Shows

Greenground // Soundcloud // Season 2Global Crisis & Conflict: Ukraine to Gaza Updates #Ukraine #GlobalNews #Conflict2025Engage with Alvin’s comprehensive update on November 1, 2025, as he delves into global crises that matter. Explore Russia’s intense strikes in Ukraine, a fragile ceasefire in Gaza, and election unrest rocking Tanzania. Uncover stories of police violence in Brazil and escalating US-China trade tensions. With a focus on human stories in Sudan’s Darfur, this breakdown keeps you informed and connected. Dive in, share your thoughts, and be part of the conversation. #UkraineConflict #GazaCrisis #TanzaniaProtests #BrazilViolence #USChinaTrade

2025-11-0105 minGreenground // Soundcloud // Season 2Global Crisis & Conflict: Ukraine to Gaza Updates #Ukraine #GlobalNews #Conflict2025Engage with Alvin’s comprehensive update on November 1, 2025, as he delves into global crises that matter. Explore Russia’s intense strikes in Ukraine, a fragile ceasefire in Gaza, and election unrest rocking Tanzania. Uncover stories of police violence in Brazil and escalating US-China trade tensions. With a focus on human stories in Sudan’s Darfur, this breakdown keeps you informed and connected. Dive in, share your thoughts, and be part of the conversation. #UkraineConflict #GazaCrisis #TanzaniaProtests #BrazilViolence #USChinaTrade

2025-11-0105 min

The Prospector News PodcastChris Temple: The Fed, Trump Economy, and US-China TradeThe Prospector News Michael Fox and Chris Temple of the National Investor analyze the Federal Reserve’s recent moves, criticizing Jerome Powell’s explanation of rising inflation and expressing doubt that the Fed will meet its 2% target amid entrenched stagflation.They highlight the challenges facing President Trump’s economy, including high debt and rising living costs, while discussing the ongoing government shutdown’s social impact, especially on vulnerable populations reliant on government aid.The conversation covers the political fallout from upcoming health subsidy changes and the potential electoral consequences in key states. They also examine the rece...

2025-10-3141 min

Jason in the MorningDeals, Deterrents, and Digital DeceptionA trade truce that keeps the global engine hummin’, a nuclear test that might start a new Cold War, a genocide the world’s forgotten, and an AI hoax that fooled half of it.This is Jason in the Morning — Episode 144: Deals, Deterrence & Digital Deception.When the headlines stop talkin’, we dig for the why.#JasonInTheMorning #JITM #Above51Media #USChinaTrade #NuclearDeterrence #Darfur #AIHoax #ThinkDeeper #StoryBehindTheStory #SouthernVoice #PodcastLife

2025-10-3010 min

Greenground // Soundcloud // Season 2Global Tensions & Diplomatic Shifts: Top Stories Oct 15, 2025 #GlobalNewsUnpack the pulse of today’s world with our latest update on October 15, 2025. From Madagascar’s parliament shakeup to Africa’s peace endeavors, immerse yourself in the drama of global markets, driven by US-China trade talks. Journey into Southeast Asia’s discreet diplomacy for peace and delve into the upcoming US-Argentina meeting, rich political currents swirling. Plus, discover Iran’s espionage verdicts and Italy’s explosion aftermath. Explore the nuance, intrigue, and global impact. Like, comment, and subscribe for your daily dose of world news! 🌍 #GlobalNews #MadagascarCrisis #USChinaTrade #SoutheastAsiaPeace #ArgentinaPolitics

2025-10-1504 minGreenground // Soundcloud // Season 2Global Tensions & Diplomatic Shifts: Top Stories Oct 15, 2025 #GlobalNewsUnpack the pulse of today’s world with our latest update on October 15, 2025. From Madagascar’s parliament shakeup to Africa’s peace endeavors, immerse yourself in the drama of global markets, driven by US-China trade talks. Journey into Southeast Asia’s discreet diplomacy for peace and delve into the upcoming US-Argentina meeting, rich political currents swirling. Plus, discover Iran’s espionage verdicts and Italy’s explosion aftermath. Explore the nuance, intrigue, and global impact. Like, comment, and subscribe for your daily dose of world news! 🌍 #GlobalNews #MadagascarCrisis #USChinaTrade #SoutheastAsiaPeace #ArgentinaPolitics

2025-10-1504 min

Daily Stock Market News and Analysis (DNA by InvestYadnya)Daily Stock Market News(Oct 14'2025):US–China Trade, India Inflation, HCL Tech & Just Dial Q2 Result📈 Your Complete Daily Stock Market Update for October 14, 2025Welcome to your daily dose of stock market news and analysis! Today's episode covers critical developments shaping global and Indian markets.Today's Key Highlights:🌏 Global Market DevelopmentsUS-China trade relations show signs of improvement with easing tensions, potentially impacting global supply chains and market sentiment. We analyze what this means for investors and the broader economic outlook.💻 Tech Sector BreakthroughOpenAI announces a massive chip manufacturing partnership with Broadcom, marking a significant development in AI infrastructure. Learn about the implications for the semiconductor industry and AI advancement.📊 India Economic MilestoneIndia's inflation hits an 8-year low, a...

2025-10-1420 min

新聞美國列23家中企黑名單 中國反制啟動晶片反傾銷調查U.S. Blacklists 23 Chinese Firms; Beijing Launches Chip Anti-Dumping Probe美國商務部於9月12日宣布,將32家企業與實體列入出口管制黑名單,其中23家來自中國,包括上海復旦微電子及其新加坡、台灣據點,理由是涉嫌協助中芯國際取得美國晶片製造設備,並直接向中國軍事、政府及安全機構供應產品。美國工業暨安全局指出,這些企業涉及高效能運算與AI晶片領域,因此即便在海外生產,只要含有美國技術,也將受到出口限制。

中國商務部批評美方「泛化國家安全、濫用出口管制」,形容是單邊霸凌,並於9月13日宣布,對原產於美國的模擬晶片發起反傾銷調查,範圍涵蓋40奈米以上製程的通用介面晶片及柵極驅動晶片,調查期自2024年1月1日至2024年12月31日,產業損害期自2022年至2024年底。調查預計於2026年9月13日前完成。

此舉被視為中方不再僅限於外交抗議,而是以具體措施維護自身產業利益。值得注意的是,中美雙方將於9月14日在西班牙舉行經貿會談,中國商務部發言人直言,美方此刻祭出制裁「意欲何為」,耐人尋味。外界普遍認為,中美科技戰與經貿摩擦恐將持續升溫。

Hashtags

#中美貿易戰 #出口管制 #反傾銷 #半導體 #晶片戰爭 #供應鏈安全

English

On September 12, the U.S. Department of Commerce announced the addition of 32 companies and entities to its export control Entity List, including 23 from China. Among them, Shanghai Fudan Microelectronics and its branches in Singapore and Taiwan were accused of assisting SMIC in acquiring U.S. chipmaking equipment and directly supplying products to China’s military and government agencies. The Bureau of Industry and Security noted that these entities are linked to high-performance computing and AI chips, meaning that even foreign-made items incorporating U.S. technology will be restricted.

In response, China’s Ministry of Commerce strongly criticized the U.S. for “abusing export controls under the guise of national security” and announced on September 13 the launch of an anti-dumping investigation into U.S.-origin analog chips, specifically 40nm+ commodity interface IC chips and gate driver IC chips. The dumping investigation period runs through 2024, with industry damage assessment spanning 2022 to 2024, and is expected to conclude by September 2026.

Analysts see this as China’s shift from verbal protest to concrete countermeasures. With Sino-U.S. trade talks scheduled in Spain on September 14, Beijing’s pointed question—“What is the U.S. aiming at with these sanctions now?”—underscores that the tech war is intensifying beyond the negotiation table.

Hashtags

#USChinaTrade #ChipW...

2025-09-1401 min

Theta FuseNVIDIA’s $4.5 Trillion Power Play: Tariff Bombshell, Record Highs & The Week AheadWall Street kicks off Monday with fireworks — record-breaking futures, an unprecedented U.S.–China chip deal, and NVIDIA at the center of the storm. 🚀In this Theta Fuse episode, we break down:Why NVIDIA is crushing the S&P 500 & SOXX ETFThe shocking 15% China chip revenue deal with the U.S. governmentHow Trump’s tariff deadline could shake markets this weekWhat CPI data & geopolitical tension mean for your portfolioWhether you’re a day trader, swing trader, or long-term investor, this is your essential Monday market brie...

2025-08-1130 min

新聞川普放話晶片課100%稅 經濟部急召台積電等業者座談因應 Taiwan Talks Chip Tariffs as Trump Threatens 100% Tax美國總統川普近日表示,若海外半導體業者未在美國設廠,將對輸美晶片課徵100%關稅。對此,經濟部今(7)日召集台積電、聯電、力積電、日月光、環球晶圓、鴻海等重要廠商,舉行座談會研商因應策略。

會中業者指出,目前美方尚未公布具體課稅範圍與細節,須密切觀察未來行政命令內容,並籲政府積極爭取公平待遇,避免重演232條款鋼鋁稅「差別對待」情況。

經濟部強調,台灣半導體產業長期為美國供應高附加價值晶片,是全球供應鏈關鍵夥伴。行政院經貿辦副總代表顏慧欣則指出,談判團隊將在供應鏈合作與關稅議題上全力爭取最優惠待遇,保障我國產業權益。

Hashtags:

台美關稅 #晶片關稅 #半導體戰略 #川普政策 #232條款 #經濟部 #TSMC #USChinaTrade #科技供應鏈 #產業安全

🇺🇸【English】

US President Donald Trump recently declared that imported semiconductors would face a 100% tariff unless companies commit to building factories in the United States. In response, Taiwan's Ministry of Economic Affairs convened a high-level meeting with key industry players including TSMC, UMC, Powerchip, ASE, GlobalWafers, and Foxconn to discuss countermeasures.

Industry representatives noted that the detailed scope and implementation of the proposed tariffs remain unclear, and called on the government to actively negotiate to avoid discriminatory treatment similar to past Section 232 tariffs on steel and aluminum.

The Ministry stressed Taiwan’s vital role in the global chip supply chain and its long-standing partnership with U.S. tech companies. Deputy Chief Trade Negotiator Yen Hui-hsin stated that Taiwan’s negotiation team is working to secure the most favorable terms under the Section 232 framework, ensuring a fair and competitive position for Taiwan’s semiconductor industry.

Hashtags:

TaiwanUS #SemiconductorTariffs #ChipWar #Section232 #TrumpTradePolicy #TSMC #TechSupplyChain #EconomicSecurity #FairTrade #TaiwanSemiconductors

🇯🇵【日本語】

アメリカのトランプ大統領は最近、「ア...

2025-08-0701 min

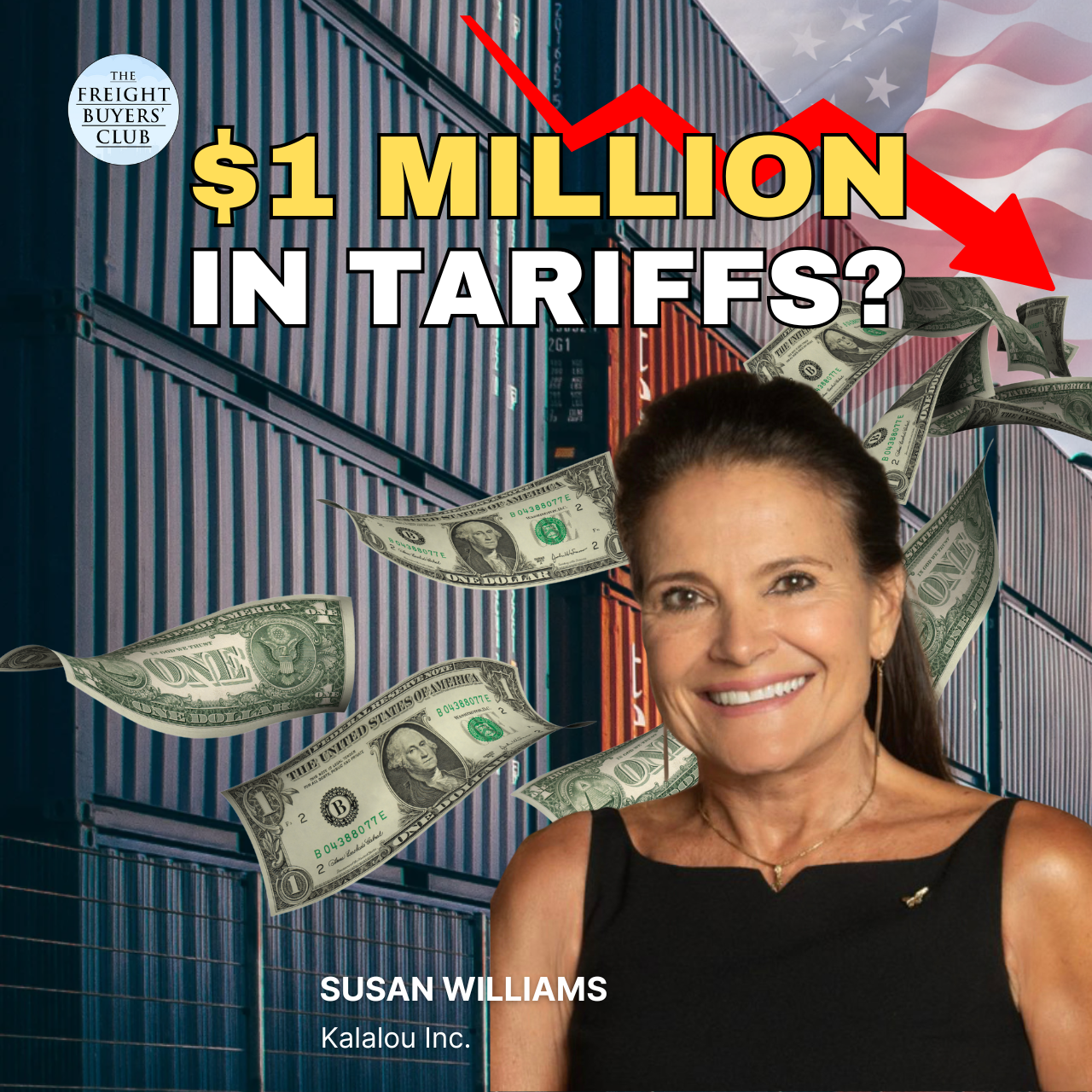

The Freight Buyers' ClubTariff Nightmares: As Told By A ‘Frustrated’ Trump SupporterIn this episode of The Freight Buyers’ Club, host Mike King speaks with Susan Williams, founder and CEO of Kalalou Inc, a Mississippi-based importer that was once a heavy shipper from China, India, Indonesia, Haiti, and more. Now, due to sweeping US tariff policies, her container volumes have nearly halved – and her company faces over $1 million in annual tariff bills.

Despite being a Trump supporter, Susan shares her growing frustration with trade policy, explains why SMEs like hers weren’t the intended target, and unveils her own profit-sharing tax credit proposal as a way to support American worker...

2025-08-0612 min

Perspectives with NeiloTaiwan's Hot Summer - Recalls, Tariffs and TensionsIt has been a sweltering few months in Taiwan's political scene with partisanship intensifying in domestic politics, increased cross-strait tensions and unfolding US tariffs.

At the end of June, I was fortunate to meet up with two of Taiwan's leading columnists and political analysts from the central city of Taichung.

Courtney Donovan Smith is a staff columnist with the Taipei Times whose regular column, Donovan's Deep Dives shares in-depth analysis on everything about Taiwan's political scene and geopolitics. He is also the central Taiwan correspondent for ICRT FM Radio.

Michael Turton is also a contributing columnist for the Taipei Times...

2025-08-0439 min

新聞台灣恐遭20%半導體關稅重擊 Taiwan May Face 20% Chip Tariff Hit美國總統川普於美東時間7月31日宣布,台灣「對等關稅」稅率調升至20%,高於日本與韓國的15%,引發台灣社會高度關注。然而專家指出,真正更具殺傷力的是即將公布的「232條款」下半導體關稅。台新新光金控首席經濟學家李鎮宇表示,台灣出口美國的關鍵項目是半導體,一旦遭到重稅,衝擊恐怕遠超其他產業。

李鎮宇推測,美國給台灣半導體的起始關稅可能是20%,並指出,超微(AMD)執行長蘇姿丰先前曾透露,台積電赴亞利桑那設廠雖增加成本,但仍控制在20%以內,代表若美方想鼓勵設廠投資,就必須設計更「划算」的關稅條件。他也呼籲台灣應努力爭取「最惠國待遇」,爭取落在15%的關稅級距內。

Hashtags:

台美關稅 #半導體戰爭 #台積電 #蘇姿丰 #川普政策 #232條款 #美中貿易戰 #台灣經濟 #對等關稅 #晶片法案

📌English

On July 31 (EST), President Donald Trump announced that Taiwan's reciprocal tariff rate would rise to 20%, higher than Japan and South Korea's 15%. While the news sparked concern in Taiwan, experts argue that the upcoming semiconductor tariffs under Section 232 could have an even greater impact.

Li Zhenyu, Chief Economist at Taishin Shin Kong Financial, predicted that Taiwan might face a 20% starting tariff on semiconductors. He referenced AMD CEO Lisa Su, who recently noted that TSMC’s Arizona plant cost increase was under 20%. This suggests the U.S. may set favorable tariffs to incentivize Taiwanese investment. Taiwan aims to secure “Most Favored Nation” status, ideally reducing the final rate to 15%.

Hashtags:

TaiwanUStrade #SemiconductorTariffs #TSMC #LisaSu #TrumpPolicy #Section232 #ChipWar #TariffImpact #USChinaTrade #ReciprocalTariffs

📌日本語

アメリカのトランプ大統領は7月31日(米東部時間)、台湾の「相互関税率」を20%に引き上げると発表し、日本や韓国の15%を上回る数字に注目が集まった。しかし専門家は、8月に発表される予定の「232条項」に基づく半導体関税の方が、台湾にとってより大きな影響をもたらす可能性があると警告する。

台新新光金控のチーフエコノミスト、李鎮宇氏は、台湾の半導体関税が20%から始まる可能性があると予測。AMDのCEOであるリサ・スー氏の発言を引用し、TSMCのアリゾナ工場コスト増は20%未満だったとし、アメリカが投資を促進するなら「割に合う」関税設定をする必要があると指摘した。

ハ...

2025-08-0301 min

Новости США и Мира на The Great Media Radio USA | Прайм Тайм Америка #news #новостисшаПрайм Тайм Америка | June 27th, 2025 | Новости США и Мира | KXPD 1040 AM #usa #новости #podcast #сша #news"Прайм Тайм Америка" — это ежедневная информационная программа на The Great Media Radio USA, предлагающая слушателям актуальные новости и аналитику о событиях в США и мире. В каждом выпуске освещаются ключевые политические, экономические и социальные события, влияющие на глобальную повестку дня.Подпишись на новостной подкаст!https://spoti.fi/41epRKDhttps://apple.co/3WunH6Q 🛍️ 1. Потребительские расходы неожиданно снизились— В мае расходы домохозяйств упали на 0,1 %, второй раз за год. Потребители «отдохнули» после массовых закупок перед введением тарифов администрации Трампа. Индекс цен PCE вырос на 0,1 %, а базовая инфляция — на 0,2 % (годовой рост 2,7 %)🔫 2. DOGE меняет 50 норм ATF по оружию— Агентство эффективности правительства (DOGE) приступило к пересмотру и отмене около 50 федеральных ограничений в сфере оружия к 4 июля, продолжая курс на дерегуляцию.💸 3. Республиканцы Сената сталкиваются с дефицитом бюджета— При рассмотрении законопроекта Трампа по налоговым льготам и расходам образовалась дыра в $600 млрд: часть ключевых Cut так и не прошла через правила бюджетной процедуры.📈 4. Wall Street на пике: надежды на сделки и смягчение ФРС— Главные индексы S&P 500 и Nasdaq обновили рекорд: инвесторы ждут сделок США–Китай по редкоземельным металлам и снижения ставок ФРС.🇰🇷 5. Трамп обещает «решить конфликт» с КНДР— Президент заявил, что США «урегулирует конфликт с Северной Кореей», что подтверждает роль США как главного гаранта безопасности Южной Кореи .#СШАновости #USNews #ConsumerSpending #Потребительскиерасходы #InflationWatch #PCE #DOGEgov #GunRegulations #ATFLaws #SenateRepublicans #BudgetBill #DebtHole #WallStreet #NASDAQ #SP500 #RareEarthDeal #USChinaTrade #FedWatch #NorthKorea #АмерикаСегодня

2025-06-2848 min

新聞川普關稅緩衝期將滿 預告全球將收信 Trump Warns Tariff Notices to Be Sent Globally美國總統川普27日表示,對等關稅的90天暫緩期即將於7月9日屆滿,美國已與中國、英國等4到5個國家達成貿易協議,未來一週將向未達成協議的國家發出函件,通知其輸美商品將被課徵的關稅稅率。川普強調,「不是每個國家都會談成」,但美國將保護本國利益,部分國家將面臨最高25%的進口關稅。

川普指出,美方正與多國協商中,並希望與印度等大型經濟體達成協議,消除貿易壁壘,保障美國企業公平進入國際市場。他亦未排除提前結束緩衝期的可能性,強調「我們可以延長,也可以縮短」。此舉引發全球市場警戒,出口導向國家高度關注美國後續關稅調整策略。

#川普 #關稅戰 #對等關稅 #全球貿易 #美中貿易 #出口挑戰 #全球供應鏈

🇺🇸 English

U.S. President Donald Trump announced on June 27 that the 90-day grace period for the reciprocal tariffs policy will expire on July 9. Trump confirmed that trade agreements have been reached with China, the UK, and several other countries, while warning that nations without deals will soon receive formal letters detailing the tariff rates on U.S.-bound exports—potentially up to 25%.

Trump emphasized that not every country will reach a deal, but the U.S. must protect its interests. He also expressed hope for a deal with India to eliminate trade barriers and ensure fair access for American businesses. While the option to extend the grace period remains, Trump said he personally prefers to shorten it and proceed directly to the full tariff implementation. The announcement has sparked global concern, especially among export-driven economies.

#Trump #TariffWar #ReciprocalTariffs #GlobalTrade #USChinaTrade #ExportChallenge #SupplyChain

🇯🇵 日本語

アメリカのトランプ大統領は6月27日、4月に発表した「対等関税」政策の90日間猶予期間が7月9日に終了することを改めて強調しました。中国、イギリスなど4〜5カ国とは既に合意済みであり、その他の国には来週中に関税率を通知する文書を送付すると予告しました。最大25%の関税が課される可能性も...

2025-06-2801 min

新聞台美關稅談判倒數 郭智輝:有信心US-Taiwan Tariff Talks Near Deadline台美關稅談判進入倒數 郭智輝:有信心不會比日韓差

美國對多國祭出「對等關稅」政策的90天暫緩期將於7月9日到期,台美雙邊談判正進入最後階段。經濟部長郭智輝表示,台灣為美國「綠區」內的優先談判對象之一,且在AI晶片等關鍵產業具備優勢,有信心台灣不會談出比日本、韓國更差的條件。對於汽車稅減讓,政府強調影響可控,未來降稅將限於台美雙邊協定,不會波及其他WTO會員國。

🇺🇸 English

US-Taiwan Tariff Talks Near Deadline, Minister Confident in Deal

As the 90-day grace period of the US "reciprocal tariffs" policy ends on July 9, Taiwan’s Minister of Economic Affairs, Wang Mei-hua, expressed strong confidence in ongoing bilateral talks. He stated that Taiwan is among the “green zone” priority partners of the US and holds key advantages in AI chips and servers. The government believes any tariff concession on autos will be limited to the bilateral deal and will not affect WTO commitments.

🇯🇵 日本語

米台関税交渉が大詰め 郭部長「日韓より悪くならない」

アメリカの「対等関税」政策による90日間の猶予期間が7月9日に終了する予定で、台湾との関税交渉が最終段階に入っています。郭智輝経済部長は、台湾は米国にとって優先交渉国(グリーンゾーン)であり、AI半導体などで競争力があると述べ、「日本や韓国より不利な条件にはならない」との自信を示しました。自動車関税の減免も影響は限定的で、WTO他国には波及しないとしています。

🇰🇷 한국어

미국-대만 관세 협상 임박, "일본·한국보다 나쁘지 않다"

미국의 '상호 관세' 정책에 대한 90일 유예 기간이 7월 9일에 종료됨에 따라, 대만과 미국 간의 관세 협상이 막바지에 접어들고 있습니다. 대만 경제부 장관 궈즈후이는 대만이 미국의 '녹색 구역' 우선 협상국이며, AI 반도체와 서버 분야에서 경쟁력이 있다고 강조했습니다. 자동차 관세 인하는 양자 협정에 국한되며 WTO 국가에는 영향을 미치지 않을 것이라고 밝혔습니다.

🇲🇾 Bahasa Malaysia

Rundingan Tarif AS-Taiwan Hampir Tamat, Taiwan Yakin Capai Kesepakatan Baik

Tempoh penangguhan 90 hari bagi dasar tarif balas AS bakal berakhir pada 9 Julai. Menteri Ekonomi Taiwan, Guo Zhi-hui, menyatakan keyakinan tinggi bahawa Taiwan tidak akan mendapat syarat yang lebih buruk daripada Jepun atau Korea. Taiwan dianggap rakan “zon hijau” oleh Amerika Syarikat, dengan kelebihan dalam cip AI dan pelayan. Sebarang konsesi cukai kereta hanya terhad kepada perjanjian dua hala dan tidak menjejaskan komitmen WTO lain.

🇹🇭 ภาษาไทย

การเจรจาภาษีสหรัฐ-ไต้หวันใกล้ถ...

2025-06-2301 min

CropLife Retail WeekCorn & Soy Near Finish, Cotton Lags | AI in Corn | Rare Earth Trade UpdateEric Sfiligoj and Lara Sowinski break down the latest USDA planting report showing corn at 97% and soybeans at 90% — while cotton struggles at just 76% due to persistent wet weather in the South. Plus, The DeLong Co. breaks ground on a $26 million ag export facility in Virginia. The team also dives into major updates on U.S.-China trade talks involving rare earth minerals and jet engine tech.

Stay up to date with the latest insights in crop protection, ag retail, and agricultural innovation from CropLife Magazine. We bring you expert interviews, product spotlights, and in...

2025-06-1316 min

Greenground.it | Daily News and Reviews | Season OneGlobal Pulse: Exploring the World's Most Pressing News Stories - June 13, 2025Global Pulse: Exploring the World's Most Pressing News Stories - June 13, 2025#MiddleEastConflict, #IranIsraelTensions, #AviationTragedies, #GlobalHumanitarianCrisis, #AfricaFamine, #SudanSecurity, #SouthAfricaFloods, #TradeUncertainty, #USChinaTrade, #GlobalNewsInsights"Join us on a journey through the world's most compelling news stories From escalating tensions in the Middle East to humanitarian crises in Africa, and from aviation disasters to economic shifts on the global stage, we explore it all. Click to learn more about these pivotal events shaping our world today...

2025-06-1304 min

Greenground.it | Daily News and Reviews | Season OneGlobal Pulse: Exploring the World's Most Pressing News Stories - June 13, 2025Global Pulse: Exploring the World's Most Pressing News Stories - June 13, 2025#MiddleEastConflict, #IranIsraelTensions, #AviationTragedies, #GlobalHumanitarianCrisis, #AfricaFamine, #SudanSecurity, #SouthAfricaFloods, #TradeUncertainty, #USChinaTrade, #GlobalNewsInsights"Join us on a journey through the world's most compelling news stories From escalating tensions in the Middle East to humanitarian crises in Africa, and from aviation disasters to economic shifts on the global stage, we explore it all. Click to learn more about these pivotal events shaping our world today...

2025-06-1304 min

Greenground.it | Daily News and Reviews | Season OneGlobal News Update - Navigating Tensions and Diplomacy WorldwideJune 12, 2025: Global News Update - Navigating Tensions and Diplomacy Worldwide#GlobalNewsUpdate, #MiddleEastTensions, #USChinaTrade, #GazaConflict, #EuropeanUnionAgreements, #UkraineRussiaConflict, #InternationalCooperation, #GeopoliticalAnalysis, #WorldNewsToday, #GreengroundToday"Stay informed about the latest global developments From shifting military strategies in the Middle East to breakthroughs in international trade, we're unpacking the complex news stories shaping our world today. Join us as we explore the ongoing tensions between the U.S. and Iran, the evolving situation in Ukraine, and the diplomatic progress in Europe...

2025-06-1203 min

Greenground.it | Daily News and Reviews | Season OneGlobal News Update - Navigating Tensions and Diplomacy WorldwideJune 12, 2025: Global News Update - Navigating Tensions and Diplomacy Worldwide#GlobalNewsUpdate, #MiddleEastTensions, #USChinaTrade, #GazaConflict, #EuropeanUnionAgreements, #UkraineRussiaConflict, #InternationalCooperation, #GeopoliticalAnalysis, #WorldNewsToday, #GreengroundToday"Stay informed about the latest global developments From shifting military strategies in the Middle East to breakthroughs in international trade, we're unpacking the complex news stories shaping our world today. Join us as we explore the ongoing tensions between the U.S. and Iran, the evolving situation in Ukraine, and the diplomatic progress in Europe...

2025-06-1203 min

Greenground.it | Daily News and Reviews | Season OneGlobal Headlines & Turning Points: Breaking Down Today’s Biggest Stories – June 11, 2025Global Headlines & Turning Points: Breaking Down Today’s Biggest Stories – June 11, 2025#GlobalNews2025, #AustriaSchoolShooting, #GazaAidShip, #GretaThunberg, #USChinaTrade, #IsraelSanctions, #NATOdefense, #InternationalRelations, #EnvironmentalActivism, #NewsAnalysisIn today’s gripping episode, Alvin from Greenground dives into the biggest international headlines shaking the world. From the devastating Austria school shooting to the controversial Gaza-bound aid ships, and the latest in US-China trade relations—this monologue covers the heart-wrenching, the groundbreaking, and the urgent.Why are global powers imposing new sanctions? What sparked...

2025-06-1103 min

Greenground.it | Daily News and Reviews | Season OneGlobal Headlines & Turning Points: Breaking Down Today’s Biggest Stories – June 11, 2025Global Headlines & Turning Points: Breaking Down Today’s Biggest Stories – June 11, 2025#GlobalNews2025, #AustriaSchoolShooting, #GazaAidShip, #GretaThunberg, #USChinaTrade, #IsraelSanctions, #NATOdefense, #InternationalRelations, #EnvironmentalActivism, #NewsAnalysisIn today’s gripping episode, Alvin from Greenground dives into the biggest international headlines shaking the world. From the devastating Austria school shooting to the controversial Gaza-bound aid ships, and the latest in US-China trade relations—this monologue covers the heart-wrenching, the groundbreaking, and the urgent.Why are global powers imposing new sanctions? What sparked...

2025-06-1103 min

Новости США и Мира на The Great Media Radio USA | Прайм Тайм Америка #news #новостисшаПрайм Тайм Америка | June 10th, 2025 | Новости США и Мира | KXPD 1040 AM #usa #новости #podcast #сша #news"Прайм Тайм Америка" — это ежедневная информационная программа на The Great Media Radio USA, предлагающая слушателям актуальные новости и аналитику о событиях в США и мире. В каждом выпуске освещаются ключевые политические, экономические и социальные события, влияющие на глобальную повестку дня.Подпишись на новостной подкаст!https://spoti.fi/41epRKDhttps://apple.co/3WunH6Q 🇺🇸 1. Военные силы переброшены в Лос-Анджелес из‑за иммиграционных протестов— Президент Трамп направил около 700 морпехов и 4 000 национальных гвардейцев в Лос‑Анджелес, чтобы контролировать протесты против депортаций. Местные власти, включая губернатора Ньюсома и мэра Бас, подали судебный иск, заявляя о вмешательстве в местное управление. Акции протеста распространились и на другие города США🇨🇳 2. Торговые переговоры США–Китай в Лондоне продолжаются— Стороны обсуждают важнейшие темы: экспорт полупроводников, ограничений технологий и поставки редких земель. Торги остаются напряжёнными, но есть признаки прогресса. Индексы S&P и Nasdaq растут, однако рынки остаются осторожны перед данными по инфляции.🛡️ 3. Военные готовятся к боевым действиям против ядерного Ирана— Генерал Курилла (CENTCOM) заявил на слушаниях в Конгрессе, что США имеют готовые опции "с применением сокрушительной силы" для предотвращения создания Ираном ядерного оружия. Дипломатические переговоры с Тегераном продолжаются.⚖️ 4. Администрация пытается обойти конвенцию о пытках в иммиграционных делах— Белый дом обратился в Верховный суд с просьбой разрешить депортацию иммигрантов в страны, где те ранее не представляли угрозу, игнорируя обеспокоенности по поводу потенциальных пыток и нарушений прав человека.🚨 5. ICE усиливает режим арестов: тройной ежедневный лимит— Иммиграционная служба ICE издаёт приказ увеличивающий ежедневный план арестов до 3,000 человек. Критики предупреждают о риске массовых задержаний и злоупотреблениях в правах задержанных.#СШАновости #USNews #ЛосАнджелес #LAProtests #MarinesInLA #TrumpImmigration #ImmigrationProtests #USChinaTrade #TradeTalks #ГлобальнаяЭкономика #WallStreet #IranNuclear #CENTCOM #NuclearOptions #БезопасностьСША #ICEarrests #МиграционнаяПолитика #HumanRights #КонвенцияОпытках #ПравосудиеСША

2025-06-1146 min

Buy Hold SellPower Hour: Jessica Stone on U.S.-China Trade Talks, Tariff Turmoil & Biden's Autopen ControversyIn this timely episode of Power Hour, host James Breslo engages in a compelling conversation with renowned Washington, D.C. correspondent Jessica Stone. With a distinguished career spanning major outlets like Voice of America, CGTN America, and Stansberry Research, Jessica brings her expertise to dissect the latest developments in global politics and economics.

Key topics discussed:

➡️U.S.-China Trade Relations: Insights into the recent 90-minute call between President Trump and President Xi Jinping, marking a potential thaw in trade tensions and plans for renewed negotiations.

➡️Tariff Implications: Analysis of the Congressional Budget Office's report on the economic impact of proposed tariffs, hig...

2025-06-0828 min

Buy Hold SellPower Hour: Jessica Stone on U.S.-China Trade Talks, Tariff Turmoil & Biden's Autopen ControversyIn this timely episode of Power Hour, host James Breslo engages in a compelling conversation with renowned Washington, D.C. correspondent Jessica Stone. With a distinguished career spanning major outlets like Voice of America, CGTN America, and Stansberry Research, Jessica brings her expertise to dissect the latest developments in global politics and economics.

Key topics discussed:

➡️U.S.-China Trade Relations: Insights into the recent 90-minute call between President Trump and President Xi Jinping, marking a potential thaw in trade tensions and plans for renewed negotiations.

➡️Tariff Implications: Analysis of the Congressional Budget Office's report on the economic impact of proposed tari...

2025-06-0827 min

The Weekly Money ClipPower Hour: Jessica Stone on U.S.-China Trade Talks, Tariff Turmoil & Biden's Autopen ControversyIn this timely episode of Power Hour, host James Breslo engages in a compelling conversation with renowned Washington, D.C. correspondent Jessica Stone. With a distinguished career spanning major outlets like Voice of America, CGTN America, and Stansberry Research, Jessica brings her expertise to dissect the latest developments in global politics and economics.

Key topics discussed:

➡️U.S.-China Trade Relations: Insights into the recent 90-minute call between President Trump and President Xi Jinping, marking a potential thaw in trade tensions and plans for renewed negotiations.

➡️Tariff Implications: Analysis of the Congressional Budget Office's report on the economic impact of proposed tari...

2025-06-0831 min

The Weekly Money ClipPower Hour: Jessica Stone on U.S.-China Trade Talks, Tariff Turmoil & Biden's Autopen ControversyIn this timely episode of Power Hour, host James Breslo engages in a compelling conversation with renowned Washington, D.C. correspondent Jessica Stone. With a distinguished career spanning major outlets like Voice of America, CGTN America, and Stansberry Research, Jessica brings her expertise to dissect the latest developments in global politics and economics.

Key topics discussed:

➡️U.S.-China Trade Relations: Insights into the recent 90-minute call between President Trump and President Xi Jinping, marking a potential thaw in trade tensions and plans for renewed negotiations.

➡️Tariff Implications: Analysis of the Congressional Budget Office's report on the economic impact of propo...

2025-06-0731 min

M Singapore Property Mastery I This is M.US-China Trade De-escalation: How It Impacts Singapore's Property Market l M Singapore PropertyNavigating Singapore's Property Market Amidst Global Trade ShiftsWelcome to The Deep Dive, your go-to podcast for in-depth analysis of complex topics impacting your world. In this episode, we unravel the intricate connection between US-China trade dynamics and Singapore's property market.As global trade relations evolve, understanding their local impact becomes crucial for anyone invested in Singapore's real estate landscape. We explore how recent de-escalation in US-China trade tensions might create ripples of opportunity in our local property scene.From shifting market sentiment to potential value appreciation, our discussion equips you with insights...

2025-05-1606 min

Buy Hold SellBear Market Playbook: Dean Smith Warns of Stagflation and Market TurmoilIn this Buy Hold Sell Special Report, Wall Street veterans Todd M. Schoenberger and Tobin Smith sit down with Dean Smith, Chief Strategist and Portfolio Manager at FolioBeyond, for a high-stakes conversation on the rising risks of stagflation, market volatility, and the global economic outlook.

Dean shares his bearish perspective on the U.S. economy, citing persistent inflation, unresolved U.S.-China trade tensions, and a Federal Reserve policy misstep as catalysts for continued market disruption. With markets swinging between euphoria and despair, Dean calls for caution and reveals how his quantitative fixed income strategy — FIXP — is navigating turbulent conditions....

2025-05-1636 min

The Weekly Money ClipBear Market Playbook: Dean Smith Warns of Stagflation and Market TurmoilIn this Buy Hold Sell Special Report, Wall Street veterans Todd M. Schoenberger and Tobin Smith sit down with Dean Smith, Chief Strategist and Portfolio Manager at FolioBeyond, for a high-stakes conversation on the rising risks of stagflation, market volatility, and the global economic outlook.

Dean shares his bearish perspective on the U.S. economy, citing persistent inflation, unresolved U.S.-China trade tensions, and a Federal Reserve policy misstep as catalysts for continued market disruption. With markets swinging between euphoria and despair, Dean calls for caution and reveals how his quantitative fixed income strategy — FIXP — is navigating turbulent conditions....

2025-05-1637 min

The Weekly Money ClipBear Market Playbook: Dean Smith Warns of Stagflation and Market TurmoilIn this Buy Hold Sell Special Report, Wall Street veterans Todd M. Schoenberger and Tobin Smith sit down with Dean Smith, Chief Strategist and Portfolio Manager at FolioBeyond, for a high-stakes conversation on the rising risks of stagflation, market volatility, and the global economic outlook.

Dean shares his bearish perspective on the U.S. economy, citing persistent inflation, unresolved U.S.-China trade tensions, and a Federal Reserve policy misstep as catalysts for continued market disruption. With markets swinging between euphoria and despair, Dean calls for caution and reveals how his quantitative fixed income strategy — FIXP — is navi...

2025-05-1639 min

Buy Hold SellBear Market Playbook: Dean Smith Warns of Stagflation and Market TurmoilIn this Buy Hold Sell Special Report, Wall Street veterans Todd M. Schoenberger and Tobin Smith sit down with Dean Smith, Chief Strategist and Portfolio Manager at FolioBeyond, for a high-stakes conversation on the rising risks of stagflation, market volatility, and the global economic outlook.

Dean shares his bearish perspective on the U.S. economy, citing persistent inflation, unresolved U.S.-China trade tensions, and a Federal Reserve policy misstep as catalysts for continued market disruption. With markets swinging between euphoria and despair, Dean calls for caution and reveals how his quantitative fixed income strategy — FIXP — is navigating turbulent...

2025-05-1636 min

d(AI)ly briefMAY 13 Daily News: Depardieu Guilty, Trump's Qatar Jet & US-China TruceCatch up on today's crucial news: Gérard Depardieu found guilty of sexual assault, the ethical firestorm over Trump considering a luxury jet from Qatar, the unexpected 90-day trade truce between the US and China, Kim Kardashian's testimony in her robbery trial, Trump's Middle East tour, and more top stories. Your concise daily briefing is here. #WorldNews #DepardieuVerdict #QatarJet #USChinaTrade #KimK #TrumpTour #DailyPodcast

2025-05-1312 min

Earn Your LeisureBreaking Down the China Tariff Pause: What It Means for the Economy & MarketsIn this insightful clip, Troy Millings, Ian Dunlap, and Rashad Bilal unpack the latest developments on U.S. tariffs against China, including the newly announced 90-day pause and drastic rate changes. The hosts break down how tariffs were originally raised up to 145%, only to be quickly slashed to 10% for most products—with further specifics on items related to fentanyl. They dive deep into what this rapid shift signals for global markets, American businesses, and the broader economy.Listen in as they discuss:The real-life impacts on business owners who struggled with delayed shipments an...

2025-05-1310 min

The Weekly Money ClipMarkets Surge as U.S.–China Tariff Truce Ignites Rally | Sam Stovall Analyzes the ImpactIn this Buy Hold Sell Special Report, hosts Todd M. Schoenberger and Tobin Smith are joined by Sam Stovall, Chief Investment Strategist at CFRA Research, to dissect the market's reaction to the unexpected 90-day ceasefire in the U.S.–China trade war.

Following weekend negotiations in Switzerland, both nations agreed to significantly reduce tariffs—U.S. tariffs on Chinese goods dropped from 145% to 30%, while China's tariffs on U.S. goods decreased from 125% to 10% . This development sparked a substantial market rally:

📈 S&P 500 surged by 3.3%

📈 Dow Jones soared over 1,160 points (2.8%)

📈 Nasdaq jumped 4.4%

Stovall provides historical context, noting that two-thirds of bear markets have occurred ne...

2025-05-1324 min

Buy Hold SellMarkets Surge as U.S.–China Tariff Truce Ignites Rally | Sam Stovall Analyzes the ImpactIn this Buy Hold Sell Special Report, hosts Todd M. Schoenberger and Tobin Smith are joined by Sam Stovall, Chief Investment Strategist at CFRA Research, to dissect the market's reaction to the unexpected 90-day ceasefire in the U.S.–China trade war.

Following weekend negotiations in Switzerland, both nations agreed to significantly reduce tariffs—U.S. tariffs on Chinese goods dropped from 145% to 30%, while China's tariffs on U.S. goods decreased from 125% to 10% . This development sparked a substantial market rally:

📈 S&P 500 surged by 3.3%

📈 Dow Jones soared over 1,160 points (2.8%)

📈 Nasdaq jumped 4.4%

Stovall provides historical context, noting that two-thirds of bear markets...

2025-05-1323 min

新聞中美關稅90天大降 全球市場暴衝 US-China Slash Tariffs for 90 Days, Markets Soar中美貿易戰出現重大轉折!美國與中國在瑞士日內瓦舉行高層會談後,宣布自5月14日起,雙方將大幅下調彼此關稅,美方從145%降至30%,中方從125%降至10%,為期90天。此舉引發市場正面反應,港股暴漲700點,美股期貨與歐股全面上揚。雙方同意建立後續對話機制,繼續推進經貿協議。

#中美貿易 #關稅戰 #港股暴漲 #全球市場 #中美會談 #經貿協議 #GenevaTalks #USChinaTrade #市場震盪

🇺🇸 English:

Major breakthrough in US-China trade tensions! Following high-level talks in Geneva, both countries announced a 90-day tariff reduction starting May 14. The US will cut tariffs from 145% to 30%, and China from 125% to 10%. The move sparked a global market rally, with the Hang Seng Index surging over 700 points and US/European futures sharply rising. A new dialogue mechanism will follow.

#USChinaTrade #TariffCut #MarketRally #GenevaTalks #GlobalEconomy #HangSeng #DowFutures #TradeAgreement

🇯🇵 日本語:

米中貿易戦争に大きな転機!スイス・ジュネーブで行われた高官会談の結果、両国は5月14日から90日間にわたり関税を大幅に引き下げると発表。米国は145%から30%へ、中国は125%から10%へ引き下げ。これを受けて、香港株式市場は急騰し、米欧の先物も上昇。今後も対話を継続する枠組みが設けられる。

#米中貿易 #関税緩和 #市場急騰 #香港株 #経済対話 #ジュネーブ会談 #グローバル市場 #米中協議

🇰🇷 한국어:

미중 무역전쟁의 중대한 전환점! 스위스 제네바에서 진행된 고위급 회담 후, 양국은 5월 14일부터 90일간 관세를 대폭 인하하기로 합의. 미국은 145%에서 30%로, 중국은 125%에서 10%로 인하. 소식 직후 홍콩 증시가 700포인트 급등하며 글로벌 시장이 급반등. 양국은 추가 협의를 위한 대화 기제를 마련하기로 했다.

#미중무역 #관세인하 #시장급등 #홍콩증시 #글로벌경제 #제네바회담 #무역협상

🇲🇾 Bahasa Melayu:

Perang perdagangan AS-China memasuki fasa baru! Selepas rundingan di Geneva, kedua-dua negara bersetuju menurunkan tarif secara besar-besaran selama 90 hari mulai 14 Mei. AS mengurangkan tarif daripada 145% kepada 30%, manakala China daripada 125% kepada 10%. Pasaran saham global melonjak dengan serta-merta, termasuk Indeks Hang Seng yang meningkat lebih 700 mata.

#PerdaganganASChina #PenguranganTarif #PasaranGlobal #GenevaTalks #EkonomiDunia #HangSeng #PerjanjianDagangan

🇹🇭 ภาษาไทย:

สงครามการค้าสหรัฐ-จีนผ่อนคลาย! หลังการเจรจาระดับสูงที่เจนีวา สองประเทศตกลงลดภาษีซึ่งกันและกันอย่างมากเป็นเวลา 90 วัน เริ่ม 14 พฤษภาคม สหรัฐลดจาก 145% เหลือ 30% จีนลดจาก 125% เหลือ 10% ตลาดหุ้นทั่วโลกดีดตัวทันที โดยเฉพาะฮ่องกงที่พุ่งกว่า 700 จุด

#สงครามการค้า #ลดภาษี #ตลาดหุ้น #สหรัฐจีน #เจนีวา #การเจรจาเศรษฐกิจ #HangSeng

🇮🇩 Bahasa Indonesia:

Perang dagang AS-Tiongkok mencair! Setelah pertemuan tingkat tinggi di Jenewa, kedua negara sepakat menurunkan tarif secara signifikan selama 90 hari mulai 14 Mei. AS memangkas tarif dari 145% m

2025-05-1202 min

Grain Markets and Other StuffTrump Throws Cold Water on US/China Optimism, Back to Trading WeatherJoe's Premium Subscription: www.standardgrain.comGrain Markets and Other Stuff Links-Apple PodcastsSpotifyTikTokYouTubeFutures and options trading involves risk of loss and is not suitable for everyone.0:00 Corn Selloff4:32 Trump Comments, US/UK Deal5:45 Podcast News9:06 Bunge and Andersons10:39 Corteva11:51 Ethaonl Production/Stocks12:44 Fed Rates📉 Corn Futures Slide Amid Trade Tensions & Weather Outlook 🌾Corn prices dipped Wednesday as optimism over US–China trade talks gave way to fresh uncertainty. July25 corn futures settled near $4.49 per bushel...

2025-05-0814 min

Grain Markets and Other StuffGrains RALLY on US/China OptimismJoe's Premium Subscription: www.standardgrain.comGrain Markets and Other Stuff Links-Apple PodcastsSpotifyTikTokYouTubeFutures and options trading involves risk of loss and is not suitable for everyone.0:00 US/China3:16 New Trade Agreements?4:33 China Wheat Problems6:49 Transition Planning8:35 Farmer Sentiment10:29 Ethanol Exports are Strong11:49 SAF News13:17 Problems at ADM🇺🇸🇨🇳 US–China Trade Talks Begin This Weekend! 🌍Big moves on the global stage! US officials are heading to Switzerland for high-stakes trade talks with China. Treasury Secretar...

2025-05-0715 min

Soar FinanciallyEXPOSED: Trump’s Tariff War Isn’t New – It Started in the ’80s - Rosenberg Research I Robert EmbreeIn this explosive episode of Soar Financially, we welcome Robert Embree, Senior Economist at Rosenberg Research, to unpack the growing economic storm. From Trump’s tariff shocks to the global slowdown, Robert shares what most analysts are still missing.We break down the recession probabilities, a shaky bond market, energy-driven inflation, disinflation, and why gold is the only asset standing tall. Is the Fed too late again? Will capital flee U.S. markets for good? And what’s really driving the dollar’s decline?Robert also discusses how Canada’s political shift could alter trade dynamics—and why the labor mark...

2025-04-2538 min

Beyond Fulfillment PodcastNegotiating the Future: US-China Tariff Standoff and Its Supply Chain Ripple EffectsWelcome to a special edition of the Beyond Fulfillment Podcast! In this episode, supply chain legend Jim Tompkins discusses in detail, Trump’s impact on the global supply chain with essential insights for entrepreneurs and small business owners navigating today’s rapidly evolving marketplace.Whether your business relies heavily on China, you’re seeking resilient supply chain strategies, or you want actionable tips on geographical diversification and nearshoring, this conversation is packed with entrepreneurial wisdom.Jim shares over 50 years of supply chain expertise, providing practical, real-world advice on adapting to trade wars, tariff...

2025-04-2333 min

Marketing Oops! Podcastสรุปรวมไฮไลต์แมตช์หยุดโลกศึกจ้าวสังเวียนการค้าระหว่าง USA vs CHINA | Oops Insight ep.04สงครามการค้าครั้งใหญ่ระหว่างอเมริกา VS จีน ที่ล่าสุดทรัมป์สั่งขึ้นภาษีจากจีนสูงทะลุ 125% และจีนก็ออกหมัดหนักตอบโต้ด้วยการหยุดส่งออกแร่หายาก ใครจะเป็นฝ่ายชนะในศึกเศรษฐกิจครั้งนี้? และทำไมประเทศไทยต้องเตรียมรับมือกับผลกระทบที่จะเกิดขึ้น? ติดตามการวิเคราะห์เจาะลึกทุกแง่มุมของสงครามการค้าที่กระทบทั่วโลก พร้อมเปิดเผยโอกาสที่ซ่อนอยู่ในวิกฤตครั้งนี้

#สงครามการค้า #ทรัมป์VSจีน #ภาษีนำเข้า #ห่วงโซ่อุปทานโลก #แร่หายาก #เศรษฐกิจโลก #AmericaFirst #TradeWar #USChinaTrade #ผลกระทบต่อไทย #โอกาสในวิกฤต #ภาษี104เปอร์เซ็นต์ #เศรษฐกิจไทย #การส่งออก #GlobalEconomy #EconomicImpact #ทรัมป์ขึ้นภาษี #จีนระงับแร่หายาก #ห่วงโซ่อุปทาน #oopsinsight

2025-04-1108 min

Stonkcast21 - The Market is Back Baby Episode🚨 Major economic updates hitting the news today! Trump has temporarily dropped tariffs to 10%, sending shockwaves through the market. The stock market just posted its third-largest gain in post-WWII history—what’s fueling this surge? Plus, we’re keeping an eye on upcoming economic data that could shape the future. Stay informed and watch for all the latest details on the US-China tariff situation.🔔 Don’t forget to subscribe for more updates and analysis on these major events!#Trump #StockMarket #Tariffs #ChinaUSTariffs #EconomicData #StockMarketGains #Economy #USChinaTrade #MarketUpdates #BusinessNews"

2025-04-1016 min

The Real Investment Show Podcast4-4-25 Will Tariff Turmoil Cause Retirement Revisions?Markets scuttled over 5% following President Trump's initial reveal of intended tariffs on trading partners he says have been trading unfairly with the U.S. The fallout continues today, and Richard Rosso and Jonathan McCarty examine Tariffs and Retirement Planning, the rise of protectionism vs globalism, and how tariffs affect the economy. Bonds are playing an important role in a 60/40 portfolio, and here are some possible Retirement Portfolio Strategies for the rest of 2025. Rich and Jonathan also discuss Market Volatility and Retirement and the Trade War's Impact on Investments. Does this week's market rout provide buying opportunities? It's unwise to completely...

2025-04-0445 min

The Real Investment Show (Full Show)4-4-25 Will Tariff Turmoil Cause Retirement RevisionsMarkets scuttled over 5% following President Trump's initial reveal of intended tariffs on trading partners he says have been trading unfairly with the U.S. The fallout continues today, and Richard Rosso and Jonathan McCarty examine Tariffs and Retirement Planning, the rise of protectionism vs globalism, and how tariffs affect the economy. Bonds are playing an important role in a 60/40 portfolio, and here are some possible Retirement Portfolio Strategies for the rest of 2025. Rich and Jonathan also discuss Market Volatility and Retirement and the Trade War's Impact on Investments. Does this week's market rout provide buying opportunities? It's unwise to completely...

2025-04-0445 min

The Real Investment Show Podcast4-3-25 Markets' Tariff TizzyPresident Donald Trump's tariff terrors were revealed Wednesday afternoon, and markets were not enthused. At all. The worse than expected tariff rates are the highest ever. Trade policy is still uncertain, however, as the tariffs are seen as a negotiating tactic, and subject to revision. But this makes it difficult for companies to re-calculate forward looking estimates of earnings. And as the ripple effects of higher expenses are felt in the economy, the risk of recession rises. Lance takes a break to extol his wife's virtues as a basketball savant; Lance and Michael discuss the likely Fed response to higher...

2025-04-0345 min

The Real Investment Show (Full Show)4-3-25 Markets' Tariff TizzyPresident Donald Trump's tariff terrors were revealed Wednesday afternoon, and markets were not enthused. At all. The worse than expected tariff rates are the highest ever. Trade policy is still uncertain, however, as the tariffs are seen as a negotiating tactic, and subject to revision. But this makes it difficult for companies to re-calculate forward looking estimates of earnings. And as the ripple effects of higher expenses are felt in the economy, the risk of recession rises. Lance takes a break to extol his wife's virtues as a basketball savant; Lance and Michael discuss the likely Fed response to higher...

2025-04-0345 min

The Real Investment Show Podcast4-2-25 Liberation Day - What Does It Mean for You?Liberation Day arrives: Clarity about tariffs should help markets. What will be the impact on economic growth: Will consumers pay higher prices or choose alternatives? There are too many variables to calculate the true economic impact. Market performance this year is all about diversification of assets within portfolios...and what's working this year may not work next year. Avoid complacency! Before the bell, downside risk still remains. RIP, Val Kilmer. Today is "Liberation Day" (from what?) Have markets already priced-in the effects? This is a difficult market to hedge: Do you bet on the Mag-7 or the other 493? The best...

2025-04-0245 min

The Real Investment Show (Full Show)4-2-25 Liberation Day - What Does It Mean for YouLiberation Day arrives: Clarity about tariffs should help markets. What will be the impact on economic growth: Will consumers pay higher prices or choose alternatives? There are too many variables to calculate the true economic impact. Market performance this year is all about diversification of assets within portfolios...and what's working this year may not work next year. Avoid complacency! Before the bell, downside risk still remains. RIP, Val Kilmer. Today is "Liberation Day" (from what?) Have markets already priced-in the effects? This is a difficult market to hedge: Do you bet on the Mag-7 or the other 493? The best...

2025-04-0245 min

Global Trade GalWhy Do US Importers Still Buy from China Despite Tariffs?Many US buyers have become hesitant to source products from China, yet tariffs haven’t completely stopped imports. The country’s strong supply chain, efficient manufacturing, cost advantages, and currency factors continue to make it a key player in global trade. In this episode of #GlobalTradeGal, Anita explores why US importers are still relying on Chinese-made goods despite trade barriers. Listen now, and for more insights, click here: Why The US Tariffs Has Not Stopped US Importers Buying From China#USChinaTrade #GlobalTrade #SupplyChain #Manufacturing #TradePolicy #ImportExport #BusinessStrategy #Tariffs #GlobalTradeGalSupport the show

2025-03-1908 min

STRATSTRAT | March 9, 2025: Navigating the Complex World of Tariffs and TradeIn this episode of the STRAT (Strategic Risk Assessment Talk) podcast, retired Marine Intelligence Officer LtCol. Hal Kempfer delves into the timely topic of tariffs and international trade. With a master's degree in international management, and work with U.S. Customs. Hal sheds light on the complex dynamics of tariffs in the global economy. He explains the historical context of trade agreements like NAFTA and the evolving nature of trade relations with countries such as China, Mexico, Canada, and the nations of the European Union. Hal discusses the political allure of tariffs and the concept of comparative advantage while...

2025-03-0932 min

The Real Investment Show (Full Show)2-7-24 Taking The No - Buy ChallengeTiring of overconsumption and desirous of paying off debt, more and more Americans are participating in the "no buy 2025" trend to reduce spending. Rich and Jonathan discuss strategies for improving household budgets, Money Saving Tips and Frugal Living Hacks, with Financial Discipline Strategies and Spending Freeze Guidance, plus tax traps to avoid as a result of the Social Security Fairness Act, and the challenges from inherited IRA's.

3:13 - Jobs Report Preview & Debunking Tariff Myths

14:46 - Candid Coffee Preview & SS Benefits Taxation

30:35 - The No-Buy in 2025 Trend

44:40 - Mall Shopping, No-Buy, & Consumer Priorities

Hosted by RIA Advisors Director of Financial Planning...

2025-02-1046 min

The Real Investment Show Podcast2-6-25 Where Money Comes FromMarkets remain in a bullish trend for the moment, despite disappointing economic news in the Trade Deficit and the ISM Services Index. Improving relative strength is also providing lift for the market. Technically, everything is fine despite disappointing news from AMD, Google, and others. Money flows continue to creep upward with continued buying. Lance and Michael spend the remaining segments of the show discussing money, currencies, and concepts of money supply management: All money is lent into existence. The Federal Reserve or the government does not print money. Those two facts are vital to understanding our lead question: where does...

2025-02-0646 min

The Real Investment Show Podcast2-5-25 What the Bond Market is Telling Us About Trump 2.0Markets are recovering from tariff troubles on Monday; a brief history of Trump's past trade wars & results; Google's earnings miss & correction; earnings have been okay, but expectations are slipping. The China Trade War retaliation begins; it's all about posturing. Markets rally from Monday; if you're worried about the volatility, there's too much risk in your portfolio. Lance razzes Danny "Bulldog" Ratliff about his absenteeism and polo shirt choices. Lance reviews market performance during Trump's trade wars 2017-2019 (charts); looking for more volatility this year. Beware Financial Media headlines; what the Bond Market is saying about Trump 2.0; commentary on volatility spikes...

2025-02-0546 min

The Real Investment Show (Full Show)2-5-25 What The Bond Market Is Telling Us About Trump 2.0Markets are recovering from tariff troubles on Monday; a brief history of Trump's past trade wars & results; Google's earnings miss & correction; earnings have been okay, but expectations are slipping. The China Trade War retaliation begins; it's all about posturing. Markets rally from Monday; if you're worried about the volatility, there's too much risk in your portfolio. Lance razzes Danny "Bulldog" Ratliff about his absenteeism and polo shirt choices. Lance reviews market performance during Trump's trade wars 2017-2019 (charts); looking for more volatility this year. Beware Financial Media headlines; what the Bond Market is saying about Trump 2.0; commentary on volatility spikes...

2025-02-0546 min

The Real Investment Show Podcast2-4-25 Trade War is Over!Well that was fast. Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. The announcement of tariffs set the market on its heels Monday morning as media writers quickly pushed narratives about the potential impacts. However, as suggested on the "Real Investment Show" before the market opened on Monday, the best thing to do would be "nothing." We stated the market's opening would likely be the worst level of the day, so any "panic selling" of positions early in the morning would likely be a mistake. Early in the...

2025-02-0446 min

The Real Investment Show (Full Show)2-4-25 Trade War Is OverWell that was fast.

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. The announcement of tariffs set the market on its heels Monday morning as media writers quickly pushed narratives about the potential impacts. However, as suggested on the “Real Investment Show” before the market opened on Monday, the best thing to do would be “nothing.” We stated the market’s opening would likely be the worst level of the day, so any “panic selling” of positions early in the morning would likely be a mistake. Early in the day, both...

2025-02-0446 min

The Bitcoin LayerGlobal Macro Update: Bitcoin Surges as China Stimulates and Trump's Trade War 2.0 LoomsIn this video, Nik dives into what could be a perfect storm brewing in global markets. He unpacks Bitcoin's sudden 5% surge due to major economic shifts. To do so, he explores China's massive 6 trillion yuan bond stimulus and its global ripple effects, alongside the potential return of Trump's aggressive trade policies. Nik discusses the shocking scope of Trump's proposed tariffs and why economists are raising red flags. As the U.S. and China continue clashing, this video explains the overall effects this will have on bitcoin and global markets as the future reshapes.

Articles linked below:

https://www.cnbc.com/2024/10/12...

2024-10-1524 min

FutureofUSChinaTrade.comInterview with Peter D. Sutherland, S.C., K.C.M.G., Chairman and Managing Director of Goldman Sachs International, former Director General of the GATTI’m deeply disappointed with where we are and I blame the big traders, China and the U.S. in particular.

2013-01-0422 min

FutureofUSChinaTrade.comInterview with Pat Choate, Economist, former vice presidential candidate, author most recently of Saving CapitalismSo the reality is that because the WTO is a rules-based system, the image of the Anglo-American model, it is structurally incompatible with the rising economic systems of the world.

2012-12-1131 min

FutureofUSChinaTrade.comInterview with Norman R. Augustine, retired chairman and chief executive officer of the Lockheed Martin Corporation and author of Rising Above the Gathering Storm: Energizing and Employing America...So I think it’s important to have a stabilizing effect like the WTO, as imperfect as it is, to at least try to bring people together as opposed to letting each nation go out on its own.

2012-12-1116 min

FutureofUSChinaTrade.comInterview with Keith Rockwell, Director, Information and External Relations Division, World Trade OrganizationThat’s one of our rules here is to try and provide some guidance in terms of rules of what you can and cannot do.

2012-12-1152 min

FutureofUSChinaTrade.comInterview with Dick Nanto, Specialist in Industry and Trade, Congressional Research ServiceFor Chinese policymakers, foreign direct investment is a tool, not an end in itself.

2012-12-1133 min

FutureofUSChinaTrade.comInterview with Clyde Prestowitz, President, Economic Strategy Institute, author most recently of The Betrayal of American ProsperityThat’s why you have trade imbalances – because the system is not working.

2012-12-1115 min

FutureofUSChinaTrade.comInterview with Bob Davis, Senior Editor, Wall Street JournalIt’s amazing to me, given that the WTO has no power whatsoever and can’t force a country to do anything, that countries generally live up to their obligations under the WTO.

2012-12-1130 min

FutureofUSChinaTrade.comAudio Interview with Robert D. Atkinson, President, Information Technology and Innovation FoundationChina gained the benefits of the WTO – which is to get access to markets – but they also got protection from the WTO.

2012-12-1033 min

FutureofUSChinaTrade.comInterview with Jigar Shah, President of the Coalition for Affordable Solar Energy (CASE)Jigar Shah, President of the Coalition for Affordable Solar Energy (CASE) and co-founder of SunEdison, talks about the anti-subsidy and anti-dumping trade case against China. He argues that if China loses the case, that won’t bring solar panel manufacturing back to the U.S. But it will increase the price of solar panels, which will reduce demand and cost American jobs in installation, distribution, sales and marketing, and other downstream activities. An interview with ChinaGlobalTrade.com Director Molly Castelazo, recorded April 2012.

2012-05-1523 min

FutureofUSChinaTrade.comAudio Interview with Geng Xiao: China Must Allow Flexibility in its Exchange Rate, and in its Interest and Inflation Rates TooFutureofUSChinaTrade.com director Molly Castelazo recently spoke with Geng Xiao, Director of Columbia Global Centers / East Asia in Beijing, about his vision of the future of trade between the U.S. and China. He explained that the enormous productivity gains that China has been realizing (as it transitions from agriculture to industry) have put incredible upward pressure on interest rates, inflation, and exchange rates. Chinese policymakers have responded by fixing those rates, a solution Xiao says is unsustainable.

2011-11-1634 min

FutureofUSChinaTrade.comAudio Interview: Derek Scissors on the Value of the Yuan, U.S. Unemployment, and the American Budget DeficitOn November 7, 2011, FutureofUSChinaTrade.com director Molly Castelazo spoke with Derek Scissors, a research fellow for economics in The Heritage Foundation's Asian Studies Center, about his view that there is no real connection between the value of the yuan and U.S. unemployment. According to Derek, “American unemployment is naturally determined by American policies, not Chinese.”

2011-11-1627 min

FutureofUSChinaTrade.comAudio Interview: Dan Ikenson on the Value of the Yuan and the Size of the Bilateral Trade DeficitOn November 8, 2011, FutureofUSChinaTrade.com director Molly Castelazo spoke with Dan Ikenson, associate director of the Cato Institute's Herbert A. Stiefel Center for Trade Policy Studies, about what he sees as a lack of recent evidence to support the premise of an inverse relationship between the value of the yuan and the size of the bilateral U.S.-China trade deficit.

2011-11-1636 min

FutureofUSChinaTrade.comAudio Interview: Joseph Gagnon on a $400-500 Billion Trade Distortion, and Taxing Chinese-Held U.S. Assets to Eliminate the DistortionOn November 9, 2011, FutureofUSChinaTrade.com director Molly Castelazo spoke with Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics in Washington D.C., about his view on the size of the trade balance distortion caused by China’s manipulation of the value of the yuan ($400-500 billion). In other words, Joseph contends, a relatively undervalued yuan leads to U.S. exports $400-500 billion lower than they would otherwise be – which translates, he said, into 3 million or more lost U.S. jobs.

2011-11-1623 min

FutureofUSChinaTrade.comAudio Interview: Gil Kaplan on the Effects of Currency Manipulation on U.S. Manufacturers, and What Policymakers Could Do About ItOn November 11, 2011, FutureofUSChinaTrade.com director Molly Castelazo spoke with Gil Kaplan, a partner at the Washington D.C. law firm King & Spalding in the International Trade Practice Group, about Gil’s view on the size of the distortion caused by an undervalued yuan, which he called “devastating” for particular industries in the U.S. Gil explained how the U.S. could apply existing countervailing duties laws to U.S. imports of Chinese-made products, and what that would mean for U.S. manufacturers.

2011-11-1620 min

FutureofUSChinaTrade.comAudio Interview: Alan Tonelson on China’s Currency Policy Disadvantages US-made Products and Costs American JobsOn October 26, 2011, FutureofUSChinaTrade.com director Molly Castelazo caught up with Alan Tonelson, Research Fellow at the U.S. Business & Industry Council Educational Foundation, to talk about China’s currency policy, which Tonelson says keeps the RMB significantly undervalued relative to the dollar and – more importantly – creates tremendous and completely artificial competitive disadvantages for U.S.-made products.

2011-11-0743 min

FutureofUSChinaTrade.comAudio Interview: Michael Pettis on Why China Needs to Switch Its Growth Model, and How to Do ItFutureofUSChinaTrade.com spoke with Michael Pettis, finance professor at Peking University’s Guanghua School of Management, about his vision of the future of trade between the U.S. and China. He argued that China needs to switch its growth model – from one dependent on investment and trade surplus to one driven by domestic consumption. Yet that transition will be a difficult one and there isn’t yet consensus in Beijing that now is the time. “It’s very difficult to change the rules of the game when you’re winning,” Michael said.

2011-10-2227 min

FutureofUSChinaTrade.comAudio Interview: Nobel Laureate Economist Ed Prescott on the Gains from TradeFutureofUSChinaTrade.com spoke with Nobel Laureate economist Ed Prescott about his vision of the future of trade between the U.S. and China. He explained the importance of economic openness and the role of multinational corporations in producing gains from “trade.”

2011-10-2213 min

FutureofUSChinaTrade.comAudio Interview: Former Intel China President Jim Jarrett on American CompetitivenessWe spoke with expert commentator Jim Jarrett about his vision of the future of trade between the U.S. and China. He argued that “fundamentally, this isn’t a China issue; it’s a U.S. competitiveness issue,” then offered his advice on ways that the U.S. can be a more effective contender in what he calls the “global competition for jobs.”

2011-10-2218 min

FutureofUSChinaTrade.comAudio Interview: Former BP China President Gary DirksJune interview with Gary Dirks, former president of BP China.

2011-07-1427 min

FutureofUSChinaTrade.comAudio Interview: Former Intel China President Jim JarrettMay 2011 interview with Jim Jarrett, former president of Intel China.

2011-07-1428 min

FutureofUSChinaTrade.comAudio Interview: Former Caterpillar CEO Jim Owens"China is investing in themselves. Without investment you don’t have real income growth. Without real income growth the standard of living starts to go down. So I’m worried."

2011-07-0612 min