Loan Payment Freeze Extended + Biden Forgiveness Updates Just before the Thanksgiving Holiday, student loan borrowers were given their first holiday gift: ANOTHER extension of the student loan payment freeze! EPISODE RESOURCES Department of Ed Press Release Future of PSLF Fact Sheet Direct Consolidation Loan Application Subscribe to the podcast and learn more about our flagship student loan course, Escape Student Loan Debt, at https://www.escapestudentloandebt.com/

2022-11-2811 min

Na RealNa Real #15 - Empreender transforma - VANESSA LIMA (LOAN ESTRATÉGIAS DIGITAIS)O episódio de hoje é com a Vanessa Lima: mãe, empreendedora há mais de 1 década, fundadora da Loan Estratégias Digitais e Host aqui do Na Real Podcast!

Falamos sobre como o empreendedorismo pode transformar a vida da pessoa, dificuldades e aprendizados dessa jornada, growth hacking, estratégias digitais, maternidade e muito mais!

Não percam!

Até,

-

💻 Redes sociais do Vanessa:

Perfil pessoal: https://www.instagram.com/vanessa.lima10rj

Empresa: https://www.instagram.com/loan.estrategiasdigitais/

💸 PATROCINADORES

Apsis Consultoria: https://apsis.com.br

2022-11-0251 min

Loan Officer Team Training with Irene DufordIntroduction to Loan Officer Team Training with Irene DufordInterviews with successful loan originators, team members, branch managers and others who have secrets to share to help us all nurture and develop a success mindset.This is a show for Mortgage Industry pros looking to build a successful team, as well as anyone looking to be inspired toward action and success! Irene brings almost 4 decades of experience in the industry to you and your team through this weekly podcast. Subscribe today and share with colleagues who would find value!Get Loan Team Training for YOUR Team: loanteamtraining.com

2022-10-1309 min

A Smarter Way Home53: Eric Ensley - VA Home Loan ExpertVeteran turned loan originator Eric Ensley joins Victor and Danielle for a deep dive into the grey area of VA loans. Having recently joined our hosts under the USA Mortage banner, Eric specializes in educating & assisting those working to get VA loans. This week, they cover:Eric's unique journey from paratrooper to loan officer.What a real loan officer is, and why not all "loan officers" can help you.Flexibility in VA loans and why it's important.How Eric trains loan officers and why education on VA loans is so critical for servicemen & women. ...

2022-10-051h 12

Wealth WarehouseEpisode 30: College, Student Loan "Forgiveness" and IBCJoin David Befort and Paul Fugere on Episode 30 of the Wealth Warehouse!This week, the guys react to the student loan forgiveness plan that was recently announced by President Biden.Was this a good idea? Does it address the root cause of the problem? With so much discussion and emotionally-charged debate swirling around this recent development - it can be hard to decipher where to stand on the issue. In this episode Dave and Paul answer these questions and more. They also share their views on higher education, government meddling, and the intersection b...

2022-09-0535 min

The WoMedPublic Service Loan Forgiveness with Certified Student Loan Professional Meagan LandressFinancial wellness is a huge part of our overall well-being, and as healthcare workers, a six-figure debt is not uncommon. Today your hosts are joined by Student Loan Planner consultant Meagan Landress who reminds us that student loan debt is treatable with the correct plan of action. Meagan joined Student Loan Planner in 2019 and since has consulted on $160M+ of student loan debt for over 900 households. Meagan shares what the Public Service Loan Forgiveness program is, how to know if you’re eligible, and what comes next after you qualify. She then discusses the 4 things you have to continue to...

2022-09-0252 min

The WoMedPublic Service Loan Forgiveness with Certified Student Loan Professional Meagan LandressFinancial wellness is a huge part of our overall well-being, and as healthcare workers, a six-figure debt is not uncommon. Today your hosts are joined by Student Loan Planner consultant Meagan Landress who reminds us that student loan debt is treatable with the correct plan of action. Meagan joined Student Loan Planner in 2019 and since has consulted on $160M+ of student loan debt for over 900 households. Meagan shares what the Public Service Loan Forgiveness program is, how to know if you’re eligible, and what comes next after you qualify. She then discusses the 4 things you have to continue to...

2022-09-0259 min

Driveway Beers PodcastStudent Loan Forgiveness Is Here!!Driveway Beers PodcastStudent Loan Forgiveness Is Here!!President Biden issued an executive order to forgive $10,000 of certain student loans. Is this the same as the public service student loan forgiveness program or something much different? We talk about the impacts on the economy and how people will perceive this action. Is it great to forgive a portion of student loans or will it not have an impact? And we probably talk about cars somewhere in this episode.Please subscribe and rate this podcast on your podcast platforms like Apple and Google as...

2022-08-301h 04

Escape Student Loan Debt PodcastTHE ESCAPE STUDENT LOAN DEBT PODCAST In this short, introductory episode, find out more about the why, what, and how of the Escape Student Loan Debt Podcast. Learn what the podcast is about, who it's for, what the format is, and what listeners can and should expect from the show. Music produced by Jesse Rugless of Trailmix Studios

2022-08-2508 min

Don't Touch My PodcastSeason 1. Episode 9. "Don’t Touch Our Education: Student Loan Debt"The UK and the United States are the countries where people carry the largest student loan debt. The average college debt among student loan borrowers in America is $32,731, according to the Federal Reserve. This is an increase of approximately 20% from 2015-2016. Most borrowers have between $25,000 and $50,000 outstanding in student loan debt. But more than 600,000 borrowers in the country are over $200,000 in student debt, and that number may continue to increase.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/donttouchmypodcast/message

Support this podcast: https://podcasters.spotify.com/pod/show/donttouchmypodcast/support

2022-07-0727 min

Escape Student Loan Debt PodcastTHE ESCAPE STUDENT LOAN DEBT PODCAST [Trailer]For listeners with private and federal loans, the ESCAPE STUDENT LOAN DEBT PODCAST demystifies Student Loans, and how to get student loan payments or balances forgiven, reduced, re-organized or expedited. Hosted by Brenton Harrison. Music provided by Jesse Rugless of Trailmix Studios

2022-07-0400 min

Accelerated Real Estate Investor279: The Difference Between Loan and Deal Sponsorships with Josh CantwellLast week, I was in Houston to check out the 552-unit and 104-unit buildings that I own with some JV partners. I also attended a mastermind with intermediate to advanced residential investors who are new to multifamily, but have extensive experience flipping and wholesale homes and oversee 200-500 units. One thing that I noticed, as they grow their businesses and start to do larger deals, many of these guys are now trying to sponsor loans–and their questions inspired today’s episode. If you’re looking to have a better understanding of the differences between loan and...

2022-05-1312 min

The TreppWire Podcast: A Commercial Real Estate Show119. Market Volatility & CRE, Mall Loan Defeasances, Hotel DistressThe markets have been on a wild ride as investors digested news this week, but how does the volatility impact CRE? In this week’s episode of The TreppWire Podcast, we dive into what matters for CRE and CMBS participants. Then, we discuss several big stories: large retail loan defeasances which represent a positive sign for CMBS investors, new hotel issuance, and our distressed hotel analysis. We close by sharing our predictions ahead of the NFL playoffs.

Episode Notes:

How does market volatility impact CRE? (0:53)

CMBS market performance (8:34)

Takeaways for non-CMBS investors (16:36)

Mall loan defeasances – positive signs for retail (18:13)

Hotel dist...

2022-01-2840 min

Premier Mortgage Lending PodcastPML Success Stories | Matt Murray – Loan OfficerMike Comerford of Premier Mortgage Lending sits down with Matt Murray to disscuss his role as a Loan Officer with PML and to dive into how he has found success after starting with the company. Matt is the top producing loan officer for the year of 2021 at Premier. He speaks on why he made the switch from a larger lending firm to a smaller firm, the importance of having a great mentor and how the office enviornment has impacted him in such a positive way. Matt gives out a few pieces of advice to new or existing loan officers and...

2021-12-2007 min

The TreppWire Podcast: A Commercial Real Estate Show111. Hotel Loan Cures, Mixed Office News, Green Shoots in the MetaverseIn this week’s episode, we discuss significant market swings and what is driving the rebound. Our theme this week revolves around several large cures in the hotel market. We also note some major office headlines and explain what is going on in the metaverse... In CMBS, we break down the latest delinquency numbers and dive into the issuance number which sets a post-GFC record. Listen here.

Episode Notes:

• Market swing, what is dominating the rebound (0:21)

• Breaking down the delinquency report (7:48)

• Issuance sets post-GFC issuance (14:30)

• Hotel green shoots and loan cures (21:47)

• CMBX 7 Chicago loan cured (25:55)

• More hotel cures (31:00)

• Office foot traffic (32:51)

...

2021-12-0248 min

The Scope of Practice PodcastPodcast Episode 87 - Can you really have it all?Episode 87 - Today I’m going to do something a little different. I’m bringing you two of my most popular talks from the recent Marriage and Money, M.D. Summit. We had over 1300 people register for the conference, and the speakers did an absolutely phenomenal job! Today we ask, "Can you really have it all?"This first conversation is with Drs. Nii and Renée Darko. They met in medical school and married after a 10-year courtship. When they realized they were drowning in almost $700,000 of student loan debt and living paycheck to paycheck without much in savings...

2021-11-291h 01

A Smarter Way Home12: Loan Officers Take on Zillow iBuy FallbackThis week, Jennifer Coppola, Sr Loan Officer at Highlands Mortgage joins Danielle and Victor in the studio. Over 75 years of experience combined in one room! They share their own takes on the industry, current matters, and this Zillow iBuy fallback!Show LinksFor more information follow the links below.Website: AssistMyRealtor.comFacebook: https://www.facebook.com/assistmyrealtorYouTube: https://www.youtube.com/channel/UCDSKvim5NsiiEUbm3kQVGqwInstagram: https://www.instagram.com/assist.my.realtor/LinkedIn: https://www.linkedin.com/in/assist-my-realtor-8101a5133/ Victor Bals - Sales Manager, Sr. Loan Officer NMLS #162273

2021-11-1748 min

The Lean to the Left PodcastAddressing the Student Loan CatastropheWith the Supreme Court’s rejection of President Biden’s debt relief program, millions of borrowers will have to resume their payments in October.For about 804,000 others, recent executive action by the president mean that their student debt will be wiped away. Since Biden has been president, he’s been looking for ways to ease this burden, an effort that’s been thwarted by Congressional Republicans and now the Supreme Court. What’s all this meant for borrowers who counted on this promised relief?For many, it's no less than a financial catastrophe. They owe thousands that they...

2021-11-1724 min

PA the FI Way041 | Interview with The Student Loan Podcast and Start Noo Daphné Vanessa, Esq. and Shamil Rodriguez, co-hosts of The Student Loan Podcast and Founders of Start Noo share why they started these projects. They are an incredibly fun couple who are very passionate about how problematic the student loan system is, and they created Start Noo as a potential solution for you to help pay back your student loan debt from undergrad and PA school. The Student Loan Podcast StartNoo.com Instagram @StartNooHQ Instagram @StartNoo Twitter @StartNoo TikTok @StartNoo LinkedIn - https://www.linkedin.com/company/startnoo-llc/ Facebook - https://www.facebook.com/startnoodotcom About the Co-Founders One Pager

2021-11-121h 05

Holland & Knight Legal PodcastThe Successes and Value of the Loan Programs Office with Jonathan SilverIn this episode of the Holland & Knight Public Policy & Regulation Group's Eyes on Washington podcast series, Energy attorney Taite McDonald is joined by Jonathan Silver, current Senior Advisor at Guggenheim Partners and former Executive Director of the U.S. Department of Energy’s (DOE) Loan Programs Office (LPO). Their conversation kicks off with a discussion about an article in The Hill, co-authored by Mr. Silver, titled Clean Energy Industry Has Come A Long Way Since Solyndra Bankruptcy. The piece touches on the drama accompanying Solyndra's bankruptcy 10 years ago, the lessons it still holds for Congress and how the LPO has tu...

2021-10-2824 min

Military CashflowEp104: Don't use your VA loan to invest until you do these 3 thingsThis week Dan Wynn is telling why you don't use your VA loan to invest until you do these 3 things. These are 3 things that you have to pay attention to when assessing how to use your VA loan to invest.

Disclaimer: The Military Cashflow Podcast and brand does not endorse any comments made by our guests and do not recommend any business opportunities promoted within any episode.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/militarycashflow/message

Support this podcast: https://podcasters.spotify...

2021-10-0221 min

Days on MarketE09: Becoming a Loan OfficerShow Notes

This week, Scott welcomes his co-worker, fellow closing attorney, Carli Jo Deskins, and loan officer, Tyra Anderson to the podcast. Carly is a proud Appalachian and speaks to her Appalachian upbringing and how she carries that heritage through her life and career. Tyra tells her story through a well-traveled childhood, multiple degrees, and owning a marketing franchise that has led her to becoming a loan officer with Stockton Mortgage. Tyra goes on to describe the certification process to become a loan officer, the support she’s received along the way, and how she is promoting he...

2021-09-0254 min

Investor Guys PodcastZero Money 80% ARV Loan StrategyYou always hear the Guru's talking about no money down deals but they never seem to walk you through just how to do them. In this episode of The Investor Guys Podcast, Bill and Kevin go over the steps, numbers and moving parts of a no money down, 80% of ARV hard money loan deal.In this episode of The Investor Guys Podcast, Bill and Kevin discuss;Zero money down dealsAfter Repair Value (ARV)Comparable Market Analysis (CMA)Loan To Value (LTV)Market Value

2021-07-2734 min

Days on MarketE03: Ease of Home Buying and Why You Should be Buying Now with Loan Officer Mike FrankShow Notes

Scott welcomes Loan Officer, Mike Frank, to the podcast. They discuss why they both believe that relationships are the core of Real Estate and building your business. Scott points out the ways Mike has established his personal brand through creative marketing that reflects his personality and how he does business. Together they highlight how transformative home ownership can be for individuals and communities, and the ease of which people can now buy a home.

.

Show Links

www.triplecrownclosing.com

.

Guest Links

Featured Guest...

2021-07-2250 min

Struggling AdultSecuring the Home...LoanWe previously discussed steps to purchasing our first home, but let’s talk about financing it! I sat down with Loan Officer Anastasia (Anna) McFadden-Plummer to understand the steps to securing a home loan. Open your notes app and listen to the end, Anna is truly the plug when it comes to confidently navigating this process, while also seeing how many times you ordered DoorDash in a week. Check out her website: https://people.rate.com/anastasia-mcfadden-1990489 and let her know your sister in the struggle sent you!

---

This episode is sponsored by

· Anchor: The easiest way to make a p...

2021-04-2247 min

Home Buying PodcastEpisode 2: Getting Approved for a LoanFree Resources✅ Download our Free Home Buying Workbook ✅ Get a Local Expert Real Estate Agent (Anywhere in the U.S.) ✅ Get a FREE Home Warranty In this episode we’ll discuss mortgage loans and the process of getting approved.Key Talking Points· How much do you really need for your down payment?· The difference between banks, credit unions, lenders, and mortgage brokers· The difference between pre-qualified, pre-approved, and approved for a loan· What you will need for getting approved...

2021-03-0512 min

The Agglomerated Perspective PodcastEpisode 2: Biden's Opportunity on Student Loan ForgivenessAs of 2/3/2021 according to Forbes and other various sources:*The average student loan debt load for nearly 45 million borrowers is at approximately 30k or roughly 1.5 trillion dollars overall.* At this point student loan debt is the second highest debt behind mortgages.Under the Democrats proposal under Chuck Shumer and Elizabeth Warren, both are proposing on eliminating as far forgiving nearly 50k in student loan forgiveness and in some cases are pushing for an executive order to eliminate them completely. Keep in mind this is federal student loans not private student loans.Under the Biden proposal, he was looking to cancel...

2021-02-1214 min

The TreppWire Podcast: A Commercial Real Estate Show52. Digging into Mall Loan Losses, Retail Loan Modifications, Falling RevPARIn this week's episodet, we dig into mall loan losses, a noteworthy CMBX retail loan modification, recent retail bankruptcies, multifamily occupancy rates, falling RevPAR, and troubled debt restructurings. Manus also shares his experience of visiting Manhattan for the first time since March.

Episode Notes:

On the ground in NYC (4:32)

A noteworthy CMBX retail loan modification (8:30)

Analyzing mall loan losses (15:25)

The surge in distribution and warehouse leases (23:10)

Retail bankruptcies (26:25)

The Chicago office market (30:09)

Revisiting multifamily occupancy (37:57)

Falling RevPAR (42:46)

Deals of the Week (48:14)

Troubled debt restructurings (53:52)

Our holiday wishlist (58:06)

Questions or comments? Contact us at podcast@trepp.com

2020-12-171h 01

The Livewire Politics PodcastStudent Loan Debt | To Forgive or Not to ForgiveAmerican students are on the hook for approximately $1.6 trillion in student loans and the topic of loan cancellation has been front page news recently. On today's episode we examine the rising cost of higher education, who would benefit most from loan forgiveness, and whether or not the Federal Government should even be in the student loan business in the first place. Thank you again for all of our faithful listeners across the globe! Donate to Feed My Starving Children: https://www.fmsc.org/ Resources: http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulushttps://www.realcleareducation.co...

2020-11-2220 min

Journey to Esquire The PodcastKamilah O'Brien "The Focused Spender" - Student Loan Debt and Living Your Best Financial LifeIn this episode, we pass the mic to Kamilah O'Brien to discuss student loan debt and living you bet financial life.Kamilah O’Brien is an operations and financial nonprofit professional with the proven ability to create and optimize operational systems as well as manage billion-dollar budgets.Upon graduating with her Masters of Public Administration in General Finance from NYU, Kamilah had over $65,000 of student loan debt. After realizing her salary wasn’t enough to conquer her debt, Kamilah researched and tested several strategies to help her achieve financial freedom. In just three years' time, Kamilah paid off her...

2020-09-1829 min

The TreppWire Podcast: A Commercial Real Estate Show12. Massive Spike in CMBS Delinquencies, Loan Forbearance Expectations, Office Exposure in CMBX 12We break down the massive spike in CMBS delinquencies (the largest month-over-month increase we’ve seen since 2009), the financial performance of malls, loan forbearance expectations, office exposure in the CMBX 12 index, office loan refinance risk, an important court decision for the syndicated loan market, and what our summer vacations might look like.

Episode Notes:

Where are we in the economic recovery? (00:59)

The largest jump in CMBS delinquencies since 2009 (7:45)

Analyzing the financial performance of malls (13:36)

Loan forbearance expectations as we enter June (20:01)

Looking at the CMBX 12 index and office exposure (25:13)

Lease comp data reveals office loan refinance risk (29:51)

An important court de...

2020-06-0537 min

Making It CountUtilizing Your Paycheck Protection Program LoanOn this episode of Making it Count, hosts Cristina and Will take a deep dive into the Paycheck Protection Program with three special guests: Eduardo Fernandez, an attorney, Paul Roldán, a financial advisor, and John de Armas, a local small business owner. Listen along to learn how to utilize your PPP loan and strategies to qualify for loan forgiveness from three people who have actually gone through the process!

Links

U.S. Small Business Administration: https://www.sba.gov/

Economic Injury Disaster Loan Emergency Advance: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/economic-injury-disaster-loan-emergency-advance

F...

2020-06-0428 min

Making It CountUtilizing Your Paycheck Protection Program LoanOn this episode of Making it Count, hosts Cristina and Will take a deep dive into the Paycheck Protection Program with three special guests: Eduardo Fernandez, an attorney, Paul Roldán, a financial advisor, and John de Armas, a local small business owner. Listen along to learn how to utilize your PPP loan and strategies to qualify for loan forgiveness from three people who have actually gone through the process!

Links

U.S. Small Business Administration: https://www.sba.gov/

Economic Injury Disaster Loan Emergency Advance: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/economic-injury-disaster-loan-emergency-advance

F...

2020-06-0428 min

AIME Podcast NetworkDefining Your Personal Brand as a Loan Officer (with Matt Gougé) - Episode 19

What are you doing to build a positive reputation? As stated by Matt Gougé, Loan Officer at Answer Home Loans, it’s all about creating a memorable name for yourself within the mortgage industry and establishing relationships that will lead to referrals from your clients and real estate partners. In this episode, Matt discusses how working as an independent mortgage broker revolves around serving the client at the highest level. Whether you’re acting as a mortgage advisor or originating a loan, it’s important to be constantly adding value to consumers in order to enhance your reputation and succeed...

2020-02-2455 min

Loan VuEp 18: Giáng sinh của LoanEp 18: Giáng sinh của Loan

Xin chào mọi người, Loan đã trở lại rồi đây? Giáng sinh của mọi người như thế nào, kể Loan nghe với nha!

2019-12-2400 min

The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI017: Crushing Student Loan Debt with Travis Hornsby (Personal Finance Podcast)On today’s show, I meet with student loan expert Travis Hornsby. Travis is the Founder and CEO of Student Loan Planner, where he and his team have consulted on over $750 million in student loan debt. He is also a Chartered Financial Analyst, and an ex-bond trader at Vanguard. Arguably more now than ever, Travis’ expertise in navigating student loans is needed to help correct the current student loan crisis.IN THIS EPISODE YOU’LL LEARN:

How the student loan crisis came to be

Where the student loan crisis currently stands

How the untrad...

2019-12-0435 min

The Minding Your Business Podcast#112- Travis Hornsby, Founder of Student Loan PlannerTravis Hornsby is the founder of Student Loan Planner and the host of the Student Loan Planner podcast. To date, Student Loan Planner has consulted on over half a billion in student debt. Travis is a Chartered Financial Analyst and brings his background as a former bond trader trading billions of dollars. He brings that same intensity to analyzing the best repayment paths for graduate degree professionals with six figures of student debt. Student Loan Planner has helped over 2,600 clients save over $120 million dollars on their student loans, and he’s been featured in U.S. News, Business In...

2019-10-1138 min

Loan VuEp 12: Cứ chân thành cái đã (Loan Vu w/ Thien Thanh)| Ep 12: Cứ chân thành cái đã |

Podcast lần này Loan có dịp trò chuyện với một cô bạn dễ thương, giỏi giang và có một trái tim ấm áp.

Cuộc sống có thể phức tạp đó, nhiều nghi ngại đó, nhưng sẽ ra sao nếu chúng ta "cứ chân thành cái đã''?

Mời mọi người cùng lắng nghe cuộc trò chuyện của Loan và Thanh nha.

2019-09-0700 min

Loan VuEp 07: Một ngày không kế hoạch của LoanEp 07: Một ngày không kế hoạch của Loan

Ngày hôm nay thời tiết Sài Gòn siêu đẹp, vì vậy mà Loan đã dành hôm nay cho những nơi mà Loan chưa đến.

Cứ đi theo cảm xúc chỉ đường cũng có niềm vui nhiều lắm đấy, bạn cũng thử xem sao nha.

2019-08-0800 min

Black Law and Legal LiesThe Student Loan CrisisThis week Becky and Dan discuss the Student Loan Crisis. Becky shares her experience with student loans and her reaction once she realized that she’d be paying back over $100,000 for a $10,000 student loan over the course of 20 years. She also talks about still owing 70% of her loan after 12 years and why she hasn’t paid the remaining balance, even though she’s able to. Dan explains how some people take advantage of student loans by using them as income. He also shares why he is unsympathetic to people drowning in student loans.Currently about 45 Million people owe $1...

2019-04-3057 min

The "Home Team" PodcastWhy its important to work with a GREAT Loan Officer!In this episode our very own Jon Reed gives you ammunition on what to look for when choosing a lender. NOT ALL LENDERS ARE CREATED EQUAL! We discuss everything from Pre-Approval vs Pre-Qualification, The different kinds of Loan Programs available to you, What Mortgage Insurance is, Programs available for both W2 and 1099 borrowers, What you should NEVER DO once you are approved for a loan and much, much more. If you are someone who is looking to buy a home... you DO NOT want to miss this podcast! Check out our Facebook page here -> https://www.facebook.com...

2019-04-2341 min