Shows

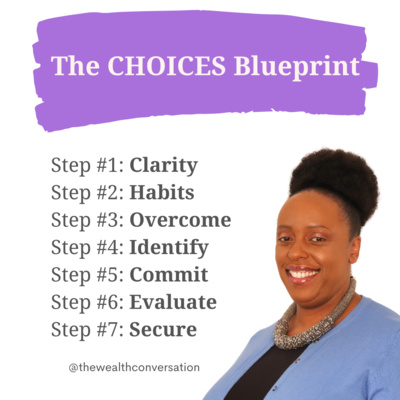

The Business & Wealth Show - Mac Attram189. Money, Mindset, & the Power of Financial Choice with Tsitsi MutitiTsitsi Mutiti is a Wealth Coach, award-winning Investment Manager, and host of The Wealth Conversation Podcast. With over 10 years in wealth management, she helps high-achieving women create generational wealth through her signature C.H.O.I.C.E.S Blueprint™. Tsitsi’s journey of overcoming debt and financial fear fuels her mission to empower others with the mindset and tools for financial success. Alongside coaching, she supports clients with investments, pensions, and trusts. A sought-after speaker and panellist, Tsitsi is known for her relatable approach and impactful insights. She’s also a proud mother, wife, and aunt, dedicated to buildi...2025-06-2438 min

The Business & Wealth Show - Mac Attram189. Money, Mindset, & the Power of Financial Choice with Tsitsi MutitiTsitsi Mutiti is a Wealth Coach, award-winning Investment Manager, and host of The Wealth Conversation Podcast. With over 10 years in wealth management, she helps high-achieving women create generational wealth through her signature C.H.O.I.C.E.S Blueprint™. Tsitsi’s journey of overcoming debt and financial fear fuels her mission to empower others with the mindset and tools for financial success. Alongside coaching, she supports clients with investments, pensions, and trusts. A sought-after speaker and panellist, Tsitsi is known for her relatable approach and impactful insights. She’s also a proud mother, wife, and aunt, dedicated to buildi...2025-06-2438 min The Wealth ConversationClosing the Ethnicity Pay Gap ft. Selena FlaviusIn this week's episode, I’m joined by Selena Flavius, founder of Black Girl Finance, to discuss the ethnicity and gender pay gaps and how these issues impact women of colour.

We dive into financial literacy, the importance of confidence in money management, and why advocating for fair pay is critical. Selena also shares her journey from late saver to finance coach and the inspiration behind her annual Black Girl Finance Festival, which empowers women with financial education and community support.

Key Themes:

Ethnicity pay gap and its fi...2024-09-1434 min

The Wealth ConversationClosing the Ethnicity Pay Gap ft. Selena FlaviusIn this week's episode, I’m joined by Selena Flavius, founder of Black Girl Finance, to discuss the ethnicity and gender pay gaps and how these issues impact women of colour.

We dive into financial literacy, the importance of confidence in money management, and why advocating for fair pay is critical. Selena also shares her journey from late saver to finance coach and the inspiration behind her annual Black Girl Finance Festival, which empowers women with financial education and community support.

Key Themes:

Ethnicity pay gap and its fi...2024-09-1434 min The Wealth ConversationThe Truth Behind the Ethnicity Pay Gap ft Selina FalviusWelcome back to The Wealth Conversation! In this episode, Selina Falvius (Black Girl Finance founder) and I tackle the ethnicity pay gap and explore how it impacts women/people of colour in the workplace.

We uncover the hidden costs of this pay gap, and how it hinders wealth-building, financial security, and retirement planning. Tune in as we discuss ways to close the gap, advocate for equal pay, and build wealth despite these financial challenges!

Key Themes:

Understanding the ethnicity pay gap and its consequences...

How to build financial security despite wage...2024-09-0607 min

The Wealth ConversationThe Truth Behind the Ethnicity Pay Gap ft Selina FalviusWelcome back to The Wealth Conversation! In this episode, Selina Falvius (Black Girl Finance founder) and I tackle the ethnicity pay gap and explore how it impacts women/people of colour in the workplace.

We uncover the hidden costs of this pay gap, and how it hinders wealth-building, financial security, and retirement planning. Tune in as we discuss ways to close the gap, advocate for equal pay, and build wealth despite these financial challenges!

Key Themes:

Understanding the ethnicity pay gap and its consequences...

How to build financial security despite wage...2024-09-0607 min The Wealth ConversationDemystifying Property Ownership: Common Misconceptions and Long-Term BenefitsIn this episode, I’m joined by Antoinette Oguntonade, co-founder of BrickzwithTipz, to uncover the truth about property ownership. We debunk common myths, discuss the long-term benefits of owning property, and explore how collaboration can help you get on the property ladder.

We also touch on the pressures of being a breadwinner and the importance of women leveraging their skills to build wealth. If you’re ready to challenge what you think you know about property, this episode is for you!

Key Themes:

• Debunking myths about property ownership.

• Long-term financial benefits of ownin...2024-08-3046 min

The Wealth ConversationDemystifying Property Ownership: Common Misconceptions and Long-Term BenefitsIn this episode, I’m joined by Antoinette Oguntonade, co-founder of BrickzwithTipz, to uncover the truth about property ownership. We debunk common myths, discuss the long-term benefits of owning property, and explore how collaboration can help you get on the property ladder.

We also touch on the pressures of being a breadwinner and the importance of women leveraging their skills to build wealth. If you’re ready to challenge what you think you know about property, this episode is for you!

Key Themes:

• Debunking myths about property ownership.

• Long-term financial benefits of ownin...2024-08-3046 min The Wealth ConversationProperty Myths Exposed: What They Don’t Want You to KnowIn this episode, I chat with Antoinette Oguntonade, co-founder of BrickzwithTipz, about the power of property ownership as a wealth-building tool!

We discuss common misconceptions about property ownership, the long-term benefits, and how it can provide financial freedom and security for future generations.

Antoinette also shares her personal journey and the importance of women contributing to family wealth, breaking traditional gender roles. Tune in!

Key Themes:

Property ownership as a wealth-building tool

Debunking common myths about owning property

Collaboration to get on the property ladder

Long-term financial benefits of...2024-08-2307 min

The Wealth ConversationProperty Myths Exposed: What They Don’t Want You to KnowIn this episode, I chat with Antoinette Oguntonade, co-founder of BrickzwithTipz, about the power of property ownership as a wealth-building tool!

We discuss common misconceptions about property ownership, the long-term benefits, and how it can provide financial freedom and security for future generations.

Antoinette also shares her personal journey and the importance of women contributing to family wealth, breaking traditional gender roles. Tune in!

Key Themes:

Property ownership as a wealth-building tool

Debunking common myths about owning property

Collaboration to get on the property ladder

Long-term financial benefits of...2024-08-2307 min The Wealth ConversationBalancing Personal and Business Finances ft Beniratio FinancesIn this episode, I sit down with Benedicta Egbeme, founder of BeniRatio Finances, to discuss the crucial importance of separating personal and business finances!

We dive into practical tips for managing your finances, avoiding tax issues, and the mindset shifts needed to treat your business as a separate entity. Benedicta shares strategies for tax planning, maximising profits, and protecting your wealth for future generations.

Key Themes:

Importance of separating personal and business finances

Setting up and managing a business bank account

Planning and preparing for taxes effectively

Understanding tax brackets, contributions, and corporation tax

...2024-08-1648 min

The Wealth ConversationBalancing Personal and Business Finances ft Beniratio FinancesIn this episode, I sit down with Benedicta Egbeme, founder of BeniRatio Finances, to discuss the crucial importance of separating personal and business finances!

We dive into practical tips for managing your finances, avoiding tax issues, and the mindset shifts needed to treat your business as a separate entity. Benedicta shares strategies for tax planning, maximising profits, and protecting your wealth for future generations.

Key Themes:

Importance of separating personal and business finances

Setting up and managing a business bank account

Planning and preparing for taxes effectively

Understanding tax brackets, contributions, and corporation tax

...2024-08-1648 min The Wealth ConversationHow Does Tax Work? (For Professionals and Entrepreneurs) ft Beniratio FinanceIn this episode, we dive into the key taxes to be aware of whether you're employed, self-employed, or running a business.

We also explore strategies for managing taxes efficiently, ensuring you're maximising your income and reinvesting smartly into your business!

Understanding income tax and National Insurance (NI) contributions.

Tax considerations for the self-employed.

Corporation tax and how it applies to business profits.

Strategies for reducing your tax bill as a business owner.

The importance of reinvesting in your business.

Work with Tsitsi and follow The Wealth Conversation:

Book an hour finance session with Tsitsi...2024-08-0908 min

The Wealth ConversationHow Does Tax Work? (For Professionals and Entrepreneurs) ft Beniratio FinanceIn this episode, we dive into the key taxes to be aware of whether you're employed, self-employed, or running a business.

We also explore strategies for managing taxes efficiently, ensuring you're maximising your income and reinvesting smartly into your business!

Understanding income tax and National Insurance (NI) contributions.

Tax considerations for the self-employed.

Corporation tax and how it applies to business profits.

Strategies for reducing your tax bill as a business owner.

The importance of reinvesting in your business.

Work with Tsitsi and follow The Wealth Conversation:

Book an hour finance session with Tsitsi...2024-08-0908 min The Wealth ConversationOvercoming Financial Anxiety & Stress (Money Mental Health) ft Norma CassiusIn this episode of The Wealth Conversation, Norma Cassius and I delve into financial anxiety and mental wellbeing!

Norma, a seasoned money management and mental health consultant, shares her personal journey and the vital role of effective money management. We explore the psychological impact of the cost of living crisis, emphasising the need for financial education and understanding one's relationship with money.

Tune in to discover practical strategies for reducing financial stress and learn how addressing mental health can transform your financial life!

Key Themes Discussed:

Essential money management practices for reducing...2024-08-0236 min

The Wealth ConversationOvercoming Financial Anxiety & Stress (Money Mental Health) ft Norma CassiusIn this episode of The Wealth Conversation, Norma Cassius and I delve into financial anxiety and mental wellbeing!

Norma, a seasoned money management and mental health consultant, shares her personal journey and the vital role of effective money management. We explore the psychological impact of the cost of living crisis, emphasising the need for financial education and understanding one's relationship with money.

Tune in to discover practical strategies for reducing financial stress and learn how addressing mental health can transform your financial life!

Key Themes Discussed:

Essential money management practices for reducing...2024-08-0236 min The Wealth ConversationNavigating Financial Anxiety in a Cost of Living CrisisIn this episode, we delve into the widespread financial anxiety caused by the current cost of living crisis. From the impact on daily expenses to the psychological toll on different socioeconomic groups, we explore strategies for resilience and resourcefulness in challenging times.

Key Themes:

- Impact of cost of living on mental health

- Strategies for financial resilience

- Emotional effects across socioeconomic groups

- Importance of financial empowerment

- Community support and resourcefulness

Resources:

Book an hour finance session with Tsitsi: https://programs.thewealthconversation.com/power-hour

LinkedIn: https://www.linkedin.com/in/tsitsi-mutiti-chartered-fcsi/

Facebook: https://www.facebook.com...2024-07-2606 min

The Wealth ConversationNavigating Financial Anxiety in a Cost of Living CrisisIn this episode, we delve into the widespread financial anxiety caused by the current cost of living crisis. From the impact on daily expenses to the psychological toll on different socioeconomic groups, we explore strategies for resilience and resourcefulness in challenging times.

Key Themes:

- Impact of cost of living on mental health

- Strategies for financial resilience

- Emotional effects across socioeconomic groups

- Importance of financial empowerment

- Community support and resourcefulness

Resources:

Book an hour finance session with Tsitsi: https://programs.thewealthconversation.com/power-hour

LinkedIn: https://www.linkedin.com/in/tsitsi-mutiti-chartered-fcsi/

Facebook: https://www.facebook.com...2024-07-2606 min The Wealth ConversationWhat Is A Will? (Wills Explained UK)In this episode, I discuss the critical importance of having a will, the potential complications that can arise without one, and how to ensure your assets and loved ones are protected!

We'll explore why creating a will is an essential step in financial planning, how it helps prevent family disputes, and the best practices for maintaining an up-to-date will.

Key Themes:

- Importance of having a will

- Avoiding family disputes

- Choosing executors and trustees

- Reviewing and updating your will

- Misconceptions about wills

Resources:

- Book an hour finance session with Tsitsi: https://programs.thewealthconversation.com...2024-07-1927 min

The Wealth ConversationWhat Is A Will? (Wills Explained UK)In this episode, I discuss the critical importance of having a will, the potential complications that can arise without one, and how to ensure your assets and loved ones are protected!

We'll explore why creating a will is an essential step in financial planning, how it helps prevent family disputes, and the best practices for maintaining an up-to-date will.

Key Themes:

- Importance of having a will

- Avoiding family disputes

- Choosing executors and trustees

- Reviewing and updating your will

- Misconceptions about wills

Resources:

- Book an hour finance session with Tsitsi: https://programs.thewealthconversation.com...2024-07-1927 min The Wealth ConversationThis Is Why You Need a Will...In this episode, I delve into common issues that arise with wills and how to avoid disputes through proper communication and regular updates. From blended family complexities to the importance of ensuring your will reflects your current wishes, I cover key factors that can lead to will contests and legal challenges!

Learn why regular review and updating of your will is crucial to prevent misunderstandings and ensure your assets are distributed according to your intentions.

Key Themes:

- Importance of Communication in Estate Planning

...2024-07-1203 min

The Wealth ConversationThis Is Why You Need a Will...In this episode, I delve into common issues that arise with wills and how to avoid disputes through proper communication and regular updates. From blended family complexities to the importance of ensuring your will reflects your current wishes, I cover key factors that can lead to will contests and legal challenges!

Learn why regular review and updating of your will is crucial to prevent misunderstandings and ensure your assets are distributed according to your intentions.

Key Themes:

- Importance of Communication in Estate Planning

...2024-07-1203 min The Wealth ConversationPower of Attorney: Why you need to plan for the FutureIn this episode of "The Wealth Conversation," I delve into the crucial yet often overlooked topic of power of attorney. Exploring scenarios from health crises to unexpected life events, I emphasize the importance of preparing for the unexpected by appointing trusted individuals to manage your affairs when you cannot!

Key Themes:

- Importance of preparing for unexpected health crises.

- Types and significance of power of attorney.

- Choosing trustworthy individuals as attorneys.

- Practical scenarios where power of attorney is essential.

2024-07-0530 min

The Wealth ConversationPower of Attorney: Why you need to plan for the FutureIn this episode of "The Wealth Conversation," I delve into the crucial yet often overlooked topic of power of attorney. Exploring scenarios from health crises to unexpected life events, I emphasize the importance of preparing for the unexpected by appointing trusted individuals to manage your affairs when you cannot!

Key Themes:

- Importance of preparing for unexpected health crises.

- Types and significance of power of attorney.

- Choosing trustworthy individuals as attorneys.

- Practical scenarios where power of attorney is essential.

2024-07-0530 min The Wealth ConversationWhat is a Power of Attorney? (UK)In this episode of The Wealth Conversation, I delve into the importance of having a Power of Attorney, highlighting scenarios where it becomes crucial, such as loss of mental capacity or unexpected accidents. Tune in to understand why everyone, regardless of age, should consider setting one up!

Key Themes:

- The definition and purpose of a Power of Attorney

- Common scenarios requiring a Power of Attorney, such as dementia or Alzheimer's

- The importance for younger individuals to consider Power of Attorney

- Real-life examples...2024-06-2803 min

The Wealth ConversationWhat is a Power of Attorney? (UK)In this episode of The Wealth Conversation, I delve into the importance of having a Power of Attorney, highlighting scenarios where it becomes crucial, such as loss of mental capacity or unexpected accidents. Tune in to understand why everyone, regardless of age, should consider setting one up!

Key Themes:

- The definition and purpose of a Power of Attorney

- Common scenarios requiring a Power of Attorney, such as dementia or Alzheimer's

- The importance for younger individuals to consider Power of Attorney

- Real-life examples...2024-06-2803 min The Wealth ConversationFinancial Education is a Necessity: Here's Why ft. Funmi OlufunwaIn today's episode my guest Funmi Olufunwa and I discuss financial education and literacy and how CRUCIAL they are for individuals to make informed decisions about their financial well-being and achieve their financial goals.

We also speak about the unique challenges women face when it comes to managing their finances and highlight the importance of educating women about their financial options and encourage them to take a more proactive approach to investing in the future.

Key Discussion Points:

- Financial literacy and education need to start from a young age!2024-06-2141 min

The Wealth ConversationFinancial Education is a Necessity: Here's Why ft. Funmi OlufunwaIn today's episode my guest Funmi Olufunwa and I discuss financial education and literacy and how CRUCIAL they are for individuals to make informed decisions about their financial well-being and achieve their financial goals.

We also speak about the unique challenges women face when it comes to managing their finances and highlight the importance of educating women about their financial options and encourage them to take a more proactive approach to investing in the future.

Key Discussion Points:

- Financial literacy and education need to start from a young age!2024-06-2141 min The Wealth ConversationWelcome to The Wealth Conversation!Welcome to The Wealth Conversation, the podcast transforming intimidating money talk into empowering financial discussions. Hosted by Tsitsi Muititi, a seasoned investment manager with over 16 years in the wealth management industry and founder of The Wealth Conversation, this podcast is designed for anyone seeking confidence and clarity in their wealth-building journey.

Whether you are striving for multi-generational wealth, or you are striving to manage your daily finances better, this podcast is for you. Each week, Tsitsi will explore a new wealth conversation, offering practical tips to make your money work for you!

2024-06-1401 min

The Wealth ConversationWelcome to The Wealth Conversation!Welcome to The Wealth Conversation, the podcast transforming intimidating money talk into empowering financial discussions. Hosted by Tsitsi Muititi, a seasoned investment manager with over 16 years in the wealth management industry and founder of The Wealth Conversation, this podcast is designed for anyone seeking confidence and clarity in their wealth-building journey.

Whether you are striving for multi-generational wealth, or you are striving to manage your daily finances better, this podcast is for you. Each week, Tsitsi will explore a new wealth conversation, offering practical tips to make your money work for you!

2024-06-1401 min The Wealth ConversationWhere to Begin with Financial Education?In this episode, we delve into the MAJOR importance of financial literacy and education. We explore income tax, National Insurance contributions and highlight the benefits of employer schemes like pensions.

Key Points:

Start financial education with an understanding of income and taxes.

Recognise the distinction between income tax and National Insurance contributions.

Knowing your tax bracket aids in financial planning.

Explore employer benefits like pensions for long-term financial security.

Utilise workplace pensions for employer contributions and tax benefits.

Resources:

Book a Power Hour: https://programs.thewealthconversation.com/power-hour

...2024-06-1405 min

The Wealth ConversationWhere to Begin with Financial Education?In this episode, we delve into the MAJOR importance of financial literacy and education. We explore income tax, National Insurance contributions and highlight the benefits of employer schemes like pensions.

Key Points:

Start financial education with an understanding of income and taxes.

Recognise the distinction between income tax and National Insurance contributions.

Knowing your tax bracket aids in financial planning.

Explore employer benefits like pensions for long-term financial security.

Utilise workplace pensions for employer contributions and tax benefits.

Resources:

Book a Power Hour: https://programs.thewealthconversation.com/power-hour

...2024-06-1405 min The Wealth ConversationThe Power of Commitment Your Key to Financial Success!Welcome back to the Wealth Conversation Podcast! In this episode, Tiritoga Gambe, Senior Manager at Holborn International, joins me to discuss tax-efficient international investing and the importance of understanding individual clients' needs.

We delve into the psychology of commitment in wealth creation, emphasising the need for a strong, intrinsic goal to stay motivated amid challenges. Tiri shares tips, including celebrating small wins, educating children about money, and investing in self-growth.

Key Topics:

- How does your cultural and local background affect your investment habits?

- The need to commit to your financial investment.

Saving and investing in order to...2024-06-0737 min

The Wealth ConversationThe Power of Commitment Your Key to Financial Success!Welcome back to the Wealth Conversation Podcast! In this episode, Tiritoga Gambe, Senior Manager at Holborn International, joins me to discuss tax-efficient international investing and the importance of understanding individual clients' needs.

We delve into the psychology of commitment in wealth creation, emphasising the need for a strong, intrinsic goal to stay motivated amid challenges. Tiri shares tips, including celebrating small wins, educating children about money, and investing in self-growth.

Key Topics:

- How does your cultural and local background affect your investment habits?

- The need to commit to your financial investment.

Saving and investing in order to...2024-06-0737 min The Wealth ConversationMastering Financial Discipline: Small Wins, Big RewardsIn today's wealth conversation, Tiri and I discuss the importance of understanding one's 'why' in staying committed to financial goals. We emphasise the need for small wins, consistent discipline, and the role of legacy and incorporating your children in the investment journey. I highlight the significance of knowing one's true intrinsic goal, while Tiri stresses the importance of being realistic about what can be achieved in the given timeframe.

Key Discussion Points:

- Understanding your "why" for staying committed to financial goals

- The importance of teaching children about money management

- Setting realistic goals, knowing your "why," and...2024-05-3104 min

The Wealth ConversationMastering Financial Discipline: Small Wins, Big RewardsIn today's wealth conversation, Tiri and I discuss the importance of understanding one's 'why' in staying committed to financial goals. We emphasise the need for small wins, consistent discipline, and the role of legacy and incorporating your children in the investment journey. I highlight the significance of knowing one's true intrinsic goal, while Tiri stresses the importance of being realistic about what can be achieved in the given timeframe.

Key Discussion Points:

- Understanding your "why" for staying committed to financial goals

- The importance of teaching children about money management

- Setting realistic goals, knowing your "why," and...2024-05-3104 min The Wealth ConversationHow to Get Out of Debt!Welcome back to the Wealth Conversation with your host, Tsitsi Mutiti, a seasoned investment manager and financial coach on a mission to empower women from underrepresented communities in their wealth journey!

Join us as we delve into the holistic aspects of wealth creation, from financial to mental, spiritual, and social well-being. Learn from Tsitsi's journey of overcoming debt and reclaiming financial freedom. Subscribe for more empowering content and share the wealth conversation with those who need it!

Key Points:

- Financial struggles and lack of understanding in debt management.

- Debt repayment and gaining financial independence.

- Financial struggles...2024-05-2411 min

The Wealth ConversationHow to Get Out of Debt!Welcome back to the Wealth Conversation with your host, Tsitsi Mutiti, a seasoned investment manager and financial coach on a mission to empower women from underrepresented communities in their wealth journey!

Join us as we delve into the holistic aspects of wealth creation, from financial to mental, spiritual, and social well-being. Learn from Tsitsi's journey of overcoming debt and reclaiming financial freedom. Subscribe for more empowering content and share the wealth conversation with those who need it!

Key Points:

- Financial struggles and lack of understanding in debt management.

- Debt repayment and gaining financial independence.

- Financial struggles...2024-05-2411 min The Wealth ConversationHow I Paid Off FIVE FIGURE Debt in 1.5 YearsIn today's episode, I share my experience with debt consolidation, revealing how I took matters into my own hands to pay off my debt within one and a half years! I discussed my financial habits, including how I was quick to help others at my own expense, but learned to prioritise my own needs by analysing my bank statements!

Key discussion points:

Debt consolidation and holding myself accountable for my debts

Paying off 6 1/2 years' worth of debt in 1 1/2 years!

Overcoming debt by organising my finances.

Work with Tsitsi and...2024-05-1704 min

The Wealth ConversationHow I Paid Off FIVE FIGURE Debt in 1.5 YearsIn today's episode, I share my experience with debt consolidation, revealing how I took matters into my own hands to pay off my debt within one and a half years! I discussed my financial habits, including how I was quick to help others at my own expense, but learned to prioritise my own needs by analysing my bank statements!

Key discussion points:

Debt consolidation and holding myself accountable for my debts

Paying off 6 1/2 years' worth of debt in 1 1/2 years!

Overcoming debt by organising my finances.

Work with Tsitsi and...2024-05-1704 min Resignation Letter RadioBecoming The Designer of Your Financial Future ft. Tsitsi MutitiI am thrilled to welcome a new guest onto the podcast this week–please welcome Tsitsi Mutiti, a Wealth Coach, award-winning Investment Manager, and Insuring Women’s Futures Ambassador, as well as the host of The Wealth Conversation Podcast.

If you’re anything like me and Tsitsi, you might not have had in-depth financial conversations with your parents. You might not be thinking past the “now” of your financial situation, but it’s important to shift that outlook…which is why Tsitsi openly shares her personal journey of overcoming debt and financial fear so she could redesign her financial f...2023-02-0838 min

Resignation Letter RadioBecoming The Designer of Your Financial Future ft. Tsitsi MutitiI am thrilled to welcome a new guest onto the podcast this week–please welcome Tsitsi Mutiti, a Wealth Coach, award-winning Investment Manager, and Insuring Women’s Futures Ambassador, as well as the host of The Wealth Conversation Podcast.

If you’re anything like me and Tsitsi, you might not have had in-depth financial conversations with your parents. You might not be thinking past the “now” of your financial situation, but it’s important to shift that outlook…which is why Tsitsi openly shares her personal journey of overcoming debt and financial fear so she could redesign her financial f...2023-02-0838 min Embrace Your PowerSuccess is a Wealth Conversation: My conversation with Tsitsi MutitiIn this episode we have a conversation with TsiTsi Mutiti, a wealth coach, an award-winning investment manager, and an Insuring Women’s Futures Ambassador.

What I love about TsiTsi and the work that she is doing is that she helps to change the narrative and really brings power to our choices. She is such a credible and reliable source when it comes to wealth building, and even more than that, I just appreciate how she and I have been able to partner together to further her vision to reach people who need to have money conversations.

...2022-12-1551 min

Embrace Your PowerSuccess is a Wealth Conversation: My conversation with Tsitsi MutitiIn this episode we have a conversation with TsiTsi Mutiti, a wealth coach, an award-winning investment manager, and an Insuring Women’s Futures Ambassador.

What I love about TsiTsi and the work that she is doing is that she helps to change the narrative and really brings power to our choices. She is such a credible and reliable source when it comes to wealth building, and even more than that, I just appreciate how she and I have been able to partner together to further her vision to reach people who need to have money conversations.

...2022-12-1551 min The Wealth ConversationPodcast Anniversary: The African Money Archetypes with Vangile MakwakwaAbout Vangile Makwakwa:

Vangile Makwakwa is the founder of Wealthy Money, a company that helps people heal ancestral money trauma so they can fall in love with their bank accounts, live their best lives and create generational wealth. She is the teacher at Wealthy Money Academy and the creator and facilitator of all the online courses on the online academy. She is also the host of the Property Magicians Podcast and the Money Magic Podcast. She is the author of Heart, Mind & Money: Using Emotional Intelligence for Financial Success. Vangile has a finance degree and an MBA...2022-07-291h 08

The Wealth ConversationPodcast Anniversary: The African Money Archetypes with Vangile MakwakwaAbout Vangile Makwakwa:

Vangile Makwakwa is the founder of Wealthy Money, a company that helps people heal ancestral money trauma so they can fall in love with their bank accounts, live their best lives and create generational wealth. She is the teacher at Wealthy Money Academy and the creator and facilitator of all the online courses on the online academy. She is also the host of the Property Magicians Podcast and the Money Magic Podcast. She is the author of Heart, Mind & Money: Using Emotional Intelligence for Financial Success. Vangile has a finance degree and an MBA...2022-07-291h 08 The Wealth ConversationPodcast Anniversary: Why Clarity Is Important with Jateya JonesAbout Jateya Jones:

Jateya Jones, fondly known as your Business Coach’s Secret Weapon and founder of Jateya Jones Consulting, is a visionary with the ability to facilitate clarity and dream transformation.

She currently serves as the CEO of Jateya Jones Consulting, a boutique consulting firm where she empowers entrepreneurs to confidently show up and boldly stand out in the marketplace – therefore increasing their income and impact. Jateya helps you get clear on what you do, not how you make your money; equipping you with the ability to clearly identify your gift, how it aligns with...2022-07-2244 min

The Wealth ConversationPodcast Anniversary: Why Clarity Is Important with Jateya JonesAbout Jateya Jones:

Jateya Jones, fondly known as your Business Coach’s Secret Weapon and founder of Jateya Jones Consulting, is a visionary with the ability to facilitate clarity and dream transformation.

She currently serves as the CEO of Jateya Jones Consulting, a boutique consulting firm where she empowers entrepreneurs to confidently show up and boldly stand out in the marketplace – therefore increasing their income and impact. Jateya helps you get clear on what you do, not how you make your money; equipping you with the ability to clearly identify your gift, how it aligns with...2022-07-2244 min The Wealth ConversationPodcast Anniversary: Shame and Indebtedness with Wadzanai GarweAbout Wadzanai Garwe:

Wadzanai Garwe is an author, a coach, an economist, an activist, a mother, a sister and a friend. She is an economist who studied finance and community economic development. Her coaching is centered around workplace toxicity. In honour of my late Father, Wadzi as she is affectionately known, founded the Edmund Garwe Trust which works on education and concentrates on child-headed households that have been affected by the two pandemics - HIV and Covid. Wadzi also currently co-facilitates a space for post-colonial Africans to discuss issues that affect them called African Conversations with Self...2022-07-1542 min

The Wealth ConversationPodcast Anniversary: Shame and Indebtedness with Wadzanai GarweAbout Wadzanai Garwe:

Wadzanai Garwe is an author, a coach, an economist, an activist, a mother, a sister and a friend. She is an economist who studied finance and community economic development. Her coaching is centered around workplace toxicity. In honour of my late Father, Wadzi as she is affectionately known, founded the Edmund Garwe Trust which works on education and concentrates on child-headed households that have been affected by the two pandemics - HIV and Covid. Wadzi also currently co-facilitates a space for post-colonial Africans to discuss issues that affect them called African Conversations with Self...2022-07-1542 min The Wealth ConversationPodcast Anniversary: Acknowledging Transition with Keji CastanoAbout Keji Castano:

Keji, also known as the Wealth Encourager, is an encourager by nature and wealth advocate by nurture. She believes soul health is real wealth, and that plays out into every area of our lives, relationships, finances and mindset. The Wealth Encourager is not just her brand but also who she is. The vision was birthed in her after going through multiple transitions in her own life and helping others navigate their own times of transition. The vision continues to grow in many areas through her podcast, workshops, IG Live interviews and literature.

...2022-07-0831 min

The Wealth ConversationPodcast Anniversary: Acknowledging Transition with Keji CastanoAbout Keji Castano:

Keji, also known as the Wealth Encourager, is an encourager by nature and wealth advocate by nurture. She believes soul health is real wealth, and that plays out into every area of our lives, relationships, finances and mindset. The Wealth Encourager is not just her brand but also who she is. The vision was birthed in her after going through multiple transitions in her own life and helping others navigate their own times of transition. The vision continues to grow in many areas through her podcast, workshops, IG Live interviews and literature.

...2022-07-0831 min The Wealth ConversationPodcast Anniversary: Influencing Your Money Habits And Mindset with Catherine Thomas-HumphreysAbout Catherine Thomas-Humphreys:

Catherine Thomas-Humphreys is a Qualified Financial Adviser & Certified Financial Coach. Catherine is also the founder of The Finflunencer and she coaches people to create a positive, confident relationship with their money, so they can focus on what matters Most to them.

Contact Catherine via her website to find out more about her group coaching programme: Emotional Spender to Motivated Saver

Key discussion points from this episode include:

· About The Finfluencer

· The importance of understanding yourself

· The Finfluneces on our habits: The chi...2022-07-0134 min

The Wealth ConversationPodcast Anniversary: Influencing Your Money Habits And Mindset with Catherine Thomas-HumphreysAbout Catherine Thomas-Humphreys:

Catherine Thomas-Humphreys is a Qualified Financial Adviser & Certified Financial Coach. Catherine is also the founder of The Finflunencer and she coaches people to create a positive, confident relationship with their money, so they can focus on what matters Most to them.

Contact Catherine via her website to find out more about her group coaching programme: Emotional Spender to Motivated Saver

Key discussion points from this episode include:

· About The Finfluencer

· The importance of understanding yourself

· The Finfluneces on our habits: The chi...2022-07-0134 min The Wealth ConversationPlanning For Retirement with Nila MistryIf you're looking for guidance on how to plan for retirement, this episode is for you. Nila Mistry, financial planner and certified money coach, shares her top tips on how to get started. Learn how to create a personalized financial plan that will give you the freedom to live your best life.

About Nila Mistry:

Nila Mistry is a Financial Planner, Registered Life Planner and Certified Money Coach. Her business is Prosperity Life Planning Ltd.

Many people don’t have access to financial guidance and then worry they won’t have...2022-06-2428 min

The Wealth ConversationPlanning For Retirement with Nila MistryIf you're looking for guidance on how to plan for retirement, this episode is for you. Nila Mistry, financial planner and certified money coach, shares her top tips on how to get started. Learn how to create a personalized financial plan that will give you the freedom to live your best life.

About Nila Mistry:

Nila Mistry is a Financial Planner, Registered Life Planner and Certified Money Coach. Her business is Prosperity Life Planning Ltd.

Many people don’t have access to financial guidance and then worry they won’t have...2022-06-2428 min The Wealth ConversationRewind: Introduction To Pensions with Michelle LambellAbout Michelle Lambell:

Michelle Lambell started her career in financial services in 1999 with Capel Cure Sharp (latterly Gerrard and Barclays Wealth) as an Assistant Investment Manager. She completed her stockbroking qualifications in 2003 and worked as part of the Investment Management team, undertaking both advisory and discretionary investment management. Michelle took a career break following the arrival of her two daughters, spending time both as a mum and running her own arts and crafts business. Michelle then returned to financial services in 2013, initially in a part time role within a Credit Union and then full time in 2014, as a Paraplanner and...2022-06-1020 min

The Wealth ConversationRewind: Introduction To Pensions with Michelle LambellAbout Michelle Lambell:

Michelle Lambell started her career in financial services in 1999 with Capel Cure Sharp (latterly Gerrard and Barclays Wealth) as an Assistant Investment Manager. She completed her stockbroking qualifications in 2003 and worked as part of the Investment Management team, undertaking both advisory and discretionary investment management. Michelle took a career break following the arrival of her two daughters, spending time both as a mum and running her own arts and crafts business. Michelle then returned to financial services in 2013, initially in a part time role within a Credit Union and then full time in 2014, as a Paraplanner and...2022-06-1020 min The Wealth ConversationThe Importance Of A Financial Life Plan with Tina WeeksAbout Tina Weeks:

Tina Weeks is the Managing Director of Serenity Financial Planning, a business which she set up to bring financial life planning to as many people as possible. Tina works with her clients over the long-term helping them build on and grow their financial plans so that they have enough money to do all the things that they want to do.

Key discussion points from this episode include:

· What a financial life plan is.

· Your possibility story.

· Why it is important to have a fin...2022-06-0344 min

The Wealth ConversationThe Importance Of A Financial Life Plan with Tina WeeksAbout Tina Weeks:

Tina Weeks is the Managing Director of Serenity Financial Planning, a business which she set up to bring financial life planning to as many people as possible. Tina works with her clients over the long-term helping them build on and grow their financial plans so that they have enough money to do all the things that they want to do.

Key discussion points from this episode include:

· What a financial life plan is.

· Your possibility story.

· Why it is important to have a fin...2022-06-0344 min The Wealth ConversationMoney Mindset And Being Wealth Conscious with Cleo MatlouAbout Cleo Matlou:

Cleo Matlou is a Money Mindset Coach. She helps women take radical responsibility for their relationship with money, gain financial freedom and attract more wealth and financial abundance. Cleo’s mission is to eradicate the fear of talking about money by addressing the emotional impact money has on our everyday lives, so women can achieve more equality, inclusivity, and freedom. She has over 15 years of experience in the finance industry, 3 properties, sound investments, and her own personal finance success story which has led to her mission in coaching and supporting others.

...2022-05-2733 min

The Wealth ConversationMoney Mindset And Being Wealth Conscious with Cleo MatlouAbout Cleo Matlou:

Cleo Matlou is a Money Mindset Coach. She helps women take radical responsibility for their relationship with money, gain financial freedom and attract more wealth and financial abundance. Cleo’s mission is to eradicate the fear of talking about money by addressing the emotional impact money has on our everyday lives, so women can achieve more equality, inclusivity, and freedom. She has over 15 years of experience in the finance industry, 3 properties, sound investments, and her own personal finance success story which has led to her mission in coaching and supporting others.

...2022-05-2733 min The Wealth ConversationThe Wealth Cornerstones Series: FinaleThe Wealth Cornerstones Series – Round Up

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this series round up The Wealth Cornerstone Series, I revisit what true wealth means to some of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your life.

...2022-05-1314 min

The Wealth ConversationThe Wealth Cornerstones Series: FinaleThe Wealth Cornerstones Series – Round Up

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this series round up The Wealth Cornerstone Series, I revisit what true wealth means to some of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your life.

...2022-05-1314 min The Wealth ConversationThe Wealth Cornerstones Series: Financial WellbeingThe Wealth Cornerstones Series – Episode 4

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this fourth episode of The Wealth Cornerstone Series, I revisit what Financial wellbeing means to some of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your life.

Do...2022-05-0610 min

The Wealth ConversationThe Wealth Cornerstones Series: Financial WellbeingThe Wealth Cornerstones Series – Episode 4

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this fourth episode of The Wealth Cornerstone Series, I revisit what Financial wellbeing means to some of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your life.

Do...2022-05-0610 min The Wealth ConversationThe Wealth Cornerstones Series: Social WellbeingThe Wealth Cornerstones Series – Episode 3

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this third episode of The Wealth Cornerstone Series, I revisit what Social wellbeing means to five of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your life.

2022-04-2908 min

The Wealth ConversationThe Wealth Cornerstones Series: Social WellbeingThe Wealth Cornerstones Series – Episode 3

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this third episode of The Wealth Cornerstone Series, I revisit what Social wellbeing means to five of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your life.

2022-04-2908 min The Wealth ConversationThe Wealth Cornerstones Series: Spiritual WellbeingThe Wealth Cornerstones Series – Episode 2

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this second episode of The Wealth Cornerstone Series, I revisit what Spiritual wellbeing means to five of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each ar...2022-04-2209 min

The Wealth ConversationThe Wealth Cornerstones Series: Spiritual WellbeingThe Wealth Cornerstones Series – Episode 2

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this second episode of The Wealth Cornerstone Series, I revisit what Spiritual wellbeing means to five of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each ar...2022-04-2209 min The Wealth ConversationThe Wealth Cornerstones Series - Physical & Mental WellbeingThe Wealth Cornerstones Series - Episode 1

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this first episode of The Wealth Cornerstones Series, I revisit what Physical and Mental wellbeing means to five of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your...2022-04-1511 min

The Wealth ConversationThe Wealth Cornerstones Series - Physical & Mental WellbeingThe Wealth Cornerstones Series - Episode 1

We all have the desire to create wealth on our own terms. I believe that this can be achieved once you are clear on what wealth truly means to you, in the following five areas of your life: Physical; Mental; Spiritual; Social and Financial.

In this first episode of The Wealth Cornerstones Series, I revisit what Physical and Mental wellbeing means to five of my previous guests and I hope that their definitions will help you to create your own unique definition of wealth in each area of your...2022-04-1511 min The Wealth ConversationFinancial Stability For Women with Gretchen BettsAbout Gretchen Betts:

Gretchen is a Chartered and Certified Financial Planner at Magenta – an award winning, specialist Financial Planning company that believes in delivering Planning with Passion every day. Since launch in 2016 the business has become known for its bright and bold brand and for proudly flying the flag for women in the profession. As a Certified Financial Coach, Gretchen is passionate about working closely with clients to understand what they really want from life and to create and implement a Lifetime Financial Plan to help them pursue their passions. Gretchen is active in promoting the need fo...2022-04-0827 min

The Wealth ConversationFinancial Stability For Women with Gretchen BettsAbout Gretchen Betts:

Gretchen is a Chartered and Certified Financial Planner at Magenta – an award winning, specialist Financial Planning company that believes in delivering Planning with Passion every day. Since launch in 2016 the business has become known for its bright and bold brand and for proudly flying the flag for women in the profession. As a Certified Financial Coach, Gretchen is passionate about working closely with clients to understand what they really want from life and to create and implement a Lifetime Financial Plan to help them pursue their passions. Gretchen is active in promoting the need fo...2022-04-0827 min The Wealth ConversationHealth and Wealth with Pamela WindleAbout Pamela Windle:

Pamela is a certified women's health coach and hypnotherapist with over 20-years of experience working in the health and wellness industry. She is passionate about supporting and empowering you to reach optimal health both inside and out. She speaks on topics of health, wellness, perimenopause and menopause and is menopause in the workplace consultant. She uses evidence-based practices to combine training and techniques with organisations, individual needs, and senior leaders.

Key areas of discussion in this episode:

· How Pamela’s personal experience with health issues influenced the work she does today

· Why it is important to focus on h...2022-04-0138 min

The Wealth ConversationHealth and Wealth with Pamela WindleAbout Pamela Windle:

Pamela is a certified women's health coach and hypnotherapist with over 20-years of experience working in the health and wellness industry. She is passionate about supporting and empowering you to reach optimal health both inside and out. She speaks on topics of health, wellness, perimenopause and menopause and is menopause in the workplace consultant. She uses evidence-based practices to combine training and techniques with organisations, individual needs, and senior leaders.

Key areas of discussion in this episode:

· How Pamela’s personal experience with health issues influenced the work she does today

· Why it is important to focus on h...2022-04-0138 min The Wealth ConversationMindful Mortgages with Sam CattellAbout Sam Cattell:

Sam has over 20 years’ experience in the property industry. She is a Mortgage Adviser who balances the professional advice alongside a warm and genuine approach. Sam understands that when you are looking for a mortgage, it's also a home and that is sacred and meaningful.

Key discussion points from this episode include:

· The definition of a mortgage

· What to consider before you embark on the mortgage journey

· Common pitfalls

· How Sam supports her clients on their property purchasing journey

· Reducin...2022-03-2536 min

The Wealth ConversationMindful Mortgages with Sam CattellAbout Sam Cattell:

Sam has over 20 years’ experience in the property industry. She is a Mortgage Adviser who balances the professional advice alongside a warm and genuine approach. Sam understands that when you are looking for a mortgage, it's also a home and that is sacred and meaningful.

Key discussion points from this episode include:

· The definition of a mortgage

· What to consider before you embark on the mortgage journey

· Common pitfalls

· How Sam supports her clients on their property purchasing journey

· Reducin...2022-03-2536 min The Wealth ConversationThe Wealth Conversation Interview with Grace NelsonI had the honour of being a guest on the Think.Create.Initiate podcast hosted by the phenomenal Grace Nelson and Charlotte Barrett. This episode is a replay of the interview, during which I share:

· My definition of wealth

· How I developed my signature method - The Choices Blueprint

· Why I believe it is important to acknowledge our past so we can have a healthier relationship with money.

Here is some information about Grace Nelson and Charlotte Barrett:

Charlotte Barrett and Grace Nelson are...2022-03-1844 min

The Wealth ConversationThe Wealth Conversation Interview with Grace NelsonI had the honour of being a guest on the Think.Create.Initiate podcast hosted by the phenomenal Grace Nelson and Charlotte Barrett. This episode is a replay of the interview, during which I share:

· My definition of wealth

· How I developed my signature method - The Choices Blueprint

· Why I believe it is important to acknowledge our past so we can have a healthier relationship with money.

Here is some information about Grace Nelson and Charlotte Barrett:

Charlotte Barrett and Grace Nelson are...2022-03-1844 min The Wealth ConversationStarting Your Own Business Whilst In a 9 to 5 with Charlotte BarrettAbout Charlotte Barrett:

Charlotte Barrett is the Co-Founder of the Business Growth Agency which she runs with her business partner Grace Nelson. They are also the creators of the Think.Create.Initiate™ Method.

The ladies are dedicated to serving corporate women and create their first £1000 months online before going on to 10x their income with the exact same system, without having to leave your 9-5! They believe that it is simply not okay to be stuck in a job where you are not living up to your full potential and you know deep down that you...2022-03-1129 min

The Wealth ConversationStarting Your Own Business Whilst In a 9 to 5 with Charlotte BarrettAbout Charlotte Barrett:

Charlotte Barrett is the Co-Founder of the Business Growth Agency which she runs with her business partner Grace Nelson. They are also the creators of the Think.Create.Initiate™ Method.

The ladies are dedicated to serving corporate women and create their first £1000 months online before going on to 10x their income with the exact same system, without having to leave your 9-5! They believe that it is simply not okay to be stuck in a job where you are not living up to your full potential and you know deep down that you...2022-03-1129 min The Wealth ConversationFamily Estrangement with Mariam Ernest*Content Warning*: This episode contains content that may be triggering to some listeners. Although there are no in-depth descriptions there are mentions of types of childhood trauma, which may include domestic violence, substance and sexual abuse.

About Mariam Ernest:

After her own experiences of family estrangement, Mariam now works with people who have experienced the same thing. Mariam believes that people have an incredible source of power within them to change their reality, however, as we experience life's challenges and adversities (such as family estrangement), it can bury and...2022-03-0453 min

The Wealth ConversationFamily Estrangement with Mariam Ernest*Content Warning*: This episode contains content that may be triggering to some listeners. Although there are no in-depth descriptions there are mentions of types of childhood trauma, which may include domestic violence, substance and sexual abuse.

About Mariam Ernest:

After her own experiences of family estrangement, Mariam now works with people who have experienced the same thing. Mariam believes that people have an incredible source of power within them to change their reality, however, as we experience life's challenges and adversities (such as family estrangement), it can bury and...2022-03-0453 min The Wealth ConversationFrom Debt To Freedom with Charmaine Dawkins-AlderAbout Charmaine Dawkins-Alder:

Charmaine is a woman who wears many hats, she is a wife, mother, grandmother, co-author of Navigating Life, Health, Grief & Loss. She is also the owner of an award winning business, Difference A Day Makes. Her passion in life is to help others become the best version of themselves.

Key discussion points from this episode include:

· About the book – ‘Navigating Life: Health, Grief & Loss’

· Charmaine’s debt story

· What Charmaine knows now about managing her money

· How Charmaine’s faith helped her during the...2022-02-2536 min

The Wealth ConversationFrom Debt To Freedom with Charmaine Dawkins-AlderAbout Charmaine Dawkins-Alder:

Charmaine is a woman who wears many hats, she is a wife, mother, grandmother, co-author of Navigating Life, Health, Grief & Loss. She is also the owner of an award winning business, Difference A Day Makes. Her passion in life is to help others become the best version of themselves.

Key discussion points from this episode include:

· About the book – ‘Navigating Life: Health, Grief & Loss’

· Charmaine’s debt story

· What Charmaine knows now about managing her money

· How Charmaine’s faith helped her during the...2022-02-2536 min The Wealth ConversationEmbracing Your Power with Denise TaylorAbout Denise Taylor:

25+ years of proven business and leadership success

25+ years of relationship success

50+ years of life success

Denise’s combined experiences position her to help women develop success strategies for every area of their life. When asked, Denise will quickly affirm she lives a Blessed Life. But don't get it twisted - her life has NOT been perfect or easy. Denise overcame many traumas, losses, and disappointments. She persevered. Her success is rooted in her faith in God along with her "Never Give Up" passion and "Make It Happen" attitude.

...2022-02-1845 min

The Wealth ConversationEmbracing Your Power with Denise TaylorAbout Denise Taylor:

25+ years of proven business and leadership success

25+ years of relationship success

50+ years of life success

Denise’s combined experiences position her to help women develop success strategies for every area of their life. When asked, Denise will quickly affirm she lives a Blessed Life. But don't get it twisted - her life has NOT been perfect or easy. Denise overcame many traumas, losses, and disappointments. She persevered. Her success is rooted in her faith in God along with her "Never Give Up" passion and "Make It Happen" attitude.

...2022-02-1845 min The Wealth ConversationDivorce And Money with Tamsin CaineAbout Tamsin Caine:

Tamsin Caine is a Chartered Financial Planner and Resolution accredited divorce financial planner. She founded Smart Divorce in 2018 to help couples and individuals to work out how to separate their finances so that they can divorce without the need for court, preferably amicably.

Key discussion points from this episode include:

· Why Tamsin decided to focus on working with clients who are going through a divorce

· The book that Tamsin co-authored a book titled ‘Your Divorce Handbook – It’s What You Do Next That Counts’.

· How to unscramble finances when going through a divorce

· Designing your next chapter (How to think...2022-02-1148 min

The Wealth ConversationDivorce And Money with Tamsin CaineAbout Tamsin Caine:

Tamsin Caine is a Chartered Financial Planner and Resolution accredited divorce financial planner. She founded Smart Divorce in 2018 to help couples and individuals to work out how to separate their finances so that they can divorce without the need for court, preferably amicably.

Key discussion points from this episode include:

· Why Tamsin decided to focus on working with clients who are going through a divorce

· The book that Tamsin co-authored a book titled ‘Your Divorce Handbook – It’s What You Do Next That Counts’.

· How to unscramble finances when going through a divorce

· Designing your next chapter (How to think...2022-02-1148 min The Wealth ConversationHow Childhood Trauma Can Impact Your Relationship With Money with Mary Hemingway* Content Warning*: This episode contains content that may be triggering to some listeners. Although there are no in depth descriptions there are mentions of types of childhood trauma, which may include domestic violence, sexual and physical abuse, mental health, neglect, poverty and bullying.

About Mary Hemingway:

Mary is a certified financial coach and multi-award winning financial adviser based in the Scottish Borders. She uses her life experience as a trauma survivor, alongside person-centered counseling skills and a decade in financial services, to help heal the financial wounds left as a legacy of...2022-02-0436 min

The Wealth ConversationHow Childhood Trauma Can Impact Your Relationship With Money with Mary Hemingway* Content Warning*: This episode contains content that may be triggering to some listeners. Although there are no in depth descriptions there are mentions of types of childhood trauma, which may include domestic violence, sexual and physical abuse, mental health, neglect, poverty and bullying.

About Mary Hemingway:

Mary is a certified financial coach and multi-award winning financial adviser based in the Scottish Borders. She uses her life experience as a trauma survivor, alongside person-centered counseling skills and a decade in financial services, to help heal the financial wounds left as a legacy of...2022-02-0436 min The Wealth ConversationHow Emotions Impact The Way We Charge with Julie FlynnAbout Julie Flynn:

Julie is an independent financial planner and certified financial coach. Years of qualifications and research have led Julie to have a unique understanding of how our brains behave under stress, and how this impacts on our financial decision making and well-being. Julie works with women experiencing or planning significant change in their lives. She is founder of Ebb & Flow Financial Coaching, where she focusses on her work with women who have lost their partner. She also coaches women wanting to change how they charge for their services.

Key discussion...2022-01-2828 min

The Wealth ConversationHow Emotions Impact The Way We Charge with Julie FlynnAbout Julie Flynn:

Julie is an independent financial planner and certified financial coach. Years of qualifications and research have led Julie to have a unique understanding of how our brains behave under stress, and how this impacts on our financial decision making and well-being. Julie works with women experiencing or planning significant change in their lives. She is founder of Ebb & Flow Financial Coaching, where she focusses on her work with women who have lost their partner. She also coaches women wanting to change how they charge for their services.

Key discussion...2022-01-2828 min The Wealth ConversationEthical and Sustainable Investing with Emily PoolNothing in this podcast constitutes personal financial advice. For personal advice please speak to an Independent Financial Planner. Investments carry risk. Past performance is no guarantee of future performance.

About Emily Pool:

Emily is passionate about empowering people to invest their wealth (pensions and savings) sustainably and in line with their personal values. She believes people will naturally engage more meaningfully with their financial futures by investing ethically and sustainably, and will feel more empowered knowing that their savings can have a positive impact on global problems.

...2022-01-2138 min

The Wealth ConversationEthical and Sustainable Investing with Emily PoolNothing in this podcast constitutes personal financial advice. For personal advice please speak to an Independent Financial Planner. Investments carry risk. Past performance is no guarantee of future performance.

About Emily Pool:

Emily is passionate about empowering people to invest their wealth (pensions and savings) sustainably and in line with their personal values. She believes people will naturally engage more meaningfully with their financial futures by investing ethically and sustainably, and will feel more empowered knowing that their savings can have a positive impact on global problems.

...2022-01-2138 min The Wealth ConversationManaging Your Business Finances with Jackie StewartAbout Jackie Stewart:

Jackie Stewart is a Chartered Certified Accountant and a Qualified Teacher. She is also a qualified Money Coach for CAP (Christians Against Poverty). As well as being the Director of her Company, Funancial Training & Consultancy (FT&C), Jackie has facilitated various courses and workshops on Financial Management, I.T., QuickBooks Accounting software and Personal Money Management.

Key discussion points from this episode include:

· What motivated Jackie pursue a career in accounting.

· Why Jackie is passionate about supporting businesses that are focused on community building.

...2022-01-1434 min

The Wealth ConversationManaging Your Business Finances with Jackie StewartAbout Jackie Stewart:

Jackie Stewart is a Chartered Certified Accountant and a Qualified Teacher. She is also a qualified Money Coach for CAP (Christians Against Poverty). As well as being the Director of her Company, Funancial Training & Consultancy (FT&C), Jackie has facilitated various courses and workshops on Financial Management, I.T., QuickBooks Accounting software and Personal Money Management.

Key discussion points from this episode include:

· What motivated Jackie pursue a career in accounting.

· Why Jackie is passionate about supporting businesses that are focused on community building.

...2022-01-1434 min The Wealth ConversationPreparing Your Finances For Family Life with Charlotte WoodAbout Charlotte Wood:

Charlotte is a Chartered Financial Planner and runs her own practice alongside raising her two small humans. Charlotte is also increasingly well known as a Women's advocate and pursing an agenda for gender diversity within the Financial Planning profession.

Key discussion points from this episode include:

How Charlotte prepared her finances prior to having you a family

The importance of have the money conversation with your partner when you were still dating

The one thing that Charlotte believes could help support individuals and families navigate...2022-01-0748 min

The Wealth ConversationPreparing Your Finances For Family Life with Charlotte WoodAbout Charlotte Wood:

Charlotte is a Chartered Financial Planner and runs her own practice alongside raising her two small humans. Charlotte is also increasingly well known as a Women's advocate and pursing an agenda for gender diversity within the Financial Planning profession.

Key discussion points from this episode include:

How Charlotte prepared her finances prior to having you a family

The importance of have the money conversation with your partner when you were still dating

The one thing that Charlotte believes could help support individuals and families navigate...2022-01-0748 min The Wealth ConversationTalking About Money With Children with Funmi OlufunwaAbout Funmi Olufunwa:

After working as a lawyer in financial services for well over a decade, Funmi recently left her legal career and set up an education and coaching business to fill the financial education gap and provide information and guidance that empowers people to understand their relationship towards money and how they can make their money work best for them.

Key discussion points from this episode include:

· About Funmi Olufunwa and the mission for her business.

· How the absence of the money conversation at a young age mi...2021-12-3139 min

The Wealth ConversationTalking About Money With Children with Funmi OlufunwaAbout Funmi Olufunwa:

After working as a lawyer in financial services for well over a decade, Funmi recently left her legal career and set up an education and coaching business to fill the financial education gap and provide information and guidance that empowers people to understand their relationship towards money and how they can make their money work best for them.

Key discussion points from this episode include:

· About Funmi Olufunwa and the mission for her business.

· How the absence of the money conversation at a young age mi...2021-12-3139 min The Wealth ConversationPhysical Wellbeing: Yoga with Kinga KovacsAbout Kinga Kovacs:

Kinga has been practicing yoga for over 12 years and has been teaching in corporate, group and one to one settings over the past 3 years. She teaches yoga as a holistic practice: offering a safe space, nurturing and guiding students into self- exploration, building deeper self-awareness where they can re-discover their inherent full potentials as a unique part of this cosmos and feel fully alive and well physically, mentally and emotionally. She enjoys building relationships and deeper connections and through her method offers a complete toolkit for empowering people with self-love, positive body image, deeper a...2021-12-2439 min

The Wealth ConversationPhysical Wellbeing: Yoga with Kinga KovacsAbout Kinga Kovacs:

Kinga has been practicing yoga for over 12 years and has been teaching in corporate, group and one to one settings over the past 3 years. She teaches yoga as a holistic practice: offering a safe space, nurturing and guiding students into self- exploration, building deeper self-awareness where they can re-discover their inherent full potentials as a unique part of this cosmos and feel fully alive and well physically, mentally and emotionally. She enjoys building relationships and deeper connections and through her method offers a complete toolkit for empowering people with self-love, positive body image, deeper a...2021-12-2439 min The Wealth ConversationThe African Money Archetypes with Vangile MakwakwaAbout Vangile Makwakwa:

Vangile Makwakwa is the founder of Wealthy Money, a company that helps people heal ancestral money trauma so they can fall in love with their bank accounts, live their best lives, and create generational wealth. She is the teacher at Wealthy Money Academy and the creator and facilitator of all the online courses on the online academy. She is also the host of the Property Magicians Podcast and the Money Magic Podcast. She is the author of Heart, Mind & Money: Using Emotional Intelligence for Financial Success. Vangile has a finance degree and an MBA...2021-12-171h 08

The Wealth ConversationThe African Money Archetypes with Vangile MakwakwaAbout Vangile Makwakwa:

Vangile Makwakwa is the founder of Wealthy Money, a company that helps people heal ancestral money trauma so they can fall in love with their bank accounts, live their best lives, and create generational wealth. She is the teacher at Wealthy Money Academy and the creator and facilitator of all the online courses on the online academy. She is also the host of the Property Magicians Podcast and the Money Magic Podcast. She is the author of Heart, Mind & Money: Using Emotional Intelligence for Financial Success. Vangile has a finance degree and an MBA...2021-12-171h 08 The Wealth ConversationMoney Mindset, Financial Wellbeing and Workplace Savings with Charlie GoodmanAbout Charlie Goodman:

Currently a Partner at the Employee Benefits Collective LLP, Charlie Goodman specializes in financial wellbeing and pensions in the workplace. He is a qualified IFA, Financial Coach, and Reward Specialist. Charlie leads the Initiative for Financial Wellbeing’s Workplace Wellbeing offering.

Key discussion points from this episode include:

· Why Charlie decided to focus on employees benefits and financial wellbeing - 2:40

· About The Initiative For Financial Wellbeing - 10:42

· The basics that employers should consider having in place to support their employees’ financial wellbeing - 26:29

· The r...2021-12-1055 min

The Wealth ConversationMoney Mindset, Financial Wellbeing and Workplace Savings with Charlie GoodmanAbout Charlie Goodman:

Currently a Partner at the Employee Benefits Collective LLP, Charlie Goodman specializes in financial wellbeing and pensions in the workplace. He is a qualified IFA, Financial Coach, and Reward Specialist. Charlie leads the Initiative for Financial Wellbeing’s Workplace Wellbeing offering.

Key discussion points from this episode include:

· Why Charlie decided to focus on employees benefits and financial wellbeing - 2:40

· About The Initiative For Financial Wellbeing - 10:42

· The basics that employers should consider having in place to support their employees’ financial wellbeing - 26:29

· The r...2021-12-1055 min The Wealth ConversationWhy You Should Have A Will In Place with Primerose ChiguriAbout Primerose Chiguri:

Primerose Chiguri (nee Makunzva) LLB (hons) LLM, is a Solicitor at Kimberly Wayne & Diamond Solicitors in London. Her experience is in Immigration, Family Law , Civil Litigation and Wills and Probate.

Primerose specialises in complex cases and she prides herself in achieving high success rates for her clients and making a difference. She represents clients in Judicial Review applications as well as in appeals before the First Tier Tribunal, Upper Tribunal and in other civil matters in the County courts.

Primerose believes in excellence in legal service and providing a high...2021-12-0343 min

The Wealth ConversationWhy You Should Have A Will In Place with Primerose ChiguriAbout Primerose Chiguri:

Primerose Chiguri (nee Makunzva) LLB (hons) LLM, is a Solicitor at Kimberly Wayne & Diamond Solicitors in London. Her experience is in Immigration, Family Law , Civil Litigation and Wills and Probate.

Primerose specialises in complex cases and she prides herself in achieving high success rates for her clients and making a difference. She represents clients in Judicial Review applications as well as in appeals before the First Tier Tribunal, Upper Tribunal and in other civil matters in the County courts.

Primerose believes in excellence in legal service and providing a high...2021-12-0343 min The Wealth ConversationWhy Representation Matters with Joyce OseiAbout Joyce Osei:

Joyce is on a mission to inspire, impact and innovate with Entrepreneurs and Senior Leaders in Tech and beyond through Diversity and Inclusion. For over 8 years Joyce worked to increase the representation of women in male dominated industries by supporting leaders to attract retain and develop their female talent. Joyce is very passionate about increasing the representation of people from marginalized backgrounds through video content because it’s vital that people have a safe space to share their lived experiences.

As part of tackling under-representation in Diversity & Inclusion, Joyce wrote and published he...2021-11-2621 min

The Wealth ConversationWhy Representation Matters with Joyce OseiAbout Joyce Osei:

Joyce is on a mission to inspire, impact and innovate with Entrepreneurs and Senior Leaders in Tech and beyond through Diversity and Inclusion. For over 8 years Joyce worked to increase the representation of women in male dominated industries by supporting leaders to attract retain and develop their female talent. Joyce is very passionate about increasing the representation of people from marginalized backgrounds through video content because it’s vital that people have a safe space to share their lived experiences.

As part of tackling under-representation in Diversity & Inclusion, Joyce wrote and published he...2021-11-2621 min The Wealth ConversationAcknowledging Transition with Keji CastanoAbout Keji Castano: