Shows

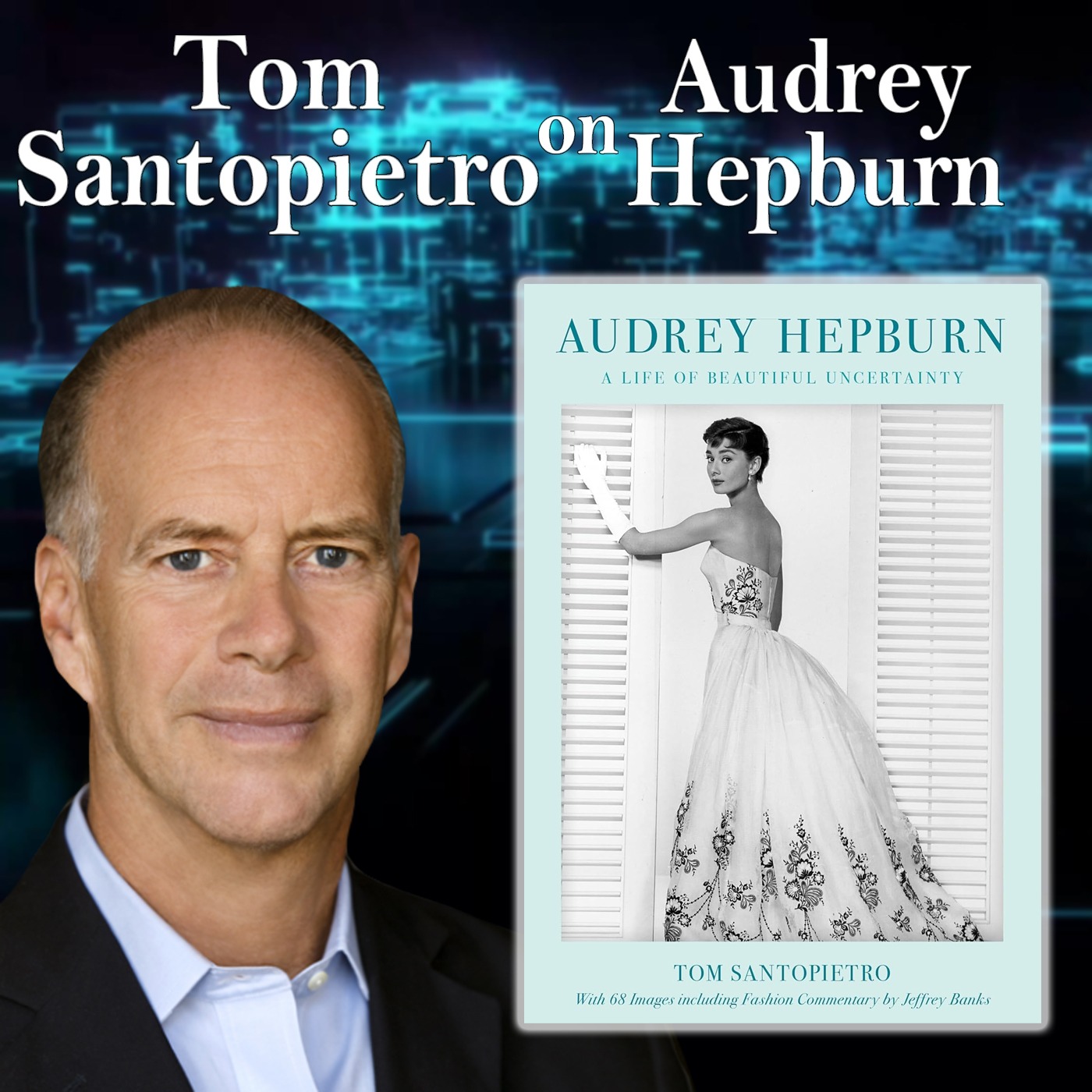

Harvey Brownstone Interviews...Harvey Brownstone Interviews Tom Santopietro, Author, “Audrey Hepburn: A Life of Beautiful Uncertainty”Harvey Brownstone conducts an in-depth Interview with Tom Santopietro, Best-Selling Author, “Audrey Hepburn: A Life of Beautiful Uncertainty”About Harvey's guest:Today’s guest, Tom Santopietro, making his 5th appearance on our show, is a renowned author whose books about the entertainment world are as insightful, entertaining and compelling as the iconic superstars and movies he writes about. He’s written 8 bestselling books, including “The Sound of Music Story”, “The Godfather Effect: Changing Hollywood, America and Me”, “The Importance of Being Barbra”, and “Barbara Cook: Then and Now”. Hi...

2025-07-2540 min

Harvey Brownstone Interviews...Harvey Brownstone Interviews Acclaimed TV, Screen & Stage Actor, Richard KindHarvey Brownstone conducts an in-depth Interview with Acclaimed TV, Screen & Stage Actor, Richard KindAbout Harvey's guest:Today’s special guest, Richard Kind, is a renowned and beloved, multi-award winning actor whose exceptional body of work includes many iconic performances. On the big screen, you’ve seen him in dozens of movies including “Mr. Saturday Night”, “Hacks”, “Quicksand”, “The Station Agent”, “A Serious Man”, “The Producers”, “For Your Consideration”, “Argo”, “Tankhouse”, and “Wolfs”, to name just a few. And on television, he’s best remembered for playin...

2024-12-091h 08

Harvey Brownstone Interviews...Harvey Brownstone Interviews Renowned Actor, Tom AmandesHarvey Brownstone conducts an in-depth Interview with Renowned Actor, Tom AmandesAbout Harvey's guest:Today’s guest, Tom Amandes, is a renowned actor who is perhaps best remembered for his portrayal of “Elliot Ness” in the 1990’s hit TV show “The Untouchables”, and as “Dr. Harold Abbott” in “Everwood”. But over the past 4 decades he’s brought us dozens of other memorable roles. On the big screen, he played Geena Davis' boyfriend in “The Long Kiss Goodnight”, and he was Abraham Lincoln in the 2013 movie, “Saving Lincoln”. Some...

2024-09-1847 min

PersonableGAMBLING GENIUS: How Tom Hyland Made MILLIONS Counting Cards | 2002 Blackjack Hall of FamerSend a textTom Hyland is an inductee of the 2002 Blackjack Hall of Fame. He has had a gun pulled on him, his money stolen, and been intimidated on multiple occasions. As a card-counting expert, Tom has managed and bankrolled some of history's most successful blackjack teams. This is the story of how a young boy from Springfield, Ohio, became one of the most successful gamblers ever.This is the first time Tom has shown his face on camera.Personable is a podcast dedicated to helping listeners become the best they can be...

2024-07-281h 05

The Tom Woods ShowEp. 2481 Yale's Harvey Risch: The Corruption of American MedicineHarvey Risch, professor emeritus at the Yale School of Medicine and Yale School of Public Health, says he went from "naive" about the medical establishment in 2019 to astonished and appalled in 2024. Sponsors: Tom Woods Mastermind: Want to get your business to the next level? Tom's mastermind is where you'll meet and get specific guidance from smart and successful people. Click here for the details. Persist SEO Guest's Faculty Page: Harvey Risch Guest's Twitter: @DrHarveyRisch Show notes for Ep. 2481

2024-04-2044 min

PRsonalEP18: ‘Even our partners have the same name': Meet business twins Tom and Jack AthaTom and Jack Atha share each other like, dislikes – and their girlfriends even share the same name. Perhaps it isn’t a surprise then that they are twin brothers. The pair also work together as co-directors of Atha Developments. And on this episode of PRsonal, they talk to host Charlotte about how their unique bond shaped personal relationships, their time at university and boarding school, as well as their career in property development. In this revealing episode, the brothers talk about the trials and tribulations of running a business together with your twin – along with t...

2023-10-111h 11

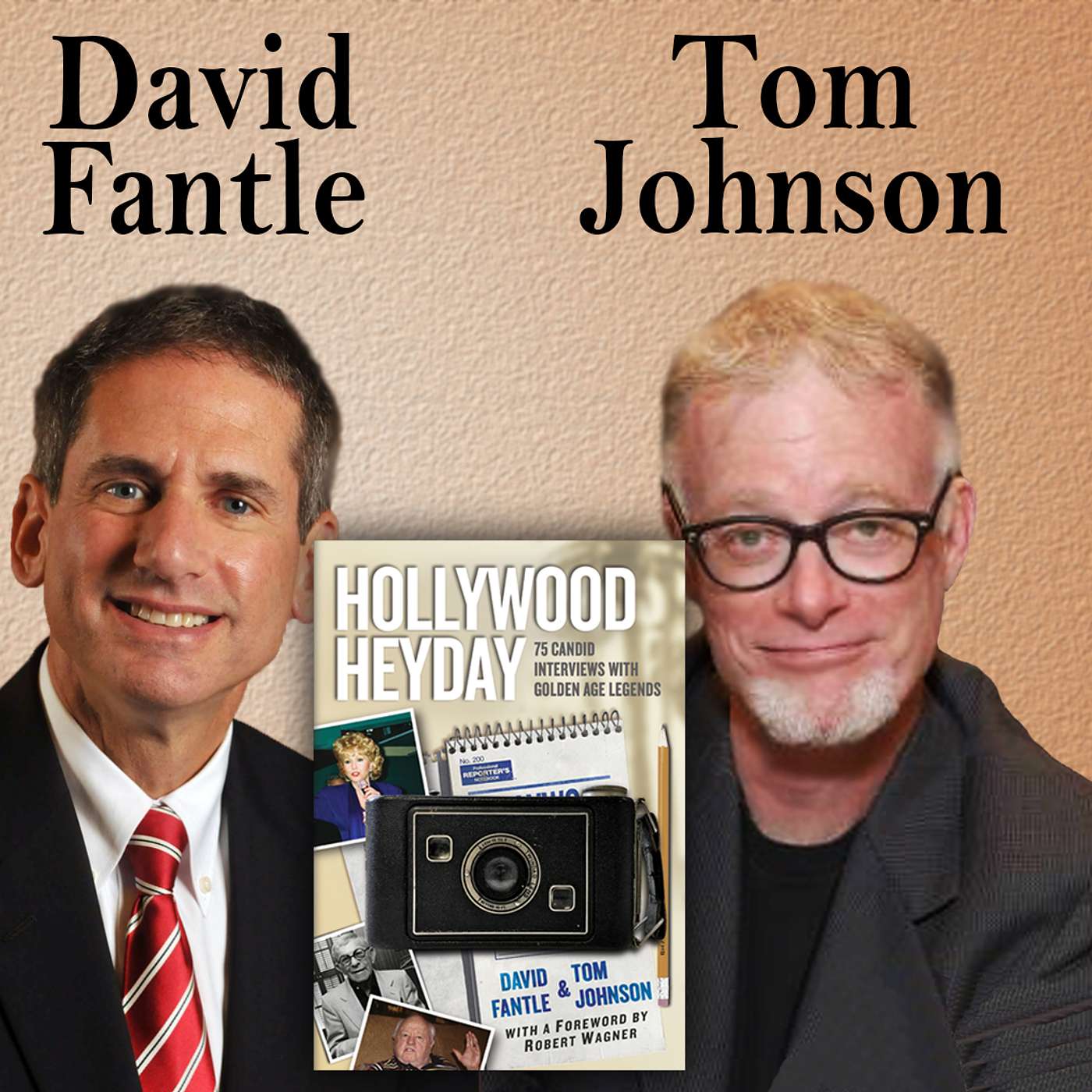

Harvey Brownstone Interviews...Harvey Brownstone Interviews David Fantle & Tom Johnson, Authors, “C’mon, Get Happy: The Making of Summer Stock”Harvey Brownstone conducts an in-depth interview with David Fantle & Tom Johnson, Authors, “C’mon, Get Happy: The Making of Summer Stock” About Harvey's guest: Today’s guests, David Fantle & Tom Johnson, are co-authors who last appeared on our show to discuss their landmark book entitled, “Hollywood Heyday: 75 Candid Interviews with Golden Age Legends”. The interviews contained in that book were conducted when our guests were mere teenagers living in Minnesota, visiting Hollywood in the hopes of meeting movie stars. And boy, did they ever! Since then, our guests have gone on...

2023-10-0341 min

No Title Necessary: Big Ideas in BusinessIgniting Human Potential and The Quest for Making an Impact with Tom Bilyeu and Lisa BilyeuStep into the inspiring world of Tom Bilyeu and Lisa Bilyeu, visionary entrepreneurs and co-founders of Quest Nutrition, as well as the driving forces behind Impact Theory. With an unwavering passion for empowering individuals to unlock their true potential, Tom and Lisa have journeyed from humble beginnings to create a revolutionary impact in the worlds of business and personal growth.As the minds behind Quest Nutrition, they turned a simple protein bar into a global phenomenon, transforming the health and wellness industry. But their ambitions didn't stop there. Harnessing their relentless drive, they founded...

2023-08-0921 min

Tom Ray's Art PodcastSara Harvey Patrick: Comics artistOn this episode of the podcast, I meet Sara Harvey Patrick. Sara is a comics artist living in Rochester, New York. Sara tells me about starting out as a newspaper reporter, then writing comedy with improv groups, and eventually started making comics. Sara is also in the progress of starting a webcomic series.

Sara Harvey Patrick's website https://saraharveypatrick.com

Sara Harvey Patrick on Instagram https://www.instagram.com/ambivalent_sun

Tom Ray's Art Podcast website - https://www.tomrayswebsite.com

Join my email list to get a call out for...

2023-03-0550 min

Harvey Brownstone Interviews...Harvey Brownstone Interviews Tom Santopietro, Author, “The Way We Were: The Making of a Romantic Classic”Harvey Brownstone conducts an in-depth interview with Tom Santopietro, Author, “The Way We Were: The Making of a Romantic Classic” About Harvey's guest: Today’s guest, Tom Santopietro, is a popular and highly respected author whose books about the entertainment world are as insightful, entertaining and compelling as the iconic superstars and movies he writes about. He’s written 7 bestselling books, “The Sound of Music Story”, “The Godfather Effect: Changing Hollywood, America and Me”, “The Importance of Being Barbra”, and “Barbara Cook: Then and Now”. The 1st time he came on our show, we discussed his book, “Consid...

2023-02-2640 min

Harvey Brownstone Interviews...Harvey Brownstone Interviews Tom Moore, Celebrated Theatre, Television And Film Director, Author, “Grease: Tell Me More, Tell Me More”Harvey Brownstone conducts an in-depth interview with Tom Moore, Celebrated Theatre, Television And Film Director, Author, “Grease: Tell Me More, Tell Me More” About Harvey's guest: Today’s special guest, Tom Moore, is a celebrated theatre, television and film director who is in large part responsible for one of the greatest Broadway shows in history – “Grease”. He was the director of the original Broadway production, which ran for 8 years, from February 14, 1972 to April 13, 1980, making it the longest-running Broadway show at the time. And of course, the show inspired the blockbuster movie starring Olivia Newton-John and J...

2022-11-1052 min

Unpacked with Ron HarveyParticipatory Leadership with Tom LedbetterWelcome to the Turning Point Leadership podcast with your host Ron Harvey of Global Core Strategies and Consulting. Ron's delighted you joined us and excited to discuss and help you navigate your journey towards becoming an effective leader. During this podcast, Ron will share his core belief that effective leadership is one of the key drivers of change. So together, let's grow as leaders.Connect with Tom LedbetterConnect with Ron HarveyConnect with RonJust Make A Difference: Leading Under Pressure by Ron Harvey “If you don’t have...

2022-08-1518 min

Harvey Brownstone Interviews...Harvey Brownstone Interviews David Fantle and Tom Johnson, Authors of “Hollywood Heyday: 75 Candid Interviews with Golden Age Legends”Harvey Brownstone conducts an in-depth interview with David Fantle and Tom Johnson, Authors of “Hollywood Heyday: 75 Candid Interviews with Golden Age Legends”About Harvey's guests:Today’s guests have done something not only remarkable, but jaw droppingly unique. In 1974, when our guests were teenagers in Minnesota, they saw the MGM movie “That’s Entertainment”, and fell in love with classic Hollywood movies. In the summer of 1978, fresh out of high school, these star struck kids travelled to Los Angeles, and were somehow able to convince Fred Astaire and Gene Kelly to meet with them for an interview. ...

2022-01-1853 min

Harvey Brownstone Interviews...Harvey Brownstone Interviews Dan Foliart, Film and Television ComposerHarvey Brownstone conducts an in-depth interview with Dan Foliart, Film and Television Composer About Harvey's guest:Dan Foliart’s music has been indelibly etched on the landscape of network television. He is serving his fifth term on the ASCAP Board of Directors, currently as the Writer Co-Chairman. He sits as the immediate past- president of the Society of Composers & Lyricists, after serving that organization for five terms over ten year, developing the New York chapter and instigating the Ambassador Program, recognizing excellence in the field of film music.Included among his recent projects are G...

2021-11-0240 min

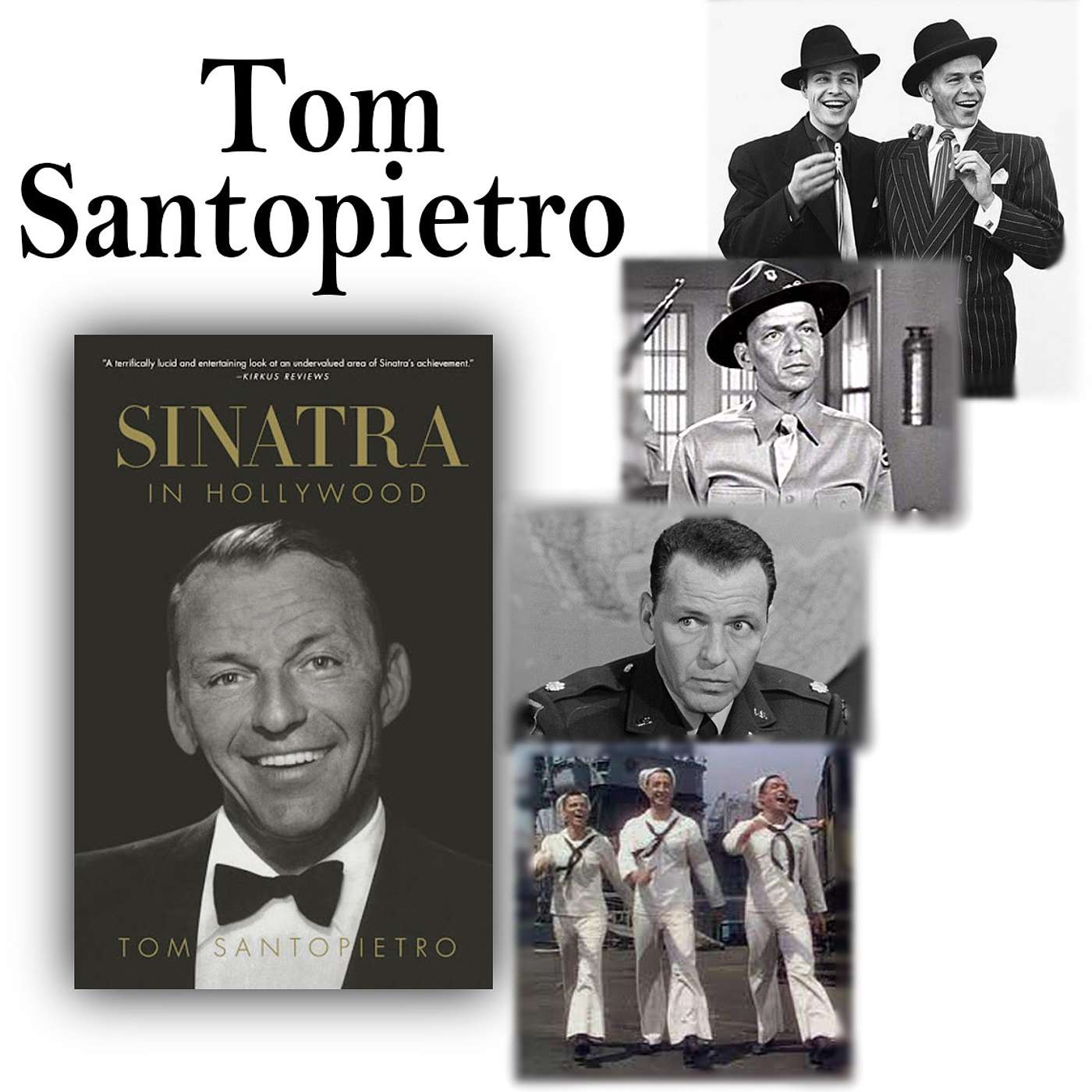

Harvey Brownstone Interviews...Harvey Brownstone Interviews Tom Santopietro, Author of , “Sinatra in Hollywood: The Film Career of a Screen Icon”Harvey Brownstone conducts an in-depth interview with Tom Santopietro, Author of “Sinatra in Hollywood: The Film Career of a Screen Icon”About Harvey's guest:Tom Santopietro is the author of five books: “The Sound of Music Story”, “The Godfather Effect: Changing Hollywood, America, and Me”, “Sinatra in Hollywood”, “Considering Doris Day” and “The Importance of Being Barbra”. A frequent media commentator in programs ranging from the PBS documentary The Italian Americans to the Jimmy van Heusen biography Swingin' With Frank & Bing, Tom conducts monthly interviews for Barnes and Noble and lectures on classic films. Over the past thirty years he...

2021-10-0146 min

Economy GuyIs it INFLATION or DEFLATION in our future?The CPI came in at 5.4%, and that is inflationary. The US Treasury bonds are decreasing in interest rates, and that is deflationary. The market is at an all time peak, and if it cracks, it is deflationary. What is going on? How can we have inflation (and we all feel that inflation at the stores we shop in) and deflation at the same time? Well today its inflation, and tomorrow (sometime) it will be deflation. But when? No one can tell you.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-07-1830 min

Economy GuyThe first SELL SIGNAL for the stock market just happened.Where did the term "TINA" come from? And, how is it being used today in the financial markets? The bond market is rising - so what does this very significant move mean? How is President Putin upsetting the French today - and why is the EU toothless in protecting the French?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-07-1129 min

Economy GuyModern Monetary Theory (MMT) and Credit Default SwapsIn the strong US economy, there exist a few cracks and worries. MMT is one of them as money printing does not create wealth, nor does it drive the economy. No one is talking about Credit Default Swaps, but what if? Buffett makes it clear that the US Government and FED are allowing leveraged speculation, but didn't previously. Why?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-07-0424 min

Economy GuyHow to Pick Stocks in any marketThe 7 rules to follow when picking growth stocks in the markets by the founder of Investor Business Daily, the best financial newspaper on the planet. What lessons can we learn from the history of margin debt in the markets? What rumors are going around the FED today about a rate rise sooner than the Chairman stated?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-06-2721 min

Economy GuyStocks and Gold are Falling - why? The Dollar is RisingThe FEDs are now thinking about raising interest rates in 2023, rather than 2024. And, they think that inflation may average out at 3.4%, and not 2/0%. That is amazing and confusing and real.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-06-2106 min

Economy GuyFamous Banker predicts INFLATION and the CPI proves itThe CPI came in at 5.0% for May, but this didn't push the markets as one would predict. The US Housing Market has a new buying organization pushing prices up. A banker's banker is predicting inflation, followed by deflation, followed by BIG inflation.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-06-1331 min

Economy GuyIs a DEPRESSION coming our way? And why do some Top Economists think so.There is a revolution coming to the Bullion Banks who control the price of gold today. It is called the Basel III Agreement. This is only positive for the price of gold in the future. Some top economists think a great deflationary depression is heading our way, and I explain their thinking - so you can decide for yourself. Isreal has a new government - so what changes are coming?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-06-0637 min

Economy GuyUS Corporate Negative REAL earnings - a precursor to inflationWhy is the FED still pumping money into the US economy when the GDP (the whole economy) has recovered from Covid? Why is the FED holding interest rates down - both FED Funds rate and mortgage rates? IS Europe moving right? Why did foreigners see $1% worth of US Treasuries last year, and what does that mean for the future?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-05-3028 min

Economy GuyBitcoin Crashing and Gold Soaring - Why?The French are in a bit of turmoil as their election next year approaches - and this is explained. Gold was the best market this last week, and it is showing. The FED has the back of the stock market - right? What happens if you are wrong? The National debt can swamp the US economy permanently - see why. When is a good time to sell gold? This is explained.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-05-2323 min

Economy GuyWatch Out for Runaway InflationBoth the CPI and wages are going up, and going up strongly. I think inflation is not only in our future, but is here today. Why are we having a shooting war in Gaza right now, and what is China thinking about Taiwan? We now have a RED indicator as one of our six precursors to a market crash - and it is CPI (Consumer Price Index).

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-05-1530 min

Economy GuyEurope in Turmoil, and the USA is shrinkingShrinking? How can that be? Ask the millennial who are postponing their child production years. Europe is getting ready for elections and everything is up for sale - Scotland nearly missed another independence election call. Will N Ireland follow Scotland? France is up for grabs in next year's election. Spain has just opened up, and everyone is partying.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-05-1022 min

Economy GuyChina is the future flash port of the worldThe markets basically went sideways last week, and politics ruled the world. In France, the French military warned the French government to get their act together and solve the problems of the country (or else!!!) China is explained as the most dangerous country in the world today, and why.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-05-0220 min

Economy GuyA weakening Dollar is now back where it started - will it fall further?The US 10 Year Treasury is at a critical technical position right now and will either rebound (higher interest rate), or fall to lower interest rates. The former is probable. The US Dollar fell against most currencies about 1% and represents a major move this last week. Will the US Dollar continue falling now that it has tested recent high values? Transitory Inflation is discussed in depth - so the influence of future inflation is more fully understandable.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-04-2629 min

Economy GuyInflation is here - and what does it mean? Will stocks crash? (Yes, eventually)The CPI came in greater than anyone expected. This week I explore the meaning of inflation to stocks and bonds. I look at the definition of inflation, and try to bet a good gut understanding of inflation - so you can make sense of it in the future. A hypothetical example of the company, DolarTree, is used to show the effect inflation can have on a company. (How about you personally?) The FED's mindset abut inflation is explained - and questioned.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-04-1829 min

Economy GuyWill WAR crash the markets & Market Crash HistoryThe war drums are beating in Ukraine. Will Russia or China take advantage of the turmoil in the world? How much electricity is Bitcoin costing the world today - and every day? What lessons can we learn from the Archegos disaster - and how was this allowed to happen? Could it have taken down the banking system?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-04-1124 min

Economy GuyFuture Technologies - will make GREAT InvestmentsHappy Easter. It was a sideways market most places last week. The US economy is strong and getting stronger as the economy opens up. Many technologies will change the face of the world and fortunes will be made in them.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-04-0417 min

Economy GuyThe FED is playing Poker with the Markets - Who will win?Several housing tidbits were covered in the US housing market this week. A large cargo ship has blocked the Suez Canal - so what? What shares should you buy, and do you know how to analyze them? How much debt is too much debt? How much is the current US administration planning on spending - and is it more than the total wwII debt?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-03-2724 min

Economy GuyMarket Crash Predictors are getting much worse each day - what does Warren Buffett and Ray Dalio say?Crises are upon us around the world - hyperinflation in Lebanon, nuclear warhead count in the UK, pandemic numbers in Europe, and (not the least) FED predictions of the future. I give a lesson in "compound interest." Warren Buffett gives his wisdom about the markets today and the poor state of retirees. Ray Dalio gives his concern about the $75T US debt market.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-03-2129 min

Economy GuyIs the FED making decisions with BAD DATA?A big change in the mortgage market will affect the mortgage rate second home and vacation home rates. How does the gold market work - here is my own ideas after decades of observations. Does the FED use bad data to determine inflation? Is better data available, but won't be used due to human frailties? What does the ever increasing 10 Year Treasury rate mean for you?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-03-1433 min

Economy GuyAre Interest Rates Driving ALL the other markets TODAY????A unique perspective of the influence of the 10 Year Treasury Bond yield on ALL other markets is presented. The market action for the week was reviewed. Many interesting tidbits in the economic news were reviewed including the massive outflow of Euros from Germany caused by negative interest rates. FIVE broken system used within the US economic system were highlighted. And the 6 precursors to a stock market crash were reviewed.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-03-0733 min

Economy GuyWhat does this RISE in Interest Rates mean?The 10 Year Treasury bond is rising rapidly in its interest rate. This means the US Government must pay more interest on its newly created bonds. Housing mortgage rates are rising slowly, and are expected to rise more rapidly. What can the FED do to keep the rising interest rates from causing a stock market crash?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-02-2732 min

Economy GuyCan you Protect Yourself from the Upcoming Market Crash?Several new indications of the US stock market being way too high were reviewed. The US markets review showed the importance of the changes in the US 10 Year Treasury Bond. An Option Hedge strategy was reviewed to protect yourself from a market crash. A new indication of using the High Year Bond value as a precursor was reviewed.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-02-2028 min

Economy GuyMarket Experts expect the Market to Crash (and burn)I review some interesting international movements and review the markets and economic measures in the USA. I review what true market experts are using to measure the "exuberance" of the market today. Do you use any of these measures? Perhaps you should.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-02-1431 min

Economy GuyDoes the FED know what it is doing?Gamestop lost most of its value, but is still elevated above its fair value - this means the fight between the little investors and the Hedge Funds is still on. The FED has shown many times in its history that it gets things wrong - what does the future hold? Is bitcoin real, and what is it really? Can you hold it in your hand? The 10 Year Treasury is rising, and could be a precursor to a market crash.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-02-0730 min

Economy GuyGameStop - Is this the signal for a Stock Market Crash?The Dow lost 1000 points last week. Why? Was it just a correction, or did the GameStop (GME) story influence all of the participants in the market? Why were the big boys and girls - hedge funds and brokerage firms - so upset about GameStop's action last week? How did a bunch of small investors beat the Hedge Funds? All this and more in this podcast.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-01-3124 min

Get Off The Treadmill for Business LeadersEpisode 15- Tom Harvey with Earthwood Design, Part 2Tom Harvey is back with us today to share about the beauty and art he is creating at Earthwood Design. His pieces aren't just regular furniture you can find at any store, these are beautiful works of art that are created with passion and love!

Tom Harvey has been a wood and architecture junky since childhood, which he spent building forts, digging holes, and carving. He has a strong Fine Art background and started a degree in sculpture but finished it in Industrial Design. During this education, Tom fell in love with the ability to...

2021-01-2924 min

Economy GuyThe Crash Approachs - what stocks will crash more?A new organization. I review the key precursors that can be use to predict the upcoming stock market crash. How the FED makes its policy changes is reviewed and the top frothy stocks in the current stock market bubble.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-01-2425 min

Economy GuyIs the Bond Bear Market a Signal of an upcoming Crash in Stocks?A bond market technical sign shows that bonds have entered a bear market. An expert shares his reasons what will be a precursor to a stock crash - and the bond bear market is one of them. The environment at the start of 2021 for investing is explored and it is not very positive.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-01-1719 min

Economy Guy4 Things that could go wrong in 2021After reviewing the markets, I talk about taking more care with your philosophy in establishing investment ideas, and then review 4 things that could go wrong and 4 thing that could go right with the 2021 economy. Then I review the major driver for the economy in 2021.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-01-1020 min

Economy GuyHistory and Future of the VirusThe markets for 2020 are reviewed with an excellent year for stocks, and better year for gold and smashing year for silver. How did we get into this virus mess and how did the authorities deal with it? What are some of the lessons learned about the virus in 2020?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2021-01-0327 min

Economy GuyHigh Yield Bonds can be a Precursor to a Crash in the Stock MarketHY bonds are discussed and their history as being a possible precursor to a stock market crash. Gold is described as a place where purchasing power can be maintained.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-12-2721 min

Economy GuyQuestions about the Virus and Vaccines???The stock market appears to be overpriced based on past experiences of almost any measure. These are reviewed in this episode. I also ask a series of questions about the virus and vaccines that haven't been answered yet.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-12-2023 min

Economy GuyInflation or Market Crash Future???I analyze a debate between Peter Schiff and Harry Dent regarding the problem of how our massive debt trap can be resolved. Peter says it will get solved through inflation, and Harry says it will get resolved through a huge market crash. I also give you the Concensus view of what will happen in the 2021 market.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-12-1221 min

Economy GuyHow to DESTROY Debt.The markets are examined and a prediction of a market crash in the next months is discussed. The 4 ways to eliminate debt is discussed along with the probable ways we can get out of our Debt Trap.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-12-0617 min

Economy GuyDid the death rate in the USA increase due to the Virus?A John Hopkins University paper is examined to scientifically study the death rate of US citizens during the virus. Comparisons showed that the rate of deaths has not changed, and that mis-classifications were suggested as the cause. the paper is a reason to not fear this virus.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-11-2915 min

Economy GuyMy retirement plan at age 146 questions are asked for the listener to solve. These include the influence of the vaccine and virus testing. The overwhelming influence of the US Federal Reserve is emphasized.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-11-2221 min

Economy GuyCan you retire on the 5% Rule Today?Stocks exploded this week - why? (I explain it.) Can markets go higher? (I explain why Mark Twain thinks so.) What are the fastest growing industries over the next 10 years? (I give you some predictions.) Why won't the classic 5% Retirement Rule work today? (I explain why this is dangerous today.)

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-11-1523 min

Economy Guy10 Rules for How Markets Work --- When Buying and SellingThe inflationary influences in the US market today with worldwide implications, and how GDP might be suppressed in the future as neighbor helps neighbor. I quote 10 rules that are proven characteristics of markets that you trade in. These rules can help you with your timing in the market.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-11-0817 min

Economy GuyThe Debt Trap - how to avoid its coming impact on you.In this episode, I state that the world is in a Debt Trap (a perfect Ponzi Scheme) and how you should plan and prepare for the massive repricing of assets that is coming. Being prepared will allow you to protect your family's assets and not lose them. Your financial survival is as stake, so a little preparation will go a long way.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-11-0121 min

Economy GuyVirus World - what to expect in the futureIn this episode, I talk about European GDP and its connection to potential future hyperinflation, and discuss the world markets with a Safe Haven explanation of gold investment. I have a special discussion of what might come along in the future in the world of the virus, and how those events would shape our future virus actions.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-10-2520 min

Economy GuyWar in the Caucasus? And is the US in a DepressionIn this episode, i talk about the ongoing conflict between Armenia and Azerbaijan, and the sides supported by Turkey and Russia. Keep informed on these dangerous conflicts. I also explore that the US is currently in a Depression (and not a recession) and it will be a long slow climb out of our economic downturn.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-10-1115 min

Economy GuyChina vs USA, and Debt is drowning usIn this episode, I discuss the current markets (going sideways) and China being the largest importer of oil - and how pays for it. The total world debt is unsustainable, and I use the US Debt situation to explain how bad it truly is - by projecting to 2030.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-10-0416 min

Mothers at Midnight PodcastEp 005 Psychedelics, Music & Movement ~ Tom Di BellaDIVE INTO TOM'S MIND...What if you found out you not only held the key, but you were the key? Would you unlock the doors, or keep them shut?Today's guest, Tom Di Bella is a group facilitator, music maker and explorer of psychedelic realms. He believes in the power of plant medicine to unlock the hidden depths of who we are. Tom talks about his journey into psychedelics and how they can open and transform our consciousness. Ready to take a trip with Tom!In today's episode, we chat...

2020-10-0452 min

Economy GuyCovid-19, the past, the present and the futureIn this episode, I talk about the success or lack of it to solve the real problem of Covid - 19. I discuss the future of vaccines and the future of testing in the world. I explore possible optimist solutions to the pandemic fear currently defeating our economies. I lastly explore future technical solutions that could completely solve the virus problem.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-09-2015 min

Economy Guy8 Problems the Economy Must Solve to RecoverIn this episode, I discuss eight problems that are concurrently being resolved. Their interactions and solutions will determine the shape and timing of the economic recovery. I also talk about the difference between the "good old days" and the future.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-09-1318 min

Economy GuyBorrowing - where is the money going? Corporate, Small Business, GovernmentIn Today's Episode, I talk about which sectors of the economy is able to access debt from lenders (funds, banks and individuals). In particular I discuss the Small Business Association loans and how they are not happening today.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-09-0520 min

Well Being Walks with Kip HollisterTom Harvey: Leading with Empathy and AuthenticityThis week Kip walks with Tom Harvey to discuss the importance of authenticity in leadership. Tom discusses his own experience being fully himself as a gay man, and also shares how motivated he is by the important work his company does in serving vulnerable patient populations. Tom Harvey is Chief Information Officer at Alkermes, a biopharmaceutical company that focuses on diseases such as such as schizophrenia, depression, addiction and multiple sclerosis.

2020-09-0255 min

Economy GuyFED Chair Powell - translated - what is the future? What are the French doing with the Virus?In this episode, I talk about the technical action of gold and lessons that can be learned. I discuss the French people and the virus - their fear and lack of it. I talk about the last 60 years of FED actions and how it fits today. I interpret FED Chair Powell's statements at Jackson Hole WI.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-08-3018 min

Economy GuyBIG Data - where is this going and how will it affect you?In this episode, I explore the area of BIG DATA. How much data is collected today? What is it used for? Where is the future of Big Data using Artificial Intelligence? What is data latency? What are the opportunities in this area?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-08-2315 min

Economy GuyGold - a Lesson in Technical AnalysisIn this episode, I talk about the price action of gold from its recent climb for 3 weeks to $2067, and its $103 fall in a single day. I also talk about how to think about technical analysis of the price action and predict the potential future for gold.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-08-1406 min

Economy GuyUS Repricing compared to Europe.In this episode, I highlight the massive rise in gold and focus on what big tech is doing with all that data YOU are voluntarily giving them. The quick highlights of economic news continues to interest. And the major discussion is Europe vs. USA on our economic comeback.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-08-0229 min

Economy GuyOur Economy Today and Tomorrow, and What is China Doing?In this episode, I happily announce gold's emergence above $1900, and cover some very serious international news about Lebanon, the EU, the UAE, and China. The Uighurs are discussed in detail and a very serious scandal is revealed. The valuation of today's US stock market is analyzed and dangerous valuations are reported.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-07-2626 min

Economy GuyOur Future Economy and Life Extension ResearchIn this episode, I talk about genetic research and its coming to market very quickly. Our favorite short topics and Oddball news items are always fun and interesting. A special report of what is driving our future global economy and the specifics about small businesses being killed off in today's world.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-07-1920 min

Economy GuyThe VIRUS and employment stats, and what about INFLATION?In this episode, I talk about the BLS unemployment statistics and new jobs. In addition, I define INFLATION in 2020 as being serious. As a novelty I talk about a small town that is printing its own money.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-07-1223 min

Economy GuyWhat if the Dollar declines 35%? Is Globalisation Good?In this episode, I have inserted two "What If's" into the podcast. What if the FED decides to unwind its asset positions SLOWLY? and What IF the US Dollar deprecisates by 35% in the near future? The key oddball news and market updates are included.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-07-0525 min

Economy GuySpending our way out of Recession, and Real Virus StatisticsIn this episode, I present some recent economic statistics on spending during our economic recession, and who is spending and who is not. I show how overvalued the stock market is today and predict a future for gold. Will we be building more hydrogen bombs in the future? What virus statistics can you trust? Did you know the US has 10 times more new cases than Europe?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-06-2816 min

Economy GuyThe US Housing Market - a solution for the Virus?In today's episode, I talk about how the world's markets are like a teeter-tooter with the FED sitting at one end. There are the usual oddball news items and a special on the US Housing Market - exploding right now.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-06-2114 min

Economy GuyIntellectuals can be "In-effectuals." Unintended Consequences.In this episode, I talk about unintended consequences of any change to a complex system. I report that the FED doesn't think we will have a rapid recovery (no V-shaped recovery) of the economy. Oddball news brings you the funny things happening around the globe.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-06-1414 min

Economy GuyA Virus Update Special - and a Great Jobs ReportIn this episode, I start by explaining my mistake about a V-shaped recovery. Europe has some interesting news, and a FED President makes a remarkable prediction. I finish with a summary of the Virus and its impact on our society.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-06-0719 min

Economy GuyEconomic Predictions in the VIRUS environmentOddball news is back by high demand, and the US economy and US economic predictions are made for both the immediate future and the next 12 months.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-05-3118 min

Economy GuyUS/China Relations in Era of VirusIn today's episode, I review the macro economics of the US and Europe, and focus on China. What does the future hold for US?Chinese relations?

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-05-2423 min

Economy GuyCan you Believe the Virus Statistics?The economy is reviewed with significantly new numbers, Europe is reviewed and looks glum, the Virus statistics are looked at, and predictions are made for our future economics.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-05-1728 min

Economy GuyFuture Stock Market Value and HawaiiInteresting Oddball news, and Europe, and the markets were discussed. US economic activity, and a spotlight on Hawaii was presented. The future of stock prices was predicted.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-05-1024 min

Economy GuyWhat will the world be Post-Virus - economically?In this episode, after the market wrap including the funny stuff going on in oil, the current state of the virus was explained. Our favorite Oddball section was added and the Europe was discussed. A special on Warren Buffett was included and the US economic news discussed. The wrap-up was a food for thought talk about what has happened in China (2 months ahead of the US in this virus fight) and what might happen in the western world.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-05-0323 min

Economy GuyEconomics to Escape Lockdown - Normal?In This episode, I review last week's markets and discuss the dramatic results of oil on Monday. I discuss falling profits in the S&P500 companies - and what that means. I discuss the ECB banking system and the concept of a "bad bank." I talk about why Stimulus is NOT Stimulus. I explain that we will never return to Normal. And I discuss one state's plan to get its people back to work.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-04-2624 min

Economy GuyThe Virus and Gold - the Future?In this episode, I review the markets for the past week, and talk about the world of the virus as it appears to be coming, some oddball news items, how Italy is determining the future of the EU, a special few words about what is going on in the gold market, and some closing thoughts to keep you focused on the ultimate target of our economy.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-04-1929 min

Economy GuyQuantitative Easing FOREVERIn this episode, I review the European problems and the state of the virus. I also discuss the government programs that are working and project my ideas of the future economy after "the era of the virus."

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-04-1225 min

Economy GuyCracks or Fissures in the Economy?In this episode, I review last week's markets, and review the Virus news and include some Oddball news items, then get serious about what's happening in Europe (very serious) and review the US economic news, and conclude with a review of today's market versus the Great Depression.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-04-0524 min

Economy GuyThe Transitional Week of virus and EconomicsIn This episode, I update the markets with predictions and the latest news of the virus and economics including Congress, the FED and Unemployment. There are miscellaneous tidbits added for your enjoyment.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-03-2916 min

Economy GuyBlood in the MarketIn this episode, I talk about last week's market action, unemployment, and a Virus lesson from China. I also talk about how the FED is trying its hardest to accomplish Bailout 2.0 (remember TARP?)

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-03-2214 min

Economy GuyThe Week That WasIn this episode, I walk through the most exciting week in the markets that has taken place since 1929. We are now officially in a BEAR market. I talk about the slow, but dangerous rise in 10 Year Treasury Interest Rates.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-03-1516 min

Economy GuyThe Markets in a NutshellIn this episode, I talk about stocks, bonds and gold over the past week, and their various price actions.. I also point out the disappointment the Federal Reserve must have felt after their 1/2 point Fed Funds Rate did not bring the expect results.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-03-0809 min

Economy GuyRECESSION coming? caused by Virus?In this podcast, I talk about the US stock market fall and its future based on a possible recession and the various possible Virus behaviors in the US. I answer the question: "Will there be a recession?" I also talk about a depression.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-03-0210 min

Economy GuyGOLD AvalancheIn This episode I talk about why gold fell like an avalanche after touching $1690. I also talk about why this happened and what gold should be doing in the future.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-03-0109 min

Economy GuyGold - UP, UP, and AwayIn this episode I walk about the price of gold recently and its fundamental and technical drivers. I also make a prediction on the possible future price for gold in 2020. I also include a spoof of an incident of an Italian meeting in Dublin.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-2613 min

Economy GuyThe Federal Reserve is in a BOXIn this episode I talk about the main tools the FED has to manage the US economy - mainly the FED Funds Rate. I discuss how these tools are working today and what shape the FED is in if a recession should hit the US economy. The purpose of this episode is to understand the fundamental workings of the FED.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-2309 min

Economy GuyPost Brexit BlowupIn this episode we look at what has changed in the UK after Brexit has happened. Not much. We also look at the problems that the EU faces without having the major contribution that Britain made to its annual budget. Lots of infighting.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-2310 min

Economy GuyAn Update on Life in Antibes France - a spoofIn this episode, I relive the sewer episodes of a prior blog and the latest construction project across the street of our apartment. In addition, I give an update on the movement of the town's Merry-Go-Round - and associated construction. Fun.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-2110 min

Economy GuyDo you Believe CPI - the inflation rate?In this episode we talk about the definitions (yes plural) of inflation. And is it meaningful in your life? We look at the things that make up the CPI calculation, and alternative measures like PCE and Chapwood. We look at what can go wrong with inflation.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-1910 min

Economy GuyWhat is GDP?Today's episode explains the definition and measurement of US GDP. It talks about the influence of government spending on GDP.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-1307 min

Tóm Tắt Sách Cùng TanyaTóm Tắt Sách: Cư Xử Như Đàn Bà, Suy Nghĩ Như Đàn Ông – Steve HarveyChào các bạn! Hôm nay Tanya sẽ chia sẻ và tóm tắt lại nội dung của một quyển sách được coi là chiến thuật giúp phụ nữ hiểu được từng ngõ ngách trong suy nghĩ của đàn ông, hiểu được động lực nào khiến đàn ông tiếp cận bạn? Tại sao đàn ông lừa dối? Và bí quyết nào giúp bạn luôn ở thế chủ động trong mối quan hệ của mình? Quyển sách được viết bởi diễn viên, ngôi sao hài kịch và là người dẫn chương trình...

2020-02-1116 min

Tóm Tắt Sách Cùng TanyaTóm Tắt Sách: Cư Xử Như Đàn Bà, Suy Nghĩ Như Đàn Ông - Steve HarveyHãy tải ngay ứng dụng Waves để cập nhật những tập podcast mới nhất và có những trải nghiệm miễn phí tuyệt vời nhất:

iOS: https://apps.apple.com/gb/app/waves-podcast-player/id1492378044

Android: https://play.google.com/store/apps/details?id=com.waves8.app

Tóm Tắt Sách: Cư Xử Như Đàn Bà, Suy Nghĩ Như Đàn Ông - Steve Harvey | Tóm Tắt Sách Cùng Tanya

Chào các bạn! Hôm nay Tanya sẽ chia sẻ và tóm tắt lại nội dung của một quyển sách...

2020-02-1116 min

Economy GuyState of the World Markets - 2020In this episode Tom Harvey talks about the US stock, bond, commodity and real estate markets - predicting their outcome for 2020. He also introduces some possibly negative events that could, but probably won't come along.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-0912 min

Economy GuyWhy Listen to Economy GuyThis episode tells you something about Tom Harvey and the reason this podcast could be useful to you. It also gives you many examples of what the future podcast topics will be: including how to protect yourself, stocks, bonds, commodities, interest rates, The Federal Reserve, real estate, strong and weak economies, and more.

---

Support this podcast: https://podcasters.spotify.com/pod/show/tom-harvey6/support

2020-02-0915 min

WikiJabberTom Harvey, Adam Seth Moss, Gerald Shields

Tom Harvey, Adam Seth Moss, and Gerald Shields. Photo: Sebastian Wallroth. License: CC-BY 4.0

Tom Harvey (User:Sixflashphoto), Adam Seth Moss (User:Mitchazenia), an Gerald Shields (User:Geraldshields11) talked with Sebastian Wallroth at WikiConference North America 2018 in Columbus, Ohio.

Since all of the are photographers for Wikipedia, this was the main topic. The talk moved from why taking photos, suggestions for Wikipedia newbies to tips on how to beacome a Wikipedia phtoto contributer.

2019-05-0951 min