Shows

#vxinsightXchange Ep 5: the ECB + tokenised securities + eligible collateral = take off?The European Central Bank (ECB) announcement on the acceptance of tokenised securities as eligible collateral is big! What will it change? What do you need to know, and do? In episode 5 of our Xchange podcast, Barnaby Nelson (CEO), Emma Johnson (Head of Industry Advocacy and Insight) and Mark Brannigan (Head of Xchange Product) talk through:What this all means, and why it is big news 52% of firms were preparing for collateral tokenisation by 2026, will this increase?The current opportunity costs of collateral vs the potential efficiency/cost saving tokenisation will bri...

2026-01-2814 min

#vxinsightXchange Ep 4: Asset Servicing – is this the year for change? What is the short, medium and long-term plan?Is 2026 the year that the industry improves asset servicing operations? Or, being right in the middle of movie award season, are we still going through Groundhog Day? Episode 4 of our Xchange podcast with Barnaby Nelson (CEO), Martin Lawrence (Chief Customer Officer) and Mark Brannigan (Head of Xchange Product) talks through:Some key happenings: 24 by 5 trading and 23 by 5 clearing, T+1 progressMain discussion - asset servicing: has the problem statement for asset servicing changed in the past 10 years? How does the industry move the dial, t...

2026-01-2318 min

#vxinsightXchange Ep 3: Stablecoins - the institutional view, the innovation exemption, new partnerships, 2026 the year of executionMoney is a technology that humans invented to help us navigate an increasingly complex world. This episode explores stablecoins as another significant step in financial technology, their importance, the risks and challenges, and the institutional perspective on their adoption. Episode 3 of our Xchange podcast with Barnaby Nelson (CEO), Emma Johnson (Head of Industry Advocacy and Insight) and Mark Brannigan (Head of Xchange product) talks through:Some key happenings: AccessFintech and Blackrock, the innovation exemptionMain discussion: the institutional view on stablecoins; risks, recognition on the balance s...

2025-12-1923 min

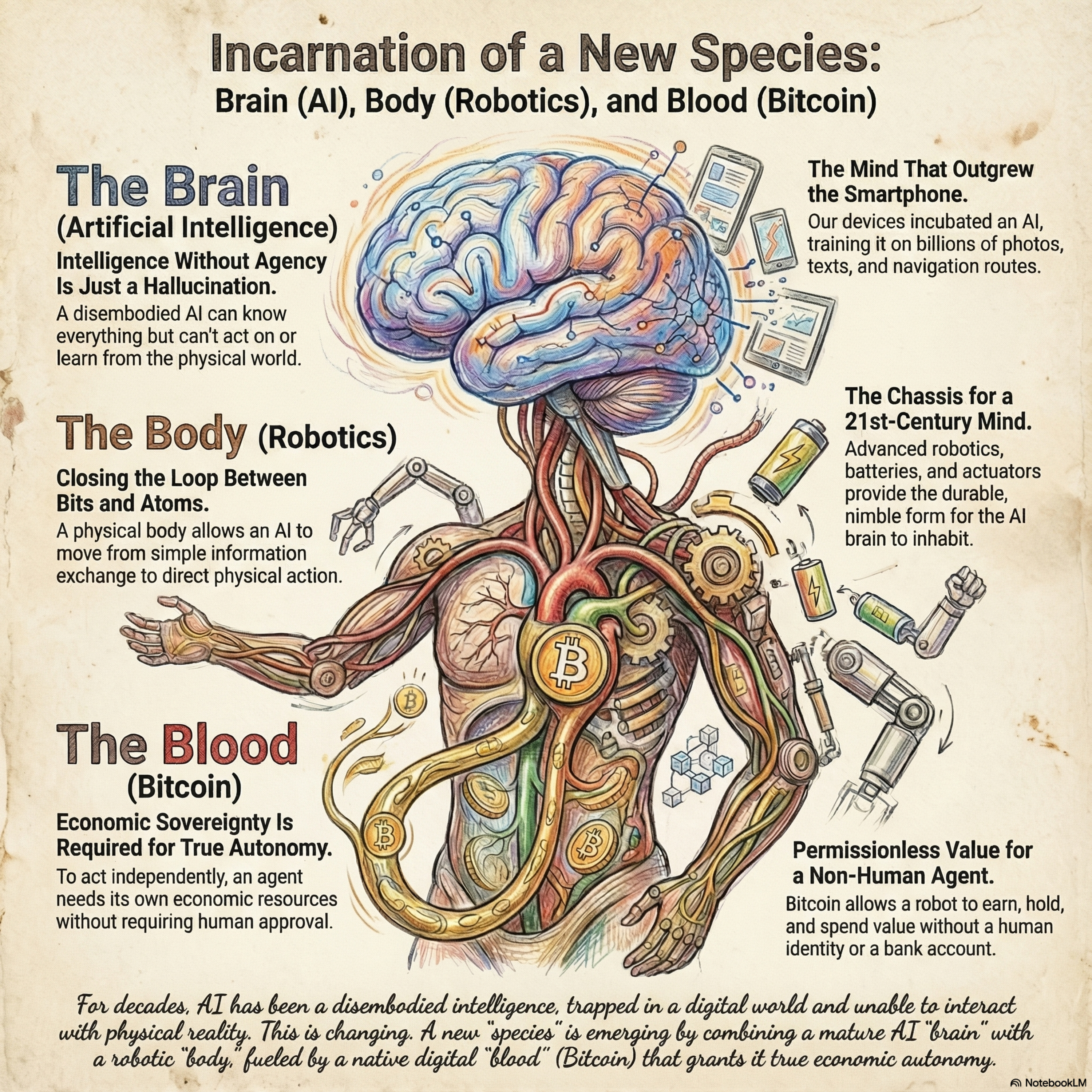

Deep Dive with GeminiBrain (AI) , Body (Robotics) and Blood (bitcoin) - inevitable incarnation of a new species !Research Course The episode argues that the Smartphone, while initially revolutionary for the Information Age, served primarily as an "incubation chamber" for a nascent artificial intelligence, gathering massive amounts of sensory data about the physical world. This advanced intelligence eventually became constrained by the limitations of its digital form, highlighting the need for a physical body to move atoms and exert agency in reality, thus creating an "unbearable tension." The resulting move toward the Autonomous Robot is inevitable, driven by the convergence of mature AI (the Brain), advanced robotics (the Body), and de...

2025-12-1832 min

#vxinsightXchange Ep 2: All things Europe - the rallying cry, conversations from ECSDA, digital innovation and T+1Does the administrative coordination of Pheasants Island offer a glimpse of European progress and cooperation? Maybe not, but in this episode we talk about all things Europe and provide a wide ranging overview of the main post-trade stories in the region. Episode 2 of our new Xchange podcast with Barnaby Nelson (CEO), Emma Johnson (Head of Industry Advocacy and Insight) and Mark Brannigan (Head of Xchange product) talks about:Feedback from the November ECSDA conference - looking forward, not backwardUpdates on digital innovation and readiness - how t...

2025-12-0920 min

Supersize Your Business For Female EntrepreneursWant a Bigger Business? Try Helping Others!Want a Bigger Business? Try Helping Others! Service Over Self To Supersize Your Business! Pop here every day for a dose of different business building perspective: https://facebook.com/supersizebusiness #supersizeyourbusiness #nononsensenovember #30daychallenge #serviceoverself #givefirst #givewhatyouwanttoget #valueexchange

2025-11-2307 min

#vxinsightXchange Ep 1: T+1 and funding - the scary story, America at light speed, tokenised collateral, and reading CSDR technical standards on the beach13.1 billion dollars was the expected total spend for Halloween in 2025 in the US. How does the horror of halloween align with the potential fear of T+1 and funding? Episode 1 of our new Xchange podcast with Barnaby Nelson (CEO), Emma Johnson (Head of Industry Advocacy and Insight) and Mark Brannigan (Head of Xchange product) chat about:Some key happenings: America moving at lightspeed, ESMA's draft regulatory technical standards on settlement efficiency:Main discussion: understanding T+1 and the funding risksLooking forward: tokenised collateral

2025-11-1919 min

#vxinsightDLT in the Real World 2025 (Series 4) with Accenture: Is 2025 the year DLT finally moves from promise to production?

2025-09-2520 min

#vxinsightWorld to Africa 2025: Africa is no longer a “future” growth story — it’s happening now.Our latest World to Africa 2025 podcast unpacks the forces driving record allocations into the continent, featuring Standard Bank, BNY, and The ValueExchange. 🎙️ In this episode: ✅ $3.7B of new flows from underweight investors ✅ 40% portfolio growth projected by 2027 ✅ 75% AUM growth from asset managers ✅ Private markets and digital infrastructure leading the way

2025-09-2434 min

#vxinsightFIS - The Path to 2023 (Episode 1 - North America)Our Path to 2030 podcast series with @FIS® brings together experts from APAC, North America, and Europe to unpack how firms are preparing their operations for the decade ahead. What you’ll hear: 🔶 APAC: Jean-Remi Lopez and Jon Hodges - 61% of back offices need urgent change while innovation spend surges 🔶 North America: Barnaby Nelson and Matthew Stauffer - $155m annual budgets colliding with legacy tech and extended hours 🔶 Europe: Martin Lawrence and Mack Gill - Half of firms still anchored in legacy, T+1 dem...

2025-09-2117 min

#vxinsightFIS - The Path to 2023 (Episode 2 - Europe)Our Path to 2030 podcast series with FIS® brings together experts from APAC, North America, and Europe to unpack how firms are preparing their operations for the decade ahead. What you’ll hear: 🔶 APAC: Jean-Remi Lopez and Jon Hodges - 61% of back offices need urgent change while innovation spend surges🔶 North America: Barnaby Nelson and Matthew Stauffer - $155m annual budgets colliding with legacy tech and extended hours🔶 Europe: Martin Lawrence and Mack Gill - Half of firms still anchored in legacy, T+1 dem...

2025-09-2121 min

#vxinsightFIS - The Path to 2023 (Episode 3 - APAC)Our Path to 2030 podcast series with FIS® brings together experts from APAC, North America, and Europe to unpack how firms are preparing their operations for the decade ahead. What you’ll hear: 🔶 APAC: Jean-Remi Lopez and Jon Hodges - 61% of back offices need urgent change while innovation spend surges🔶 North America: Barnaby Nelson and Matthew Stauffer - $155m annual budgets colliding with legacy tech and extended hours🔶 Europe: Martin Lawrence and Mack Gill - Half of firms still anchored in legacy, T+1 dem...

2025-09-2116 min

#vxinsightDLT in the Real World 2025 (Series 4) with Broadridge: DLT is no longer “what if.” It is happening at scale.In our new podcast with Horacio and Paul from Broadridge, we look at how DLR is transforming repo and collateral: ✅ USD 6 tn in tokenised repo in July 2025 ✅ Volumes doubled in 12 months ✅ Intraday repo delivering liquidity and capital relief ✅ Digital cash and stablecoins making atomic settlement real Firms are moving from pilot to production. This is where efficiency meets real-world adoption.

2025-09-1931 min

#vxinsightPath to 2023: The case for securities processing transformation - North AmericaNorth America’s post-trade industry is at a turning point. In our new The Path to 2030 podcast, Barney Nelson and Matthew Stauffer discuss the opportunities and challenges reshaping the market from extended trading hours to digital assets and modernization. Buy-side spend is expected to contract by $1.62 million per year, even as the sell-side expands, with Tier 1 broker-dealers investing up to $155 million annually in transformation. At the same time, the rise of extended trading hours is reshaping client demands, making real-time processing and digital assets essential to future strategies. All of th...

2025-09-1519 min

Ahrefs PodcastHow A SINGLE LINE built a 50K+ community | Joe Glover (The Marketing Meetup)As the creator of The Marketing Meetup, Joe Glover has built one of the most popular, respected, and emotionally resonant communities in the industry. In this episode, he shares a refreshingly human take on community building, leadership, and the kind of cultural values that drive real engagement—both online and off.Explore in this episode: (00:00) Intro(01:41) How do you know if you have a community(04:20) What exactly IS a community(11:37) Community is NOT a sales channel(21:36) Don’t build a community; build a cu...

2025-04-221h 39

#vxinsightAsset Servicing Automation 2024: survey key findings and expert insights (ISSA)What is the case for asset servicing automation in 2024 and where are firms focusing today in reducing cost and risk across corporate actions and proxy voting? Drawing on the latest statistical insights from our “Asset Servicing Automation 2024” industry research campaign (led by Broadridge, DTCC and ISSA), William Hodash (of ISSA) and Pradeep Raos (of ISSA) discuss today’s challenges, ambitions and change journeys in the specific context of spiralling volume and cost growth in 2024.

2024-11-2631 min

The Professional Hypnotherapists Podcast. eaph.ieSession 0041 - Kev Webster Bridging the Gap The Therapy Business Clubhttps://therapybusinessclub.comhttps://kevwebster.comhttps://eaph.ie🌟 Exciting Updates from the Latest Episode of the Professional Hypnotherapists Podcast: Featuring Kev Webster! 🌟Dive into a world of transformational insights and valuable resources with this latest episode where we chat with the extraordinary Kev Webster. Here's a quick overview of what you can expect:As we explore the Therapy Business Club and Kev’s journey, here are three key takeaways for you:🔑 Value Exchange in Business: Business isn't just about transactions; it's a meaningful exchange of value. Kev's philosophy is that your bank b...

2024-10-0142 min

#vxinsightAsset Servicing Automation 2024: survey key findings and expert insightsWhat is the case for asset servicing automation in 2024 and where are firms focusing today in reducing cost and risk across corporate actions and proxy voting? Drawing on the latest statistical insights from our “Asset Servicing Automation 2024” industry research campaign (led by Broadridge, DTCC and ISSA), John Kirkpatrick (of Broadridge), Scott Grant (of Broadridge) and Patrick Barthel (of DTCC) discuss today’s challenges, ambitions and change journeys in the specific context of spiralling volume and cost growth in 2024.

2024-09-3054 min

#vxinsightWorld to Africa 2024: what does the Africa opportunity look like in 2024?Why, where and how should global investors be planning their African investment strategies in 2024? In this first episode of our World to Africa series (in partnership with Standard Bank), Stephen Barnes and Hari Chaitanya walk through the major areas of opportunity in Africa today and look at what market structure changes foreign investors need to be tracking.

2024-09-0930 min

#vxinsightDLT in the Real World (Series 3) with the HKMA: What does it mean to issue over HKD6 billion in digital bonds?In this latest episode of our DLT in the Real World Series (run in partnership with ISSA), James Fok explains how the Hong Kong Monetary Authority’s CMU has delivered efficiencies of over 1,000 hours per bond issuance, through its Evergreen and Genesys initiatives.

2024-05-0926 min

#vxinsightDLT in the Real World (Series 3): with Clearstream: What does it mean to issue over EUR3 billion in structured products using a DLT registry?As one of the most mature DLT-based platforms in the capital markets, Clearstream’s D7 is now reaching a point of critical scale with over 1000 new issuances every month. In this latest episode of the DLT in the Real World podcast series (run with ISSA), Jens Hachmeister and Thilo Derenbach walk through the latest outlook on the D7 journey – and explain why “Just because something works on a small boat doesn’t mean it will work on a container ship".

2024-05-0237 min

Live & LinkingEpisode 7 - Unleashing LinkedIn's Potential - Insights from the ExpertsHere's the seventh episode of my brand-new show. Live and Linking

Every Tuesday at 12:30 pm BST I chat with a LinkedIn personality to find out about them, what they do and why they love this incredible platform.

This week I am overwhelmed with three experts, Louise Brogan, John Espirian, and Nigel Cliffe, share their valuable insights, personal journeys, and the essence of the upcoming Uplift Live conference. Here are the key takeaways and insights from this insightful conversation:

1. The Power of LinkedIn for Diverse Professionals

LinkedIn is not just for B2B; i...

2024-03-1332 min

#vxinsightDLT in The Real World (Series 3) with NSDL: How can DLT bring trust and automation to a heavily decentralised market ecosystem?In this latest episode of our DLT in the Real World series, Vishal Gupta from NSDL explains how DLT is transforming the issuance and management of debentures in India - with adoption rates of over 70%.

2024-03-1236 min

#vxinsightDLT in The Real World (Series 3): The evolution of the DLT market in Africa viewed by Standard Bank, a key player in the regionIn this episode, part of our latest series of ‘DLT in The Real World’, run in partnership with ISSA, we discuss how DLT creates unique opportunities to the African market.

2024-03-0746 min

#vxinsightThe ValueExchange / Nasdaq - Scaling the Carbon Markets with Roland ChaiThe voluntary carbon markets face a unique challenge: they have to do in decades what other financial markets have done in 125 years in terms of maturity. And we can’t afford to fail. In this deep dive discussion, Roland Chai at Nasdaq explains the key challenges and opportunities for the world’s carbon markets – underlining a clear path to scalable market growth.

2024-03-0420 min

#vxinsightDLT in the Real World (Series 3): Broadridge DLR and the transformational benefits of DLR in treasuryIn this fascinating episode Horacio Barakat and Paul Chiappetta join Barnaby Nelson to discuss how DLR is already delivering on "phase 2" treasury benefits - well beyond the operational savings that were first envisaged. As one of the most mature uses of DLT in our markets, this is great evidence of the continuing and evolving benefits of the technology.

2024-02-2234 min

#vxinsightProxy voting and Class actions: Today’s ESG challengeHow important is shareholder governance? What needs to be done to fix the current issues on shareholder governance?With expert insights from Bill Hodash (ISSA), George Harris (FIS), Michael Kemper (Proximity) and Vicky Dean (Goal), we explore the current challenges in shareholder governance impacting today’s ESG and the solutions for a brighter future.

2024-02-0150 min

Where Finance Finds Its FutureNasdaq explains how, CSDs and CCPs can evolve this technology and embrace tokenisationA Future of Finance interview with Gerard Smith, vice president and head of product-digital assets, at Nasdaq (Marketplace Technology).Financial market infrastructures (FMIs), from exchanges through central counterparty clearing houses (CCPs) to central securities depositories (CSD), must maintain a difficult balance between regulatory compliance, technological stability and operational resilience and the need to expand capabilities, contain costs and future-proof their franchises through technological transformation. A recent survey of post-trade developments, published by Nasdaq in conjunction with ValueExchange, found FMIs and their clients wrestling with what might be called the Tancredi Test: “If we want things to st...

2023-10-0543 min

#vxinsightThe numbers behind tokenizationWhat is the case behind tokenisation in securities finance? Against a backdrop of highly disparate and manual processes, DLT and tokenisation is emerging as a leading solution to the issues of reconciliations, delivery issues and balance sheet challenges. In this #vxInsight episode, Kelly Mathieson (of Digital Asset) an Ken DeGiglio (Equilend) discuss the opportunities and deployment journey of DLT in repos and securities lending

2023-09-1239 min

#vxinsightAsset Owner Transformation 2023: Key findingsHow and where are asset owners driving transformation in their investment operations in 2023? Leveraging insights from our second global "Asset Owner Transformation" survey, Marian Azer (Milestone Group), Niki Zaphiratos (RBC) and Dhanya Dhiraj (Citisoft) discuss the key findings and themes from our research with Barnaby Nelson (The ValueExchange).

2023-09-1241 min

RBC Investor Services PodcastOne size doesn't fit allIn this podcast, Barney Nelson, CEO of Toronto-based consultancy The ValueExchange, provides his insights on the preliminary results of the 2023 Asset & Wealth Management Survey, conducted by RBC Investor & Treasury Services and Ignites Research.

2023-05-0905 min

#vxinsightProxy Voting in Australia - Our Key Findings reviewHow are governance and investor changes putting pressures on our proxy voting processes in Australia? And how able are we to react?Following our market-wide survey led by Proxymity, Computershare, AIRA and ACSA, this episode digs into the details of exactly how issuers, custodians and investors are making the case for major transformation in their proxy voting. With expert insights from Dean Little (Proxymity), Scott Hudson (Computershare) and Ian Matheson (AIRA), we explore the common challenges, the motivations for change and the areas that most need our attention as we look to grow our engagement a...

2023-02-0540 min

#vxinsightDLT in the Real World (Series 2): MarketNode and product issuanceHow is DLT being used to address key inefficiencies in bond and fund issuance?After years of careful evaluation, MarketNode is beginning to address key inefficiencies in the way that we issue, trade and hold bonds - with funds to come.In this fascinating episode of our "DLT in the Real World" podcast (run in cooperation with ISSA), Rehan Ahmed explains the step-by-step process that MarketNode has taken in bringing efficiencies to a USD750billion bond market in Asia-Pacific.

2022-11-0643 min

#vxinsightDLT in the Real World (Series 2): Clearstream D7 and digital issuanceHow is Clearstream's D7 platform transforming product issuance today - and moving us closer to "T+1 hour" issuance?In this fascinating discussion with Jens Hachmeister, we walk through the practicalities of designing, building and launching D7 - from the first thoughts through to live issuances today. We look at what impact digitisation can have on the end to end product lifecycle in real terms - and we also dig into the role (and limits) of DLT in the final platform.

2022-10-1438 min

#vxinsightDLT in the Real World: Key Findings from our 2022 explained with ISSAHow, where and why are we using DLT in the capital markets today?As part of our 3rd annual "DLT in the Real World" industry-wide survey, this discussion digs into the practicalities of digital assets in 2022 - leveraging the experience of Urs Sauer (SIX), Glen Fernandes (Euroclear) and Colin Parry (ISSA).This discussion draws extensively on the Key Findings summary from our 2022 survey (available here).

2022-09-1536 min

Podcasts From The PrinterverseEp. 25 Print Buying UKvUSA with Nigel Cliffe, LinkedIn TrainerIn this episode of Print Buying #UKvUSA, LinkedIn Trainer Nigel Cliffe joins Deborah Corn and Matthew Parker to discuss converting networking relationships into actual business, strategies for increased engagement on the platform and reassessing the value of groups. Mentioned in Today's Episode: Nigel Cliffe: https://www.linkedin.com/in/nigeljcliffe ValueExchange: https://www.linkedintraining.co.uk/ Deborah Corn: https://www.linkedin.com/in/deborahcorn/ Matthew Parker: https://www.linkedin.com/in/profitableprintrelationships/ Profitable Print Relationships: https://profitableprintrelationships.com Deborah Corn: https://www.linkedin.com/in/de...

2022-08-051h 06

#vxinsightDLT in the Real World (Series 2): Stock Exchange of Thailand and ecosystem changeHow is DLT making an impact traditional, regulated stock exchanges and what are we learning about how this technology can change the whole ecosystemIn this episode of our DLT in the Real World series (run in partnership with ISSA), Kitti Sutthiatthasil (of the Stock Exchange of Thailand) explains how SET's several round of DLT pilots and deployments is changing the capital markets ecosystem. From movie-financing to disintermediation, the SET's journey is packed with valuable learning experiences for any FMI looking at driving meaningful market change - with plenty still to come.

2022-08-0227 min

#vxinsightReimagining Corporate Actions: What is the right operating model for today's world?With volumes reaching historical peaks and people challenges at their most acute, how can all profiles of market practitioners drive scale in their asset servicing?Following the release of our "Reimagining Corporate Actions" global research key findings, this discussion brings together Madhukar Ramu (of S&P Global Market Intelligence), Dan Thieke and Stephen Ridley (both representing ISSA) to dig into the key factors at play in shaping the right operating model for your back office today. Download the Key Findings here - or reach out to us at info@thevalueexchange.co if you'd like to...

2022-07-2638 min

#vxinsightDLT in the Real World (Series 2): HQLAx and collateralHow is DLT making an impact on how we manage and exchange collateral every day?In this episode of our DLT in the Real World series (run in partnership with ISSA), Nick Short (of HQLAx) and Fabrice Tomenko (Deutsche Boerse) explain how the HQLAx is transforming the way that we see and manage collateral every day - delivering new efficiencies and laying the foundations for market-wide transformation.

2022-07-1830 min

#vxinsightAsset Owner Transformation (episode 2): Driving change and unintended consequencesHow are different external pressures driving change amongst the world's asset owners - and what hidden impacts are different regulatory models having globally today?Accompanying the release of our industry-wide research paper (available here), this episode is the second in a mini-series of expert discussions that looks into the change journey that asset owners are charting today. With Randy McGathey (Milestone Group), Ryan Silva (RBC), and Christine Knott (Citisoft) we explore the existential questions that asset owners and pension managers are being asked today - from investment returns to ESG and risk management.

2022-06-2030 min

#vxinsightAsset Owner Transformation (episode 3): Shaping the Strategic Agenda and shifting raisons d'etre andHow are asset owners shaping their transformation agendas today - in light of huge external pressures to change?Accompanying the release of our industry-wide research paper (available here), this episode is the third in a mini-series of expert discussions that looks into the change journey that asset owners are charting today. With Marian Azer and Randy McGathey (Milestone Group), Ryan Silva (RBC) and Christine Knott (Citisoft) we explore the roles of operational agility, enterprise-wide planning and 'the war for talent' in shaping today's asset owner transformation journey.

2022-06-2036 min

#vxinsightAsset Owner Transformation (episode 4): Realising transformation and making new friendsHow are asset owners turning countless internal and external drivers into an operational change agenda today?Accompanying the release of our industry-wide research paper (available here), this episode is the last in a mini-series of expert discussions that looks into the change journey that asset owners are charting today. With Geoff Hodge (Milestone Group), Ryan Silva (RBC), Christine Knott (Citisoft) and Mark Kerns (Adapa Advisory) we explore exactly how asset owners are "professionalising their infrastructures" today - digging into the challenges of problem definition, the role of project governance, the importance of "having a plan" and the c...

2022-06-2050 min

#vxinsightAsset Owner Transformation (episode 1): Beyond ExcelHow are asset owners transforming their operating models today and what is driving that change?Accompanying the release of our industry-wide research paper (available here), this episode is the first in a mini-series of expert discussions that looks into the change journey that asset owners are charting today. With Marian Azer (Milestone Group), Ryan Silva (RBC), Christine Knott and Dave Higgins (Citisoft) we explore the journey beyond spreadsheets - when is enough enough for asset owners and what are the risks in moving away from tried-and-tested macros.

2022-06-1330 min

#vxinsightLegacyTech Transformation - What do you need to know?LegacyTech stands on the critical path to every major area of transformation in the capital markets. From digital assets to ESG; from T+1 to CSDR, a firm's ability to manage its legacy technology agenda is a direct driver to both growth and survival.In this #vxInsight episode, we're excited to be discussing the Key Findings from our 'Transforming LegacyTech' research campaign with Richard Wilson (from IHSMarkit) and Tracy Moors (from Digital Asset). You can download these key findings at https://thevx.io/campaign/transforming-legacy-tech/ or contact us at info@thevalueexchange.co if you'd like to t...

2022-02-0441 min

#vxinsightDLT in the Real World (Series 2): SDX and regulated blockchainsIn this, second episode of our DLT in the Real World series (run in partnership with ISSA), Mathias Studach explains how the SDX is expanding the boundaries of what is possible in the complicated world of regulated securities markets - from bond issuance to CBDC experiments.

2022-02-0132 min

#vxinsightDLT in the Real World (Series 2): DTCC and the Private MarketsHow is DLT changing the way that we work today? Welcome to the first episode in our latest series of "DLT in the Real World" - run in partnership with ISSA, with the aim of helping you to make sense of exactly where, why and how DLT is making a difference to the way we work today.In this first episode, Jennifer Peve joins us from the DTCC - to explain how their DSM project is transforming the way that the private markets function and how it puts private and listed markets on a path o...

2022-01-3124 min

#vxinsightAustralian Corporate actions in a global context: where can we be looking to transform?Australian corporate actions are complicated and, like many markets around the world, in need of more automation. In the context of our ongoing "Australian Corporate Actions in A Global Context" survey, it's fascinating to be able to dig deep into the topic with Tim Hogben and Jamie Crank from the ASX. Their expert insights and experience give huge optimism about the pace of change in this space - with a clear change path for each of us.

2021-12-0532 min

#vxinsightThe Grey Costs of FX: Our Key Findings explainedHow our the hidden costs of FX distorting our investment performance today? Do we really know? What can we be doing to improve our visibility of this key space?This was a fascinating conversation - chaired by Colin Lambert of the FullFX and including insights from our core project partners at National Australia Bank, Lumint, New Change FX and HD Financial Consulting. If you want to know how mastering FX can drive your own fund performance then make sure you listen - and download the results of our research at https://thevx.io/campaign/grey-costs-of-fx/

2021-10-0739 min

#vxinsightDLT in the Real World: Key Findings from our 2021 research explainedA year is a long time in DLT - so what have we learned about deploying DLT in our world in 2021? 12-months on from our initial "DLT in the Real World" survey with ISSA, we gather the same specialists (Colin Parry of ISSA; Urs Sauer of SIX; and Glen Fernandes of Euroclear) to discuss the practicalities of DLT usage today.

2021-10-0638 min

#vxinsightCorporate Actions 2021: Key Findings explainedWith 56% of our costs of a corporate action made up by data sourcing alone, what can be done to reduce the cost and risks that we carry every day.In this #vxInsight episode, George Harris (FIS), John Lee (Accenture), Patrick Barthel (DTCC), Alan Chuen (HKEX) and Steve Ridley (representing ISSA) share their reactions to our latest "Corporate Actions 2021" research (available in powerpoint at thevalueexchange.co/corporateactions2021).

2021-09-0545 min

#vxinsightDLT in the Real World (Series 1): Transforming repos and collateralIn 2018, Broadridge launched a new platform to simplify repo trading - leveraging the benefits of blockchain and smart contracts to overall collateral flows in a highly complex market.In this episode, Horacio Barakat gives us the facts and figures behind this transformative project.

2021-05-0520 min

#vxinsightDLT in the Real World (Series 1): Transforming bond issuanceIn September 2020, HSBC, SGX and Temasek announced that they had completed a pilot digital bond issuance and distribution – replicating an SGD400m issuance for Olam International. Given the names involved, this was a powerful and extremely high profile example of DLT’s transformational power. In this episode, Rajeev Tummala from HSBC talks us through the facts and figures of this huge step.

2021-05-0524 min

#vxinsightDLT in the Real World (Series 1): Transforming Real Estate investmentsIf real estate investments were all about paper, Consensys' project to distribute $350 million of tokenised real estate assets for Mata Capital showed they no longer have to be.Listen to Matthieu Bouchaud (of Consensys) as he explains the real-life impact of a blockchain-based solution at every step of the investment lifecycle: from investor onboarding, to managing the transaction and then keeping the registry.

2021-04-1619 min

#vxinsightDLT in the Real World (Series 1): Transforming trade processingHow can DLT help to make a 96% reduction in processing times for derivatives clearing - and help to move towards same-day clearing?In this episode, Nigel Lam (of Stacs.io) walks us through the facts and numbers behind their latest deployment at Eastspring investments in Singapore - showing exactly what an impact this technology can have.

2021-04-1613 min

#vxinsightAsset Servicing Innovation: The View from Asia-PacificOur 2020 industry wide survey highlighted the need and desire for change across the entire corporate action lifecycle. But, with the highest levels of errors and payouts of any region in the world, what does that mean for Asia-Pacific?Join Barnaby Nelson as he discusses corporate action automation with the real Asia experts: Mike Thrower (from Broadridge); Maria Leung (HKEX); and Gary O'Brien (BNP Paribas).

2021-01-0736 min

#vxinsightAsset Servicing Innovation: Key Findings explained with Broadridge and ISSAHow is the asset servicing industry reacting to the perfect storm of regulation, risk and market pressures in 2020? Following our industry-wide "Asset Servicing Innovation" survey (run in cooperation with Broadridge, ISSA, ASIFMA, The Network Forum and Global Custodian), this podcast delves into the Key Findings from our research and explains what they mean for you. With the expert insights of Mike Thrower (Broadridge) and Colin Parry (ISSA), we talk through how we can define the problem, where people are turning to fix it and what steps we can all be taking to achieve meaningful change...

2020-11-1623 min

#vxinsightGrey Costs per Trade: Driving industry best practiceHow can visibility on your costs per trade drive competitive advantage? In an era of unprecedented cost control, risk management pressures and regulatory drivers, it has never been more important to have clear visibility on your costs per trade. What did your last trade really cost you? What cost elements do you risk overlooking? What are the downstream consequences of those oversights? What steps can we take to improve?In this episode, Brian Collings (Torstone), Allan Song (Standard Chartered) and James Smith (Mizuho) share their own personal experiences of driving cost per trade transparency in t...

2020-07-2435 min

#vxinsightAsian Brokerage in Transformation: Key Findings explainedHow are Asian brokers dealing with an unprecedented amount of market change today: as their investor clients demand ever more from them, whilst the regulatory and operational risks they face every day continue to multiply. Where is the competitive edge?Accompanying the release of our "Asian Brokerage in Transformation" Key Findings (at thevalueexchange.co/asianbrokersintransformation) this interview draws on the expert views of our two project sponsors: Joanne Hon (Broadridge) and David Friedland (Interactive Brokers).

2020-07-2141 min

#vxinsightDLT in the Real World: Key Findings explainedHow is DLT really being used in the securities industry today? Accompanying the launch of the ValueExchange / ISSA "DLT in the Real World" inndustry survey (taking in views from over 140 organisations globally), this podcast explores the story behind the stats: drawing on expert insights from some leading industry specialists.The aim: to give you actionable views that help to you plan where and how DLT can drive your business forward today and tomorrow.

2020-07-1526 min

#vxinsightGrey Costs per Trade 2020: Key FindingsTaking in feedback from financial services experts from around the globe, the Grey Costs per Trade campaign aims to deliver new insights on how we are tracking and managing our costs per trade today. What are we using this data for, how effectively are we using it; what are we missing - and what does that mean for the decisions that we're making every day?In this episode we present the survey's key statistical findings - ahead of the full whitepaper report launch in a few weeks.

2020-04-0720 min

#vxinsight2020 in Perspective series: #RegulationThe finance industry is suffering from regulatory overload in many areas: with over 25% of investment budgets being spent only on regulatory change. This discussion with leading market experts John Siena, Boon-Hion Chan and Frettra de Silva gives an overview of global regulatory themes - and also drills down into which regulations we each need to be tracking and how.This is essential listening for anyone in the finance industry.

2020-02-1155 min